So much of the time, you will get way more bang for your buck (points) when you transfer them to travel partners. Each bank has its own set of partners – both hotels and airlines. Additionally, they each have their own way of transferring points. Let’s take a look at why it’s important and then go over how to actually do it.

Why you should transfer your points

Transferring credit card points to travel partners helps to get the most out of your points. Unlike getting cash back or using points for statement credits, which give you a fixed value per point, transferring points to travel partners helps your points go a lot further. You can often get two to four times the value (or more!), allowing you to afford nicer hotels or flights that might otherwise be too expensive.

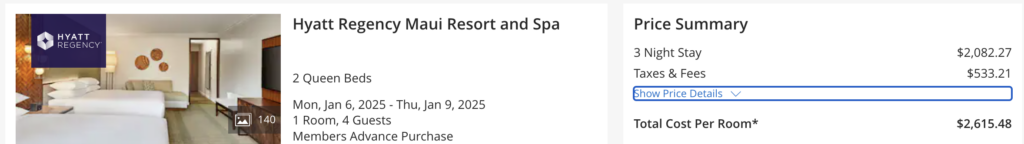

Let’s look at the Hyatt Regency Maui as an example. For a family of four, the cash rate for three nights would be over $2,600!

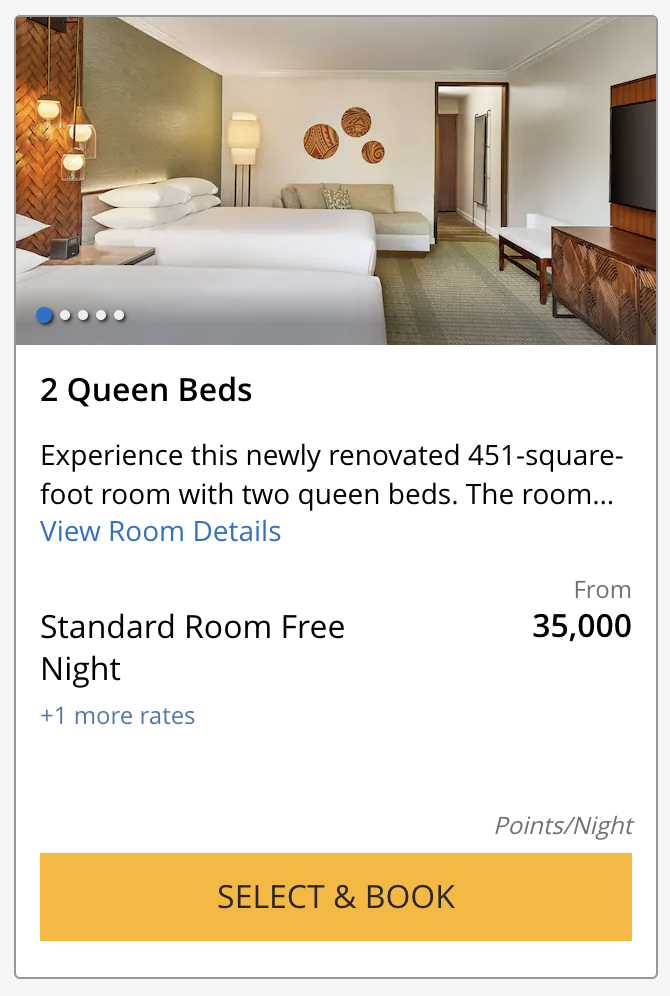

Instead, by transferring Chase Ultimate Rewards® to Hyatt, you can book the same room for just 35,000 points per night, for a total of 105,000 points.

If you were to cash out those same 105,000 points, they’d be worth $1,050. So as you can see, you’re getting 2.5 times the value by transferring your points and booking that way.

Specifics For Each Bank

Each bank has its own set of transfer partners and way of transferring points, so let’s go over the info for the four major banks.

There is one important thing to note – the name on the hotel or airline loyalty program must exactly match the name on the bank account that is transferring points. So if one says “Sam” and one says “Samantha,” you will have problems.

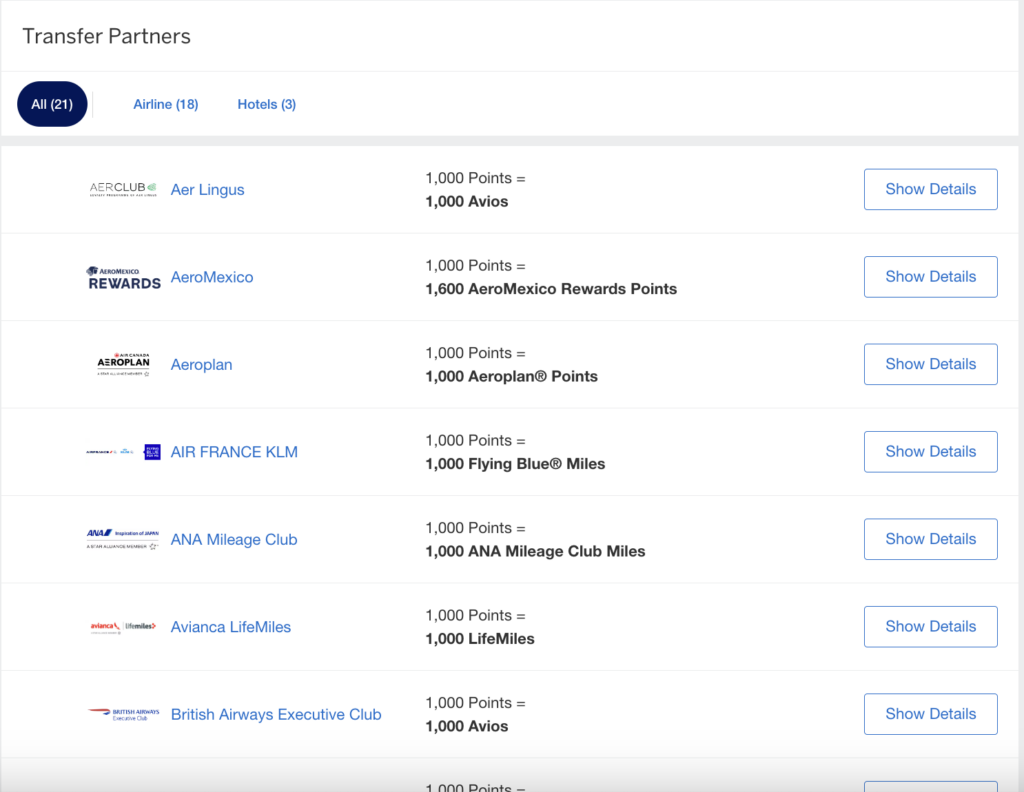

American Express Transfer Partners

Amex has 21 airline and hotel transfer partners. They are:

- Aer Lingus AerClub

- Aeromexico Rewards

- Air Canada Aeroplan

- Air France–KLM Flying Blue

- All Nippon Airways (ANA) Mileage Club

- Avianca LifeMiles

- British Airways Executive Club

- Cathay Pacific Asia Miles

- Delta SkyMiles

- Emirates Skywards

- Etihad Guest

- Hawaiian Airlines HawaiianMiles

- Iberia Plus

- JetBlue TrueBlue

- Qantas Frequent Flyer

- Qatar Airways Privilege Club

- Singapore Airlines KrisFlyer

- Virgin Atlantic Flying Club

- Choice Privileges

- Hilton Honors

- Marriott Bonvoy

There are quite a few cards that earn Amex Membership Rewards® which can be transferred to partners. They are:

- The Platinum Card® from American Express

- American Express® Gold Card

- American Express® Green Card*

- The Business Platinum® Card from American Express

- American Express® Business Gold Card

*All information about American Express Green Card has been collected independently by The Traveling Hansens. American Express Green Card is no longer available through The Traveling Hansens.

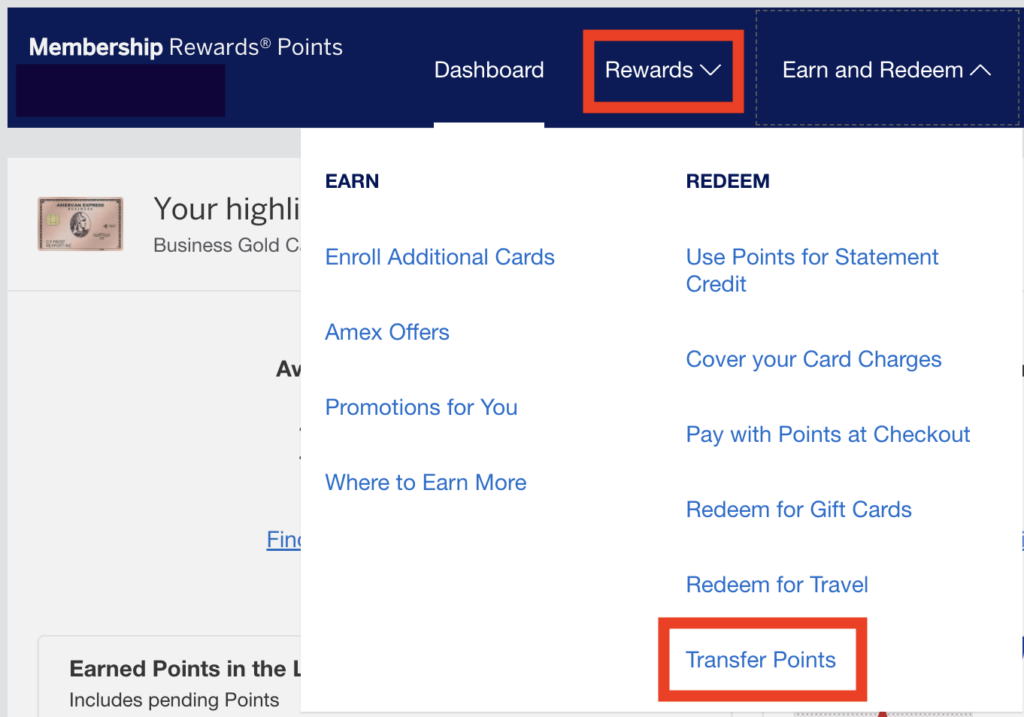

How to Transfer Points

Log on to your Amex account and navigate to your Membership Rewards®. Then, choose Rewards, then Transfer Points.

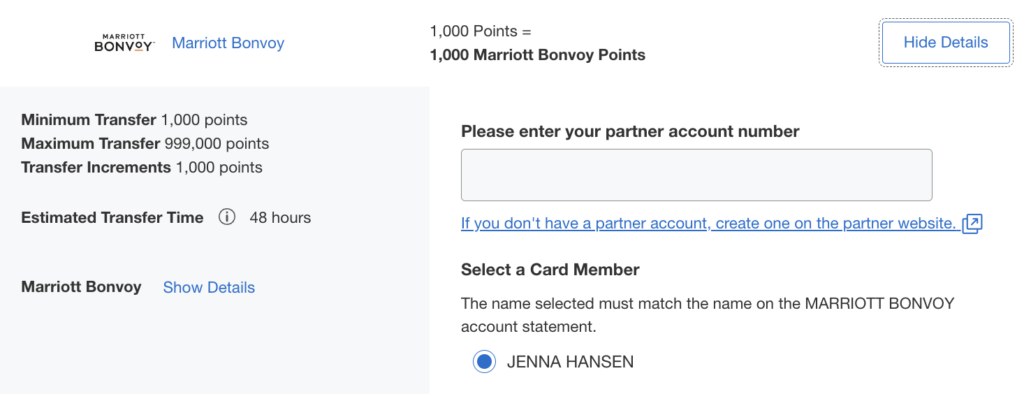

After this, choose which partner you’d like to transfer to.

Next, enter your loyalty account information. If you haven’t signed up for a free loyalty account with the hotel or airline, do that first.

Finally, enter how many points you want to transfer, then confirm the transaction.

Chase Transfer Partners

Chase has 14 airline and hotel transfer partners. They are:

- Aer Lingus AerClub

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- British Airways Executive Club

- Emirates Skywards

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United Airlines MileagePlus

- Virgin Atlantic Flying Club

- IHG One Rewards

- Marriott Bonvoy

- World of Hyatt

You will need one of three cards to transfer your points- the Chase Sapphire Preferred® Card, the Chase Sapphire Reserve®, or the Chase Ink Business Preferred® Credit Card.

How to Transfer Points

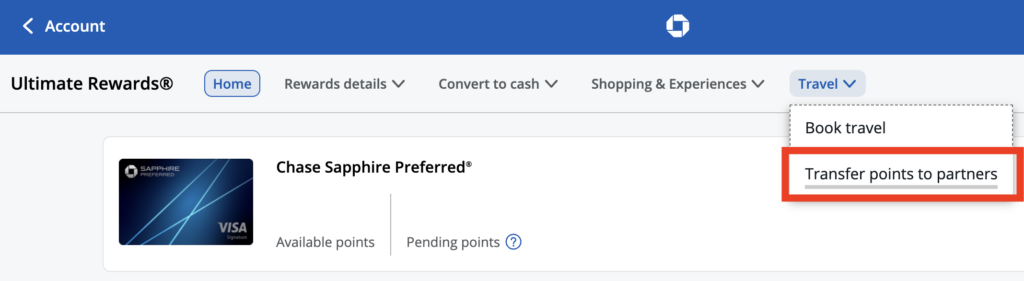

Log on to your Chase account and navigate to your Ultimate Rewards®. Next, click Travel, then Transfer points to partners.

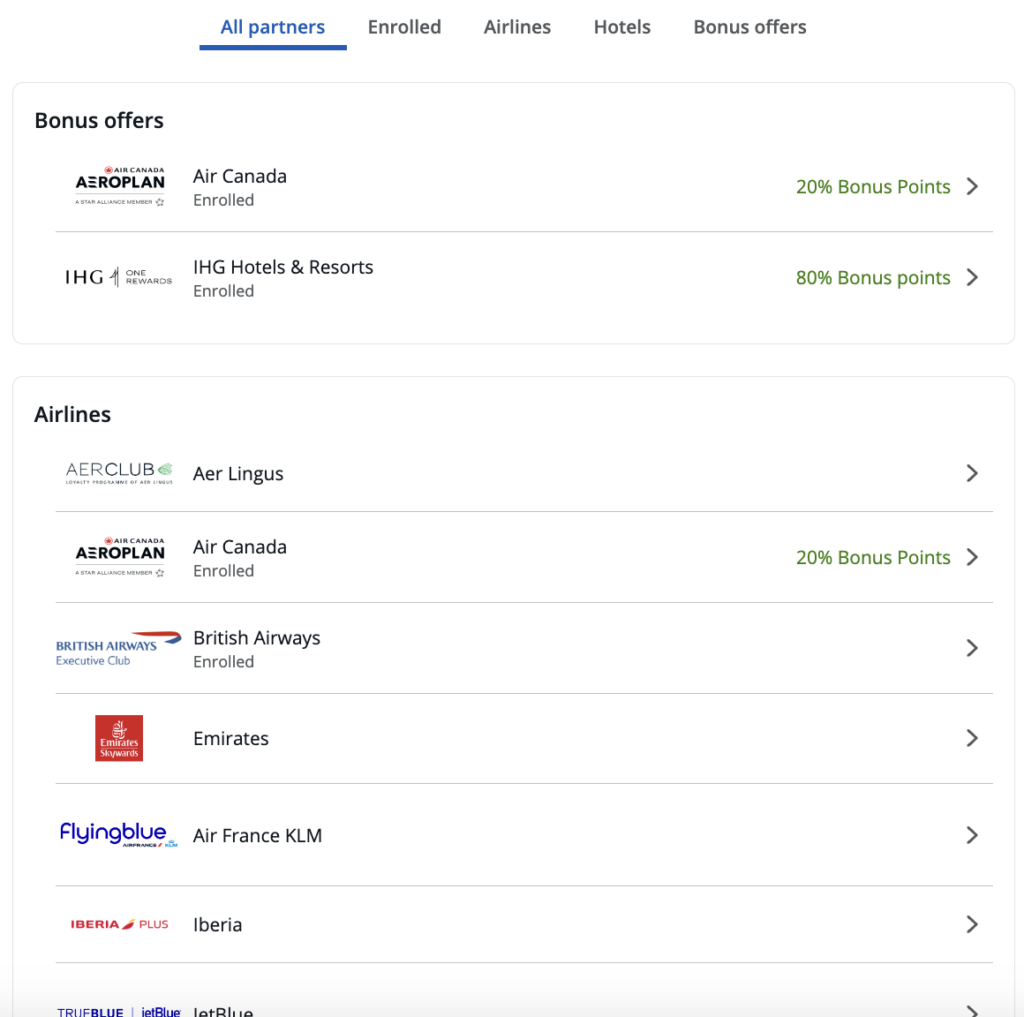

After this, you’ll see all of the available partners. Select the partner you want to transfer to.

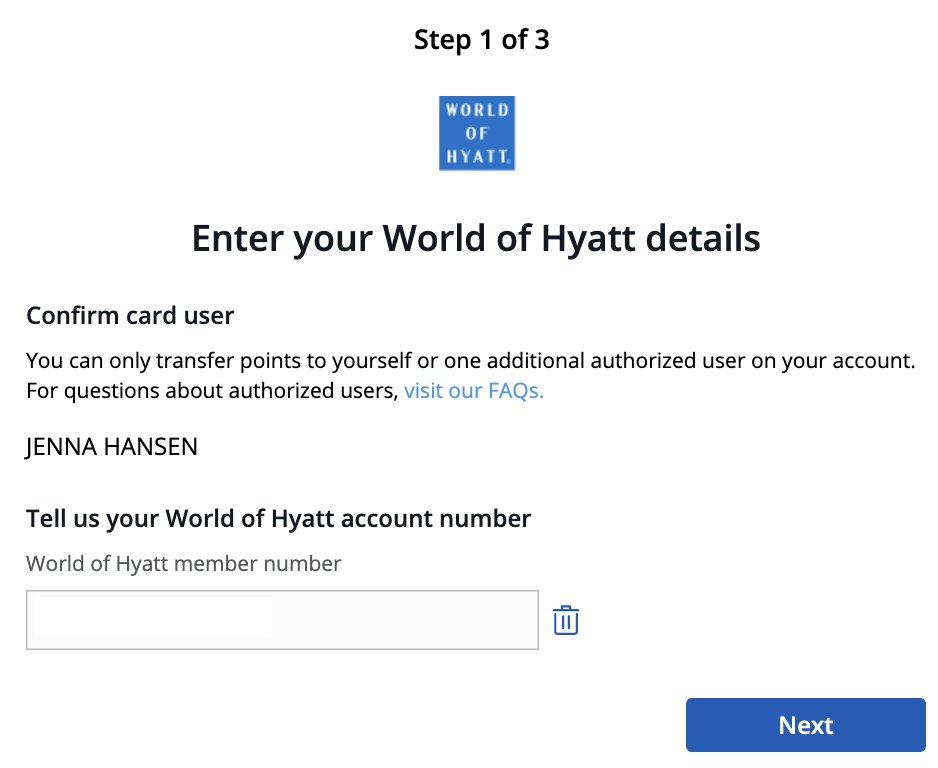

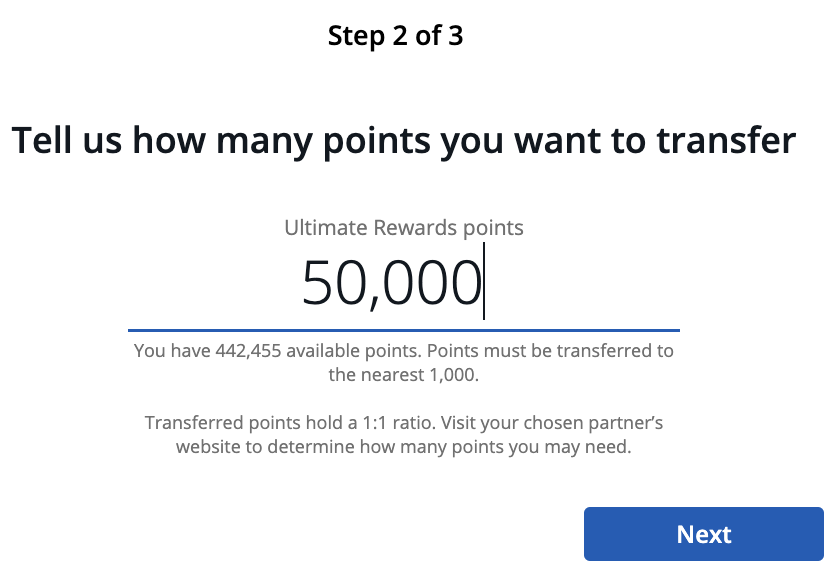

Next, enter your loyalty account information.

Then, enter how many points you want to transfer.

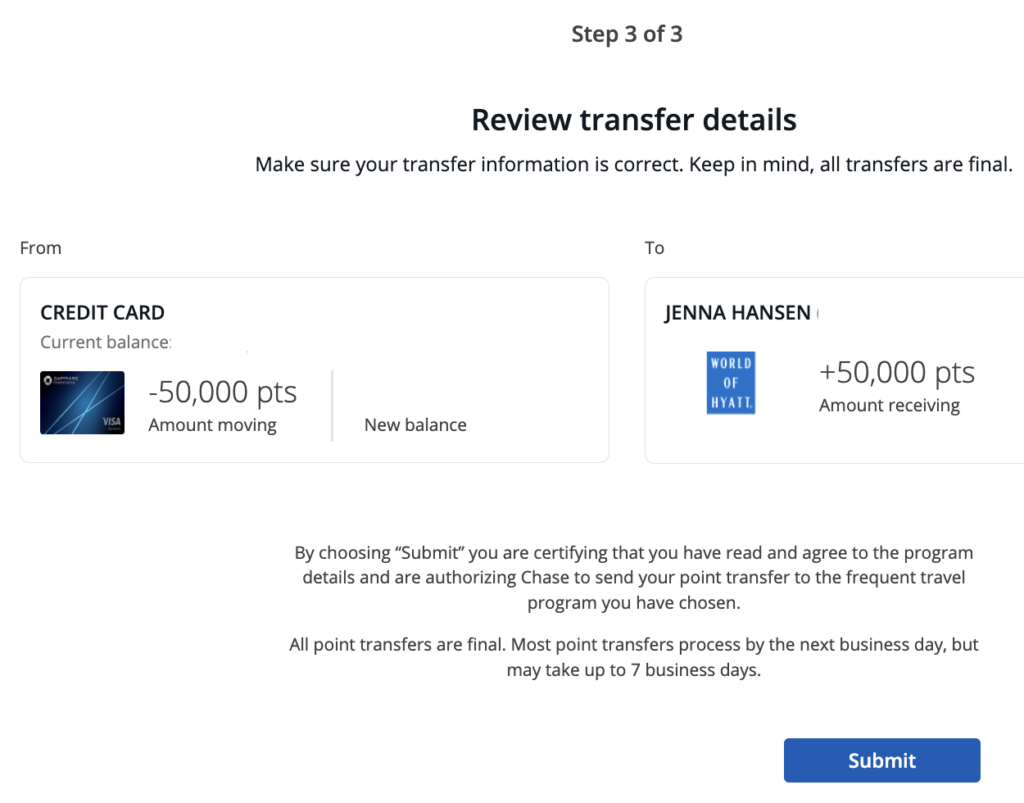

Finally, review the details then hit Submit.

Capital One Transfer Partners

Capital One has 15+ airline and hotel partners. They are:

- Aeromexico Club Premier

- Air Canada – Aeroplan

- Cathay Pacific – Asia Miles

- Avianca LifeMiles

- British Airways Executive Club

- Choice Privileges

- Emirates Skywards

- Etihad Guest

- Finnair Plus

- Flying Blue

- Qantas Frequent Flyer

- Singapore Airlines KrisFlyer

- TAP Miles&Go

- Turkish Airlines Miles&Smiles

- Virgin Red

- Wyndham Rewards

You must have one of the following cards to transfer miles:

- Capital One VentureOne Rewards Credit Card

- Capital One Venture Rewards Credit Card

- Capital One Venture X Rewards Credit Card

- Capital One Venture X Business

- Capital One Spark Miles for Business

Related: Compare the Venture and Venture X

How to Transfer Miles

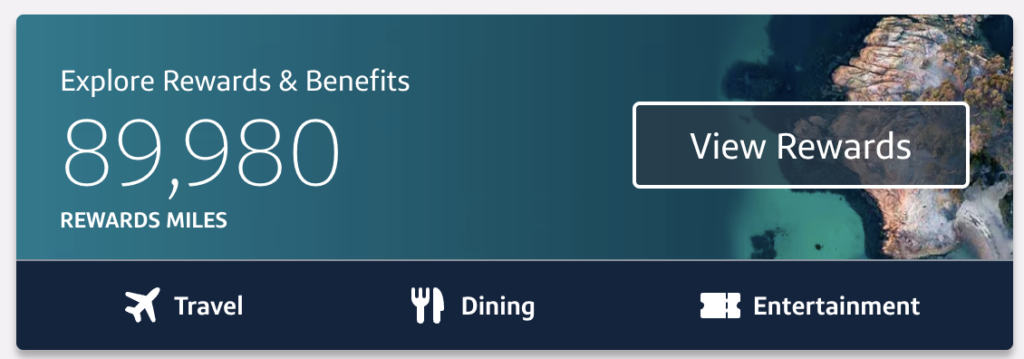

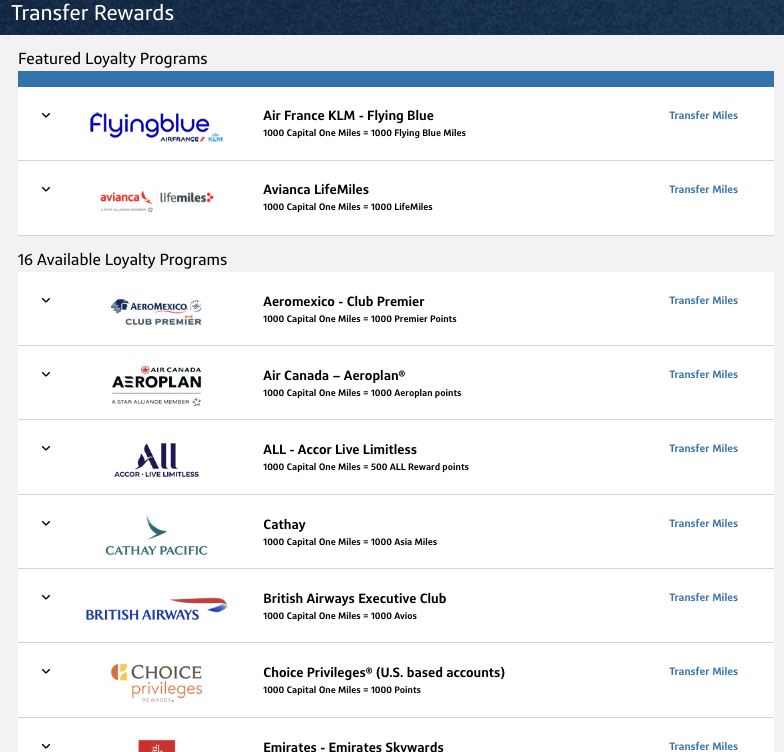

Log on to your Capital One account and navigate to the Rewards section.

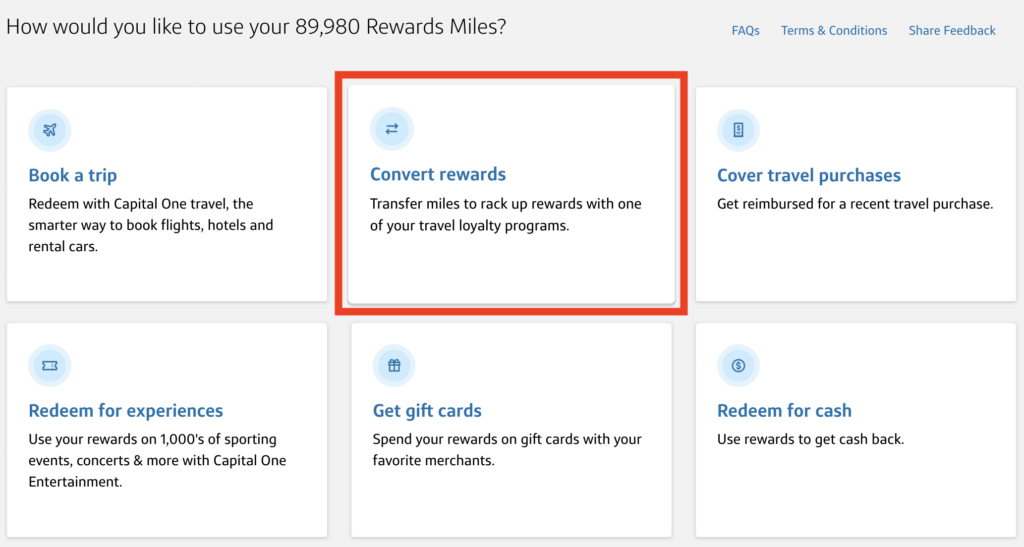

Next, choose Convert rewards.

After that, choose which program you’d like to transfer miles to.

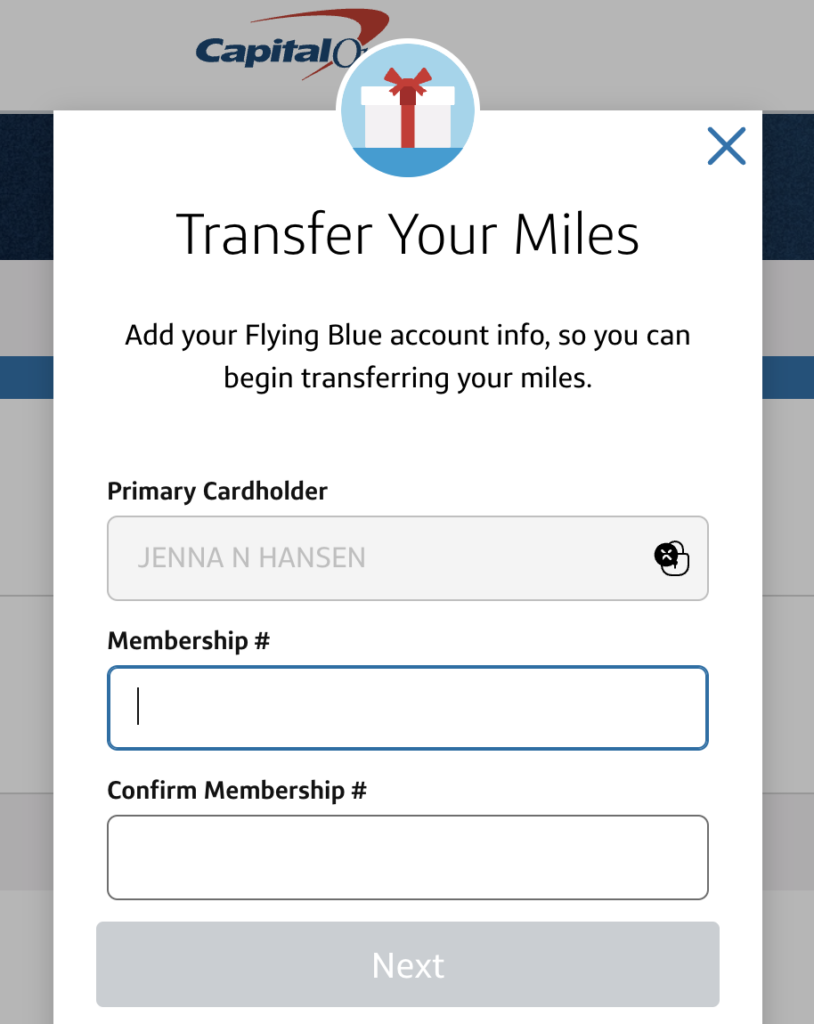

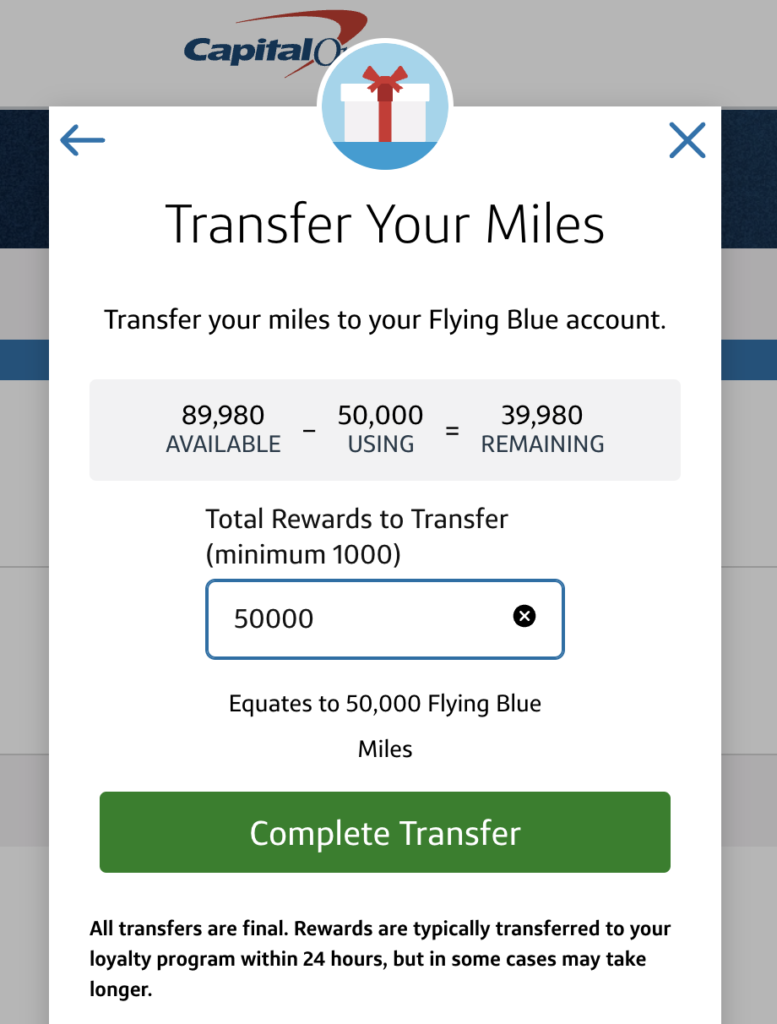

Finally, enter your loyalty account info and the amount of points.

Then choose Complete Transfer.

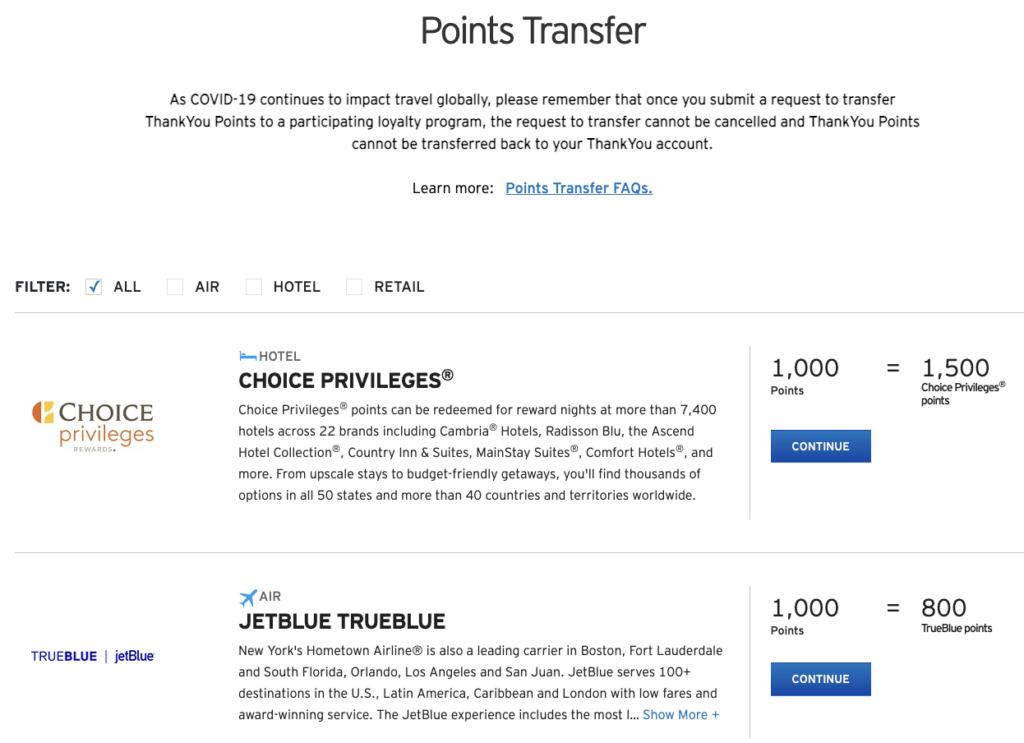

Citi Transfer Partners

Citi has 17 airline and hotel transfer partners. They are:

- Accor Live Limitless (2:1 ratio)

- Aeromexico Rewards

- Air France-KLM Flying Blue

- Avianca LifeMiles

- Cathay Pacific Asia Miles

- Choice Privileges

- Emirates Skywards

- Etihad Guest

- EVA Air Infinity MileageLands

- JetBlue TrueBlue

- Qantas Frequent Flyer

- Qatar Airways Privilege Club

- Singapore Airlines KrisFlyer

- Thai Royal Orchid Plus

- Turkish Airlines Miles&Smiles

- Virgin Atlantic Flying Club

- Wyndham Rewards

Points transfer at different rates depending on the card you have. If you have a Citi Strata Premier, most points transfer at a 1:1 ratio, except when transferring to Choice Privileges at a 1:2 ratio.

The Citi Rewards+ card offers just three transfer partners- JetBlue TrueBlue (1:0.8), Choice Privileges (1:1.5 ratio), and Wyndham Rewards.

How to Transfer Points

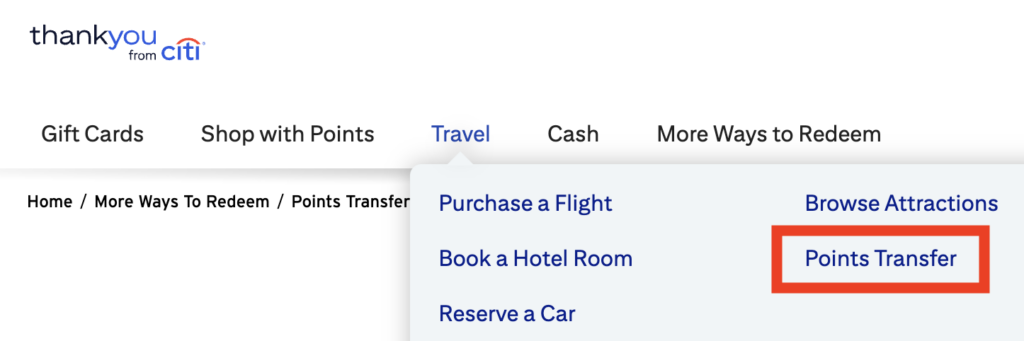

Log on to your Citi account and navigate to your ThankYou Points, then select Travel, then Points Transfer.

Next, choose the program you want to transfer to, then go through the process of entering your account information and how many ThankYou points you want to transfer.

In Conclusion

Transferring points is a great way to get maximum value. It may not be as familiar as cashing them out or using them in the bank’s travel portal, but once you learn how to do it, it’s actually quite easy and well worth the extra steps.

Thank you for using our card links when applying for new cards. It helps us run our small business at no extra cost to you. We appreciate your support!

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.