Whenever I first start talking to someone about using points and miles to travel more, they ask me which cards I recommend. The Chase Sapphire Preferred® Card is always my go-to. However, once you have that card, what do you open next? The Capital One Venture Rewards Credit Card and the Capital One Venture X Rewards Credit Card are both excellent options.

They are very similar cards, with both earning Venture miles, except the former is more of a beginner card, while the latter is a premium card. So which one to get? Let’s compare them!

Venture

Quick facts

- 75,000 miles plus a $250 travel credit to Capital One Travel when you spend $4,000 in the first three months. This offer is currently elevated.

- $95 annual fee

- Up to $100 statement credit for TSA PreCheck or Global Entry

- 5X on flights, hotels, and rental cars booked in the Capital One Travel portal

- 2X on all purchases

- No foreign transaction fees

Venture X

Quick facts

- 75,000 miles when you spend $4,000 in the first three months

- $395 annual fee

- Up to $100 statement credit for TSA PreCheck or Global Entry

- Lounge access

- $300 annual travel credit

- 10X on hotels and rental cars, and 5X on flights booked in the Capital One Travel portal

- 2X on all other purchases

- No foreign transaction fees

- 10,000 card anniversary miles

Check out our full blog post about the Venture X to learn more about the benefits and how to use them.

There is also the Capital One Venture X Business, which is identical to the personal version in terms of benefits. However, it has a $30,000 minimum spend requirement, so it’s only a good option if you have a large business that can meet that! Read more about business cards here.

Comparing the Two

As you can see, the Venture X has many more benefits, which is why I usually recommend it over the Venture card. I know that the annual fee is steep, however, the benefits more than make up for it! The $300 travel credit alone makes it the same price as the Venture. Plus, when you consider all of the other benefits, it’s much easier to stomach that larger fee.

Nevertheless, I know that a $395 fee may not be an option for you – even if the benefits make up for it. The Venture is still an excellent choice and has all of the same options for using your Venture miles as the Venture X.

How to use Venture Miles

I love Venture Miles because they are so flexible and can be used in a variety of ways!

Transfer

My favorite way to use flexible points is by transferring to travel partners. Capital One has 15+ hotel and airline transfer partners. We’ve used Venture Miles transferred to Flying Blue to book flights to Europe on Air France. We’ve also transferred Venture Miles transferred to Virgin Atlantic to book flights on Delta Air Lines to Cabo.

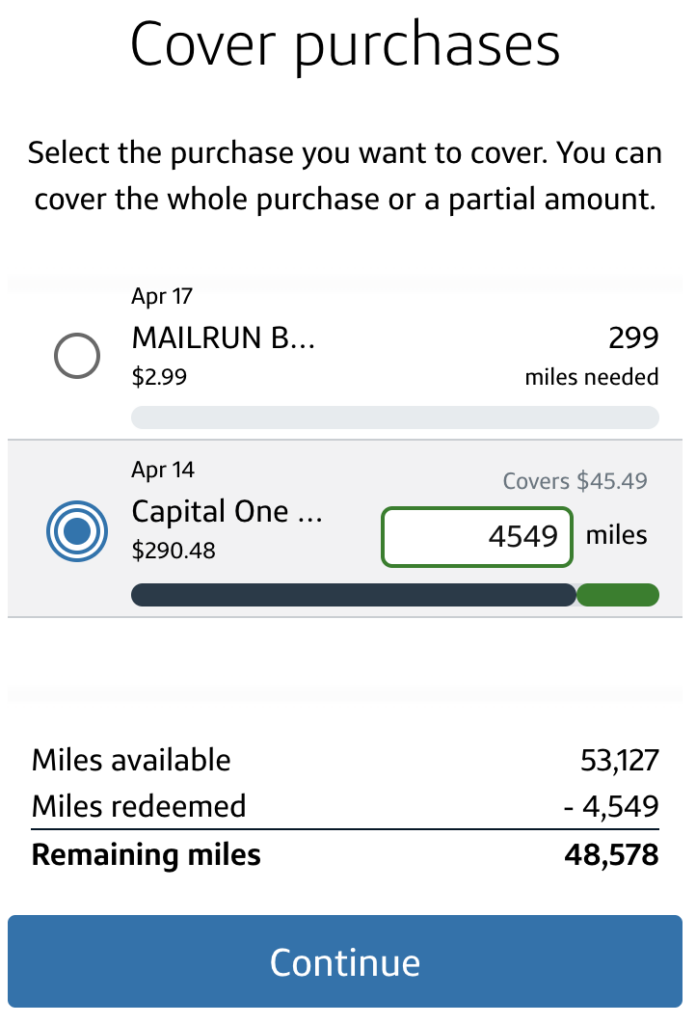

Cover travel purchases

You can also cash out your points for a statement credit to cover travel purchases. Basically, anything that is considered travel on your card statement is eligible to be covered with Venture Miles.

Capital One Travel

Finally, you can use your miles through Capital One Travel. This works like Expedia or Travelocity where you can search all available airlines or hotel brands and then choose the best one for you. However, I don’t recommend using miles this way!

Instead, pay with cash so that you earn 5X or 10X back on your purchase (depending on the type of travel and the card you have). The transaction will show up as a travel purchase, which means you can use miles afterward to cover the cost. This way, you’re still using the miles for your trip, but you’re first earning the extra miles by making a cash purchase.

Can You Have Both Cards?

Short answer, yes! The only thing is that they cannot be opened closer than six months apart. Additionally, Capital One is sensitive to how many recent accounts you’ve opened. You may not be approved for another Venture/Venture X card if you’ve opened 4+ cards in the previous 24 months. This is why I recommend opening at least one of these cards at the beginning of your points and miles journey.

You can also have the Venture X Business, even if you already have both the Venture and Venture X. But again, to be approved, it must be six months since your last Capital One card application.

Wrapping Up

Honestly, you can’t go wrong with either of these cards. My top choice is always the Venture X, but both cards have great welcome offers, benefits, and earning rates. It’s a win-win no matter which you choose.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Thank you for using our card links when applying for new cards. It helps us run our small business at no extra cost to you. We appreciate your support!

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.