If you’re anything like me when I first jumped into points and miles, you probably think business cards are out of the question. When I first heard about opening business cards to earn more points, my immediate response was, “Well, I don’t have a business, so I can’t do that.” But the thing is, you do not need a registered business to open business cards! Who knew??

Opening business cards is actually much simpler than you may think. Here are the need-to-know details.

Why open business cards?

There are two main reasons to open business cards. First, business cards often have higher welcome offers, which is a great way to earn more points. Second, most business cards do not count against Chase’s 5/24 number. This is hugely beneficial since there are so many Chase cards and we don’t want to be ineligible to open them.

One note- business cards from Discover and some from Capital One (Spark cards) will count against your 5/24 number.

Who is eligible?

Anyone who makes money (no matter how little) outside of a W2 job is eligible. This means that if you sell a few things on Marketplace each year, you’re eligible. Or if you walk a neighbor’s dog and they pay you, you’re eligible. Or you do freelance work on the side… eligible! Basically, there are MANY things that make you eligible for a business card.

Here are a few other examples:

- Owning a rental property

- Photography

- Tutoring

- Babysitting/daycare

- Rideshare driving

- Food delivery

One note – Chase seems to be somewhat cracking down on business card applications. I’ve been hearing more and more about people being denied recently. The most common reason seems to be too many recent cards and/or applications. It’s worth keeping in mind that spacing your cards a full 90 days (or more) may help with the approval odds.

How do you fill out the application?

Much of the application is filled out with the same information you put on a personal card application. But there are a few differences, so let’s take a look at those.

First, and most importantly, if you do not have a registered business, you will use your name and social security number to apply. If you do have a registered business (like an LLC), make sure to use that information. Here’s what it looks like if you do not have a registered business.

- Legal name of business: Your name

- Business name on card: Your name

- Business mailing address: Your address

- Type of business: Sole proprietor

- Tax ID: Your SSN unless you have an EIN

- Business type: Pick a category that is closest to what you do. It does not have to match exactly. In fact, I’ve found that it’s quite hard to get it to match exactly.

- Number of employees: This will usually be zero, however, some banks don’t let you put zero, so if that’s the case then you’ll put one.

- Annual business revenue: This is your projected income for the whole year, even if you haven’t made it yet.

- Years in business: Put the number of years you’ve been operating your business, even if you weren’t making any money at first.

- Gross annual income: This is your total household income including all business and W2 income from you and a player two (if you have one).

Can you put personal spending on business cards?

Most business cards come with language in the fine print that says business cards are supposed to be used for business expenses. The thing is, it’s hard for banks to know which expenses are personal and which are business. So do what you feel comfortable with.

Either way, for tax purposes it’s important to keep track of which charges are business and which are personal. If you make a very small amount for your business, you likely will not need to file taxes related to it. However, if you do file business taxes, it’s important that what you’re claiming as write-offs truly are business expenses that can be tracked on your business card.

Note- this is not tax advice. Please seek advice from a tax professional.

Can you open multiple business cards?

The great thing about business cards is that you can have multiple of them for the same exact business. Additionally, if you have more than one business – even if they’re both sole proprietor businesses – you can open the same card for each business.

For example, the Chase Business Ink cards are my favorite business cards. Two of them have no annual fee and 0% APR for the first year (although you should always pay your cards off on time and in full each month). The third one has a low $95 annual fee and lets you access Chase’s transfer partners.

Ink Business Unlimited® Credit Card

Ink Business Cash® Credit Card

Ink Business Preferred® Credit Card

So let’s say you have two sole proprietor businesses – you do freelance blog writing and you sell your kids’ old clothes on Marketplace. You could apply for each of the Ink cards for both of your businesses, meaning you could open six total cards and get 500,000 points! Plus, none of those cards would count against 5/24, which means you can still open personal cards and earn more points.

One quick note- there is a fourth Ink card, but it has a higher annual fee and the points cannot be transferred or combined with other Ultimate Rewards, so I do not typically recommend opening it.

Combining points

If you open an Ink Business Cash® Credit Card or Ink Business Unlimited® Credit Card, you will need to combine your points onto an Ink Business Preferred® Credit Card, Chase Sapphire Preferred® Card, or Chase Sapphire Reserve® to transfer your points to travel partners. Here’s how to do it.

First, log on to your Chase account and click the card with your points, then click on your Ultimate Rewards balance.

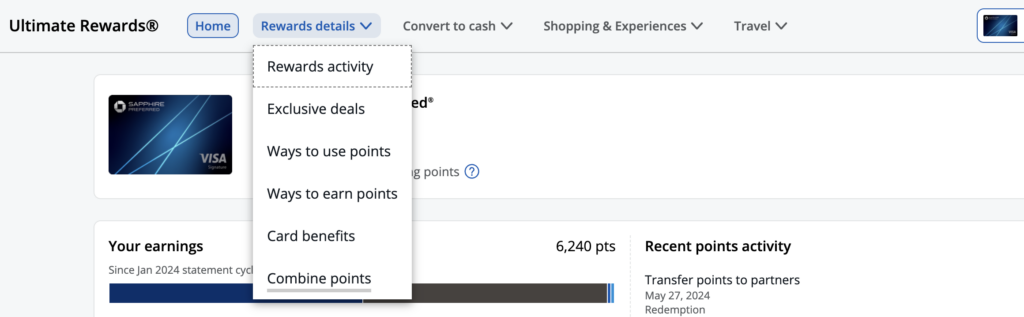

Next, click Rewards Details, then Combine Points.

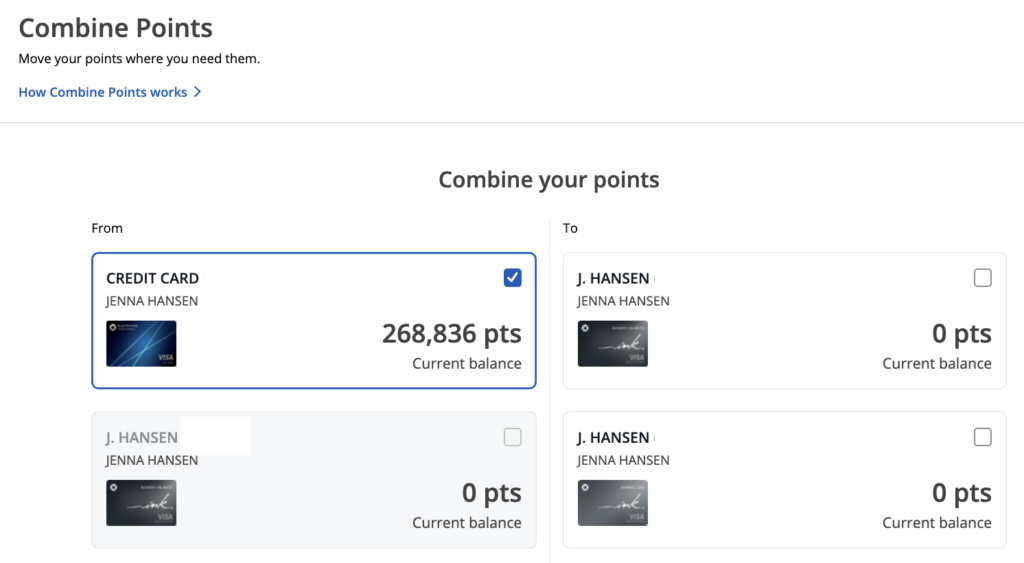

After that, you’ll see all of your cards listed. You can choose which card to move from and which card to move to. I recently moved all of my points from my Ink cards to my Sapphire Preferred, which is why my example only shows points on my Preferred.

Finally, enter the amount of points you want to combine then hit submit. The points transfer is instant.

You can also combine points with one other member of your household. To do this, you will first need to call Chase and have them link your accounts. After that’s done, their card will show up as an option to combine points with. For our family, I am the only one with a Sapphire Preferred, so my husband sends all of his points to me and then I transfer them out to travel partners to book flights and hotels.

Lastly, Capital One also allows you to combine miles. If it’s between cards you hold, you can do it online in the same way you do it through Chase. You can also combine points with any other Capital One member, you just have to do it over the phone.

Citi and American Express do not allow points to be combined between members.

In conclusion

So are you surprised that opening business cards is that easy? They’re a great way to earn a lot of extra points and stay under 5/24. Plus you can alternate between business and personal cards and between banks so that you can earn tons of points every single year!

Thank you for using our card links when applying for new cards. It helps us run our small business at no extra cost to you. We appreciate your support!

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.