The Chase Ink Business Unlimited® Credit Card is an excellent card with a high welcome offer, solid return on spending, and no annual fee. Here’s everything you need to know.

Ink Business Unlimited® Credit Card Details

Earn $750 bonus cash back after you spend $6,000 on purchases in the first three months from account opening. This card is marketed as a cash-back card, which is why you see the offer listed as $750 cash back instead of 75,000 points.

However, the card actually earns Ultimate Rewards. The thing is, you need an additional card to make these points flexible. The Chase Sapphire Preferred® Card or the Ink Business Preferred® Credit Card are my top choices for this. When you move your points to one of these card, you can easily double or triple the value of your points by accessing Chase’s transfer partners.

The Ink Unlimited has no annual fee.

It will not count against Chase’s 5/24 rule because it’s a business card. Don’t automatically discount it because you “don’t have a business” – business cards are much easier to get approved for than you might think!

You DO NOT need a registered business; any small side hustle income counts. You can learn about all things business cards in this post.

Ink Business Unlimited® Credit Card Benefits

- Earn 1.5X on all purchases

- 5% back on Lyft rides through March 2025

- Primary rental car coverage when renting for business purposes

- Extended warranty and purchase protection.

How to redeem Ultimate Rewards

TRANSFER POINTS

My favorite way to use Ultimate Rewards is to transfer them to travel partners. The Ink Business Preferred gives you access to Chase’s 11 airline and 3 hotel partners. All points transfer at a 1:1 ratio in increments of 1,000.

Here are the partners:

- Aer Lingus

- Air Canada

- Air France-KLM

- British Airways

- Emirates

- Iberia

- JetBlue

- Singapore

- Southwest

- United

- Virgin Atlantic

- Hyatt

- IHG

- Marriott

More often than not, we transfer our Ultimate Rewards to Hyatt. Hyatt points rates are so much lower than other hotel chains, which means we can get really great value out of them.

However, we’ve also used them for things like Flying Blue (Air France) flights to Paris, Southwest flights to Hawaii, Virgin Atlantic flights to Cabo, and more. They really are the very best points.

USE THEM WITH CHASE TRAVEL℠

Another way to use your Ultimate Rewards is by booking travel through Chase Travel℠. This works like any other travel search portal and allows you to run searches across all airlines and hotels to find the best option for you.

This is not my top recommendation since your points are worth a standard one cent per point, meaning every 10,000 points is worth $100, when redeemed this way. However, it can be a good option when booking boutique hotels that may not be part of a larger program like Hyatt or Marriott or when you can’t find decent transfer partner flight options.

CASH THEM OUT

Your final option is to cash out your points as a statement credit. This also gives you a one cent per point value, but it’s still a viable option if you’d rather save yourself the extra steps of the travel portal or transferring to partners. However, I promise you that both of those options are easier than you think!

Earning more points and combining

You can earn an absolute ton of Ultimate Rewards through a variety of Chase cards. The great thing is that all of these points can be combined easily. As I mentioned previously, when you earn points with the Ink Unlimited, you will need to combine them with another card to make them flexible. Your options for this are:

You can stock up on Ultimate Rewards by earning extra points through any of these cards:

- Chase Freedom Flex® – click the link and choose Flex. This card is advertised as cash back, but it actually earns Ultimate Rewards.

- Chase Freedom Unlimited® – click the link and choose Unlimited. This card is advertised as cash back, but it actually earns Ultimate Rewards.

- Ink Business Cash® Credit Card – advertised as cash back, but it actually earns Ultimate Rewards

Just remember, similar to the Ink Unlimited, they will need to be combined with the cards mentioned previously to make them flexible.

HOW TO COMBINE POINTS

So how do you combine the points between cards? It’s pretty simple!

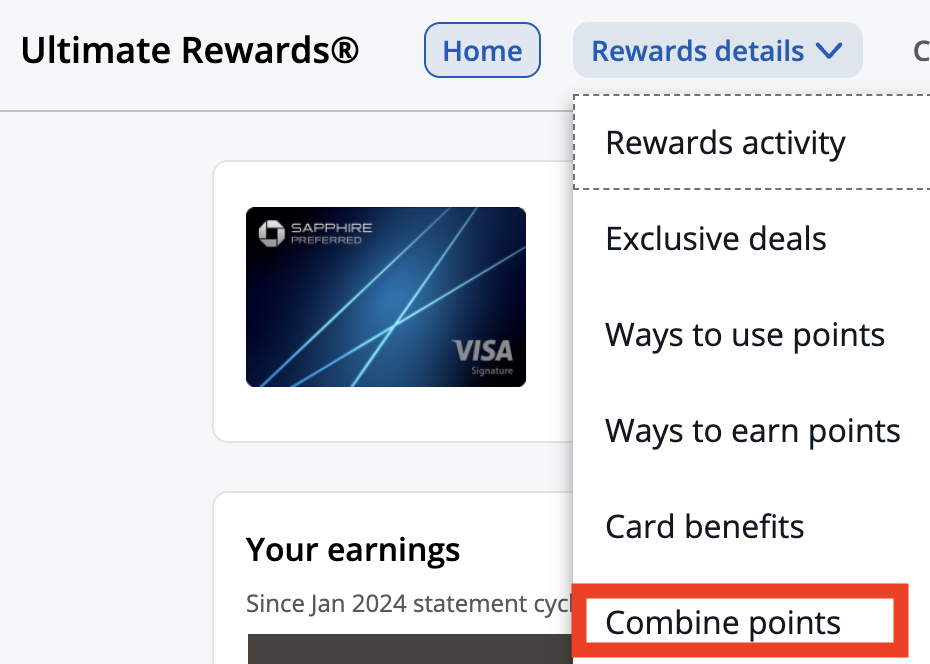

To combine points from multiple cards, log in to your Chase account, and go to your Ultimate Rewards. Click Rewards Details, then click “combine points”.

Choose which cards you want to move points from and to, enter how many points you want to move, and hit confirm. It’s easy and instant!

What to do after one year

The Ink Business Unlimited has no annual fee, which means that it doesn’t hurt to keep it open long-term. As with all cards, ALWAYS keep them open for a full year. After that, you can decide what to do.

You can have each of the Ink cards open for the same business. You can also hold more than one of the same Ink card for the same business. There are no stipulations in the fine print that prevent you from earning the bonus again. So, there isn’t a strong reason to close the card unless you have quite a few open and you’d like to free up some of your credit limit with Chase.

Wrapping it up

The Chase Ink Business Unlimited is an excellent all-around card with a great welcome offer and no annual fee. Plus, it doesn’t count against your 5/24 number. It’s a great way to stock up on Ultimate Rewards so you can take nearly free trips with your family.

Thank you for using our card links when applying for new cards. It helps us run our small business at no extra cost to you. We appreciate your support!

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.