When it comes to navigating the world of credit cards, people often get confused by all of the different rules. One of these rules is Chase’s infamous 5/24 rule. Let’s look at what the 5/24 Rule is, why it’s important, and how to build a strategy when choosing which cards to open.

What is the 5/24 Rule?

The rule states that if you have opened five or more credit cards from any bank in the last 24 months, Chase will automatically deny your application for a new Chase card. This applies to both personal and business cards.

The 5/24 rule does not only apply to cards from Chase but also to cards from other banks. This means that even if you’ve opened five or more accounts with different banks, you will still be denied if you apply for a new Chase card.

Why is the 5/24 Rule Important?

This is important to understand because it requires planning when thinking through which cards you want to open and when. Chase offers some of the best rewards credit cards in the industry with big sign-up bonuses, great rewards programs, and valuable travel perks. So if you don’t keep track of your 5/24 number, you may lose out on some great bonuses and perks.

How To Track Your 5/24 Status

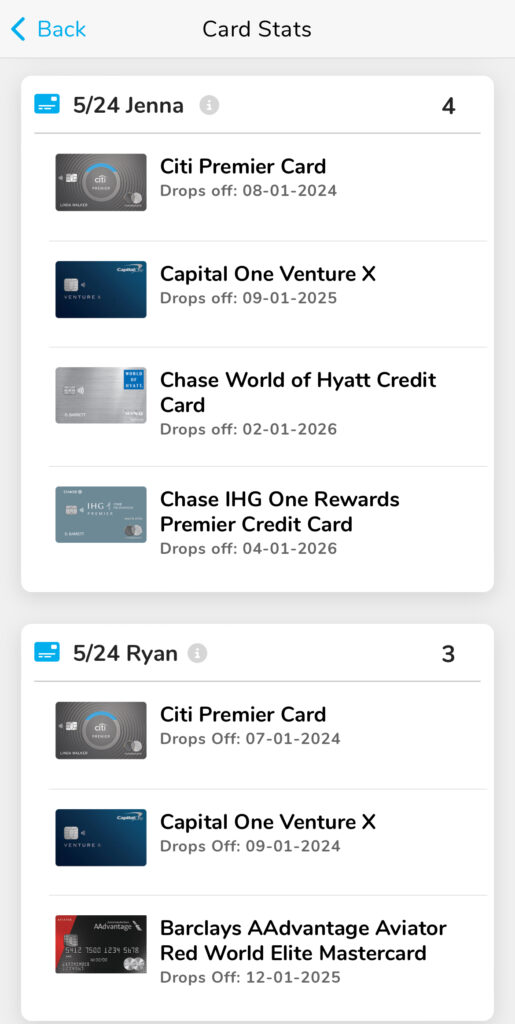

My favorite app is the key to this! Instead of trying to keep track of it all on your own, you can use Travel Freely to track it for you. It doesn’t require any sensitive credit card information and it’s completely free to use.

Each time you open a new card (or if you’re just starting out using the app), you will enter which card it is and the date you opened it. The app will automatically track how many you’ve opened in the last 24 months. You can see this number listed under the cards tab > card stats. The app will also show you when the card drops off of your 5/24 number.

The app is also great because it tracks how many cards you have in total, how many points you’ve earned, when sign-up bonus spending and annual fees are due, and more. It’s a life-saver!

Developing A Card Strategy

Coming up with a plan for the next year or two is important if you want to make sure you can keep opening cards. I recommend waiting approximately 90 days between Chase cards. This helps protect your credit score and your relationship with Chase.

Two things to note about your card strategy:

One, most business cards do not count again your 5/24 number, so this is an important part of our personal strategy. You can check out THIS POST to learn more about opening business cards. It’s actually much easier than you might think!

Two, if you have a player two (someone you regularly travel with and can combine points with, like a spouse, partner, or family member), be sure to refer each other to the cards so that you can earn extra points; some from the sign-up bonuses and some from referrals.

Personal Card Strategy

Ok, here is a sample personal card strategy that will help you earn a big chunk of points while being mindful of 5/24:

- Chase Sapphire® Preferred Card– this is my number one recommended card! Grab this one first so that you can access all of Chase’s transfer partners.

- Capital One Venture X Rewards Credit Card– I always recommend this card second because Capital One is very sensitive to recent card inquiries, so you want to apply before you have many other cards. The annual fee is high ($395), but the card has SO MANY benefits that truly make the fee worth it.

- Co-branded card for your favorite hotel- A few of my favorites are Hyatt, IHG, and Marriott.

- Co-branded card for your favorite airline- A few of my favorites are Southwest, United, and American Airlines.

- Chase Freedom Flex® – This card earns 5X at quarterly rotating categories. In the past, these have been things like Amazon, grocery stores, gyms, restaurants, and more. This is a great card to have in your arsenal as you’re earning more points.

At this point you will be at 5/24. You can open cards from other banks, but cannot open any more from Chase until one of these falls off after 24 months. Just remember that even if you move on and open cards from another bank, those cards will still count against your 5/24 status. This is where it’s helpful to have a player two so that person can also open cards and earn more points.

Personal + Business Card Strategy

Here is another sample strategy that includes business cards. As I already mentioned, this makes it significantly easier to stay under 5/24.

- Chase Sapphire Preferred® Card– I still recommend grabbing this one first!

- Capital One Venture X Rewards Credit Card– I also still recommend opening this one second!

- Ink Business Unlimited® Credit Card– This is a great business card that has no annual fee! It earns 1.5X on all purchases.

- Co-branded hotel business card- I recommend the business version of the ones I listed above. You can choose from Hyatt, IHG, and Marriott. Hilton also has a business card, although Hilton isn’t my top choice since it’s harder to use their points.

- Ink Business Cash® Credit Card– This is another great Chase business card similar to the Unlimited. You can have both cards for the same business. It earns 5X at office supply stores and on phone and internet.

- Capital One Venture Rewards– I like to add this in so you’re not opening too many Chase cards in a row. Just make sure it’s been at least six months since you opened the Venture X.

- Co-branded airline card- at this point you’ve earned a lot of points that can be used in a variety of ways, so adding in a hotel card can be a great option. Some favorites include Southwest, United, and American Airlines.

- Ink Business Preferred® Credit Card– You can also have this third Ink card for the exact same business.

This plan will last you up to two years if you open cards 90 days apart. It’s also helpful to refer your spouse or parter to these same cards and double the amount of points you earn together.

In Conclusion

As you can see, keeping track of your 5/24 score is important when navigating the world of credit cards. Being mindful of 5/24 can help you unlock valuable rewards and benefits while avoiding potential denials.

Thank you for using our card links when applying for new cards. It helps us run our small business at no extra cost to you. We appreciate your support!

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.