The Chase Ink Business Preferred® Credit Card is an excellent card with a high welcome offer, really great benefits and perks, and a low annual fee. Here’s everything you need to know.

Ink Business Preferred® Credit Card Details

Earn 90,000 Ultimate Rewards (Chase points) when you spend $8,000 in the first three months of account opening. This is worth a minimum of $1,125 in travel, but you can easily double or triple the value by accessing Chase’s transfer partners. More about that in a bit.

There is a $95 annual fee.

This card will not count against Chase’s 5/24 rule because it’s a business card. And before you automatically discount it because you “don’t have a business”, let me tell you something – business cards are much easier to get approved for than you might think.

You DO NOT need a registered business, and any small side hustle income counts. You can learn about all things business cards in this post.

Ink Business Preferred® Credit Card Benefits

- Earn 3X up to 150,000 spent per card anniversary year on travel, shipping purchases, Internet, cable, and phone services, and advertising purchases with social media sites and search engines.

- 5X on Lyft rides through March 2025.

- 1X on all other purchases.

- 25% points boost when booking through Chase Travel℠, so instead of every 10,000 points being worth $100, they’re worth $125.

- Primary rental car coverage.

- Cell phone protection when you use your card to pay the bill.

- Trip cancellation/interruption insurance, lost luggage insurance, extended warranty, and purchase protection.

- No foreign transaction fees.

How to redeem Ultimate Rewards

TRANSFER POINTS

My favorite way to use Ultimate Rewards is to transfer them to travel partners. The Ink Business Preferred gives you access to Chase’s 11 airline and 3 hotel partners. All points transfer at a 1:1 ratio in increments of 1,000.

Here are the partners:

- Aer Lingus

- Air Canada

- Air France-KLM

- British Airways

- Emirates

- Iberia

- JetBlue

- Singapore

- Southwest

- United

- Virgin Atlantic

- Hyatt

- IHG

- Marriott

More often than not, we transfer our Ultimate Rewards to Hyatt. Hyatt points rates are so much lower than other hotel chains, which means we can get really great value out of them.

However, we’ve also used them for things like Flying Blue (Air France) flights to Paris, Southwest flights to Hawaii, Virgin Atlantic flights to Cabo, and more. They really are the very best points.

USE THEM WITH CHASE TRAVEL℠

Another way to use your Ultimate Rewards is by booking travel through Chase Travel℠. This works like any other travel search portal and allows you to run searches across all airlines and hotels to find the best option for you.

When you redeem your points this way, they’re worth 25% more thanks to the Ink Business Preferred. So every 10,000 points is worth $125. This seems like a great deal, and sometimes it is, but it’s important to compare the cost of booking directly with travel partners. More often than not, it will cost less points to transfer and book directly than to book in the portal.

However, it’s definitely a great option for rental cars, cruises, and other activities since you can’t transfer points to book directly with those companies.

It’s also a good option when booking boutique hotels that may not be part of a larger program like Hyatt or Marriott.

CASH THEM OUT

Your final option is to cash out your points as a statement credit. If you do this, you’re getting a one cent per point value, meaning every 10,000 points is worth $100. While this is the lowest value, it’s still a viable option if you’d rather save yourself the extra steps of the travel portal or transferring to partners. However, I promise you that it’s easier than you think!

Earning more points and combining

You can earn an absolute ton of Ultimate Rewards through a variety of Chase cards. The great thing is that all of these points can be combined easily.

Here are the other cards that earn Ultimate Rewards:

- Chase Sapphire Preferred® Card

- Chase Sapphire Reserve®

- Chase Freedom Flex® – click the link and choose Flex. This card is advertised as cash back, but it actually earns Ultimate Rewards.

- Chase Freedom Unlimited® – click the link and choose Unlimited. This card is advertised as cash back, but it actually earns Ultimate Rewards.

- Ink Business Cash® Credit Card – advertised as cash back, but it actually earns Ultimate Rewards

- Ink Business Unlimited® Credit Card – advertised as cash back, but it actually earns Ultimate Rewards.

Points earned from any of these cards can be combined onto your Ink Business Preferred (or Sapphire Preferred) and then transferred to travel partners.

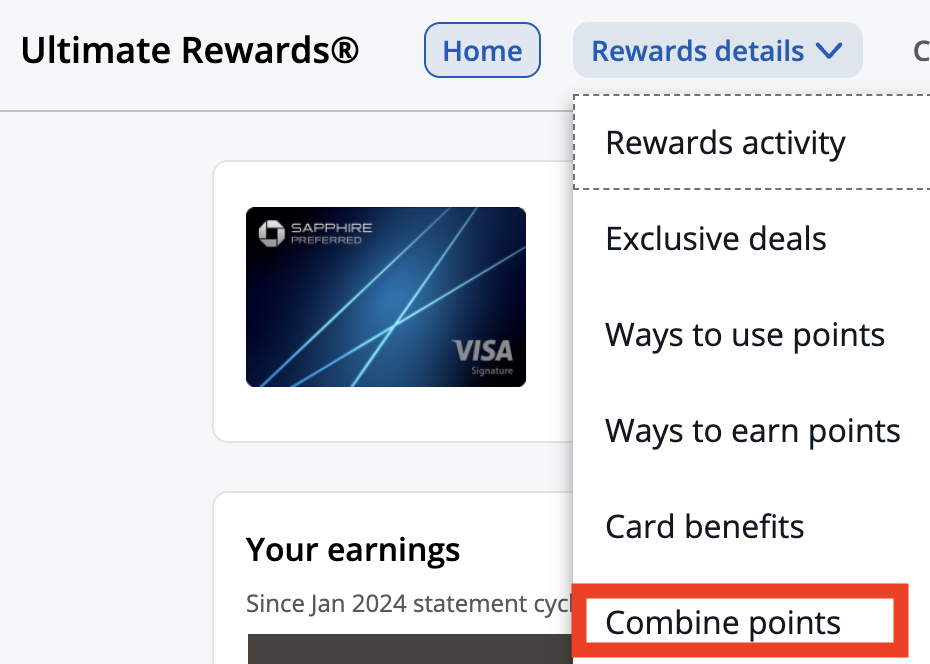

HOW TO COMBINE POINTS

To combine points from multiple cards, log in to your Chase account, and go to your Ultimate Rewards. Click Rewards Details, then click “combine points”.

Choose which cards you want to move points from and to, enter how many points you want to move, and hit confirm. It’s easy and instant!

What to do after one year

The Ink Business Preferred has a $95 annual fee, which means you may think about whether to keep it open long-term. First, ALWAYS keep your cards open for a full year. The annual fee is always worth it for that big welcome offer. After that, you can decide what to do.

With this card, you need to consider a few things. First, do you also have a Sapphire Preferred that will give you access to Chase’s transfer partners? Are the spending categories useful for your everyday spending? Do you have other cards that offer travel protections?

If the answer is yes to any of those questions, then you may consider closing this card after the first year. However, if you answered no to any of those questions, then this card may be a long-term keeper.

Wrapping it up

The Chase Ink Business Preferred is an excellent all-around card with a great welcome offer, low annual fee, good benefits, and solid spending categories. Plus, it doesn’t count against your 5/24 number. It’s an absolute win in my book!

Thank you for using our card links when applying for new cards. It helps us run our small business at no extra cost to you. We appreciate your support!

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.