The Happiest Place on Earth can also be one of the most expensive. We are a Disney-obsessed family, but we’ve watched Disney prices rise over the past few years, and now we’ve been nearly priced out. The cash cost for a family to spend a few days at Disneyland or Disney World can be astronomical. But thankfully, there’s a workaround. You can use points and miles to cover the majority of your trip, and I’m going to show you how to do it!

Choosing the Right Credit Card

To help offset the cost of your Disney trip, you will need some credit card points. So which ones are the best? Well, there are multiple cards that will help, and they are each good in their way. Overall, you’ll want to focus on earning flexible points. These are points that can be used for airfare, hotels, rental cars, and park tickets.

My favorite flexible points cards are:

- Chase Sapphire Preferred® Card

- Capital One Venture Rewards Credit Card

- Capital One Venture X Rewards Credit Card

- Ink Business Preferred® Credit Card

- American Express® Gold Card

- The Platinum Card® from American Express

You will need multiple cards if you want to cover the majority (or all!) of the cost of your Disney trip. Having a good stash of flexible points will give you options for using them. So let’s look at each part of the trip — flights, hotel, rental car, and park tickets — to see how you can use your points.

Flights

There are three main ways to use points to cover airfare.

FLEXIBLE POINTS AND TRANSFER PARTNERS

If you earn flexible points from the cards mentioned above, you can transfer these points to airline partners and book directly with them. This article covers the details about how to book award flights.

CO-BRANDED AIRLINE CARDS

Another option is to open co-branded cards – cards that earn specific airline points. Once you’ve earned these points, you can use them to book directly with the airline.

Some of my favorite co-branded cards that earn points with domestic U.S. airlines are:

- United℠ Explorer Card

- United℠ Business Card

- Southwest Rapid Rewards® Plus Credit Card

- Southwest® Rapid Rewards® Premier Business Credit Card

- Citi® / AAdvantage® Platinum Select® World Elite Mastercard®

- AAdvantage® Aviator® Red World Elite Mastercard®

BANK TRAVEL PORTAL

The final way to book your flights is directly through the bank’s travel portal. This works like Expedia or Travelocity, which searches for all available flights from most airlines. The flight is treated like a cash booking, but the bank lets you use your points to pay.

This article goes over how to book through Chase Travel℠.

This article goes over how to book through Capital One Travel.

You can also book through American Express Travel® if you have Amex Membership Rewards®, or Citi Travel℠ if you have Citi ThankYou® Points.

Hotels

Just like flights, there are three main ways to book your hotel near the Disney parks.

FLEXIBLE POINTS AND TRANSFER PARTNERS

You can earn flexible points from the cards I mentioned at the beginning of this article and then transfer them to hotel partners. By far, my favorite option is to transfer Chase Ultimate Rewards® to Hyatt. We stay at Hyatts for the majority of our trips because you can get such outsized value.

CO-BRANDED HOTEL CARDS

We also like to have co-branded hotel cards so that we have options. Hotel cards are valuable because many of the come with an annual free night certificate (starting with your first account anniversary), which easily makes up for the annual fee. Besides Hyatt, we especially like IHG hotels because the fourth night is free for cardholders. This benefit has saved us a ton of points over the years.

Typically, we save our flexible points for Hyatt, and we open co-branded cards to earn points for the other hotels. Most other hotels cost more points per night, so you can usually get better value by opening co-branded cards to earn more points.

Here are some of my favorites:

- The World of Hyatt Credit Card

- World of Hyatt Business Credit Card

- IHG One Rewards Premier Credit Card

- IHG One Rewards Premier Business Credit Card

- Marriott Bonvoy Bold® Credit Card

- Marriott Bonvoy Business® American Express® Card

- Hilton Honors American Express Surpass® Card

- The Hilton Honors American Express Business Card

I included business and personal cards in this list. You can double your points by opening one of each for each hotel. Business cards are great because they don’t count against 5/24, and they’re easier to get than you might think! You don’t even need a registered business.

BANK TRAVEL PORTAL

Hotels can also be booked through the bank’s travel portal. However, unlike flights, which are treated as cash stays, hotel bookings work slightly differently. The hotel views nights booked through bank portals as a third-party booking, which means that you won’t get elite qualifying nights or receive any benefits for your stay. It can also be more challenging to make changes. I highly recommend booking directly with the hotel instead.

FAVORITE POINTS HOTELS NEAR DISNEY

Here are some of the best points options near the Disney parks.

Disneyland:

- Hyatt House Anaheim (this is my top choice!)

- Hyatt Place Anaheim

- Holiday Inn Express Anaheim Resort Area (IHG)

- Hotel Indigo Anaheim (IHG)

- Courtyard Anaheim Theme Park Entrance (Marriott)

- SpringHill Suites at Anaheim Resort (Marriott)

Disney World:

- Hyatt Regency Grand Cypress (this is my top choice!)

- Holiday Inn Orlando- Disney Springs (IHG)

- Hyatt Place Orlando/Lake Buena Vista

- Marriott Swan, Swan Reserve, or Dolphin

- Disney properties booked through DVC

Park Tickets

Tickets for both Disneyland and Disney World can be covered with points when you use them as a statement credit to cover the cost. This is easiest with either Chase or Capital One.

I usually recommend using Capital One Miles to cover the cost of park tickets because I like to save my Ultimate Rewards® for Hyatt hotels (and sometimes flights).

HOW TO USE CAPITAL ONE MILES

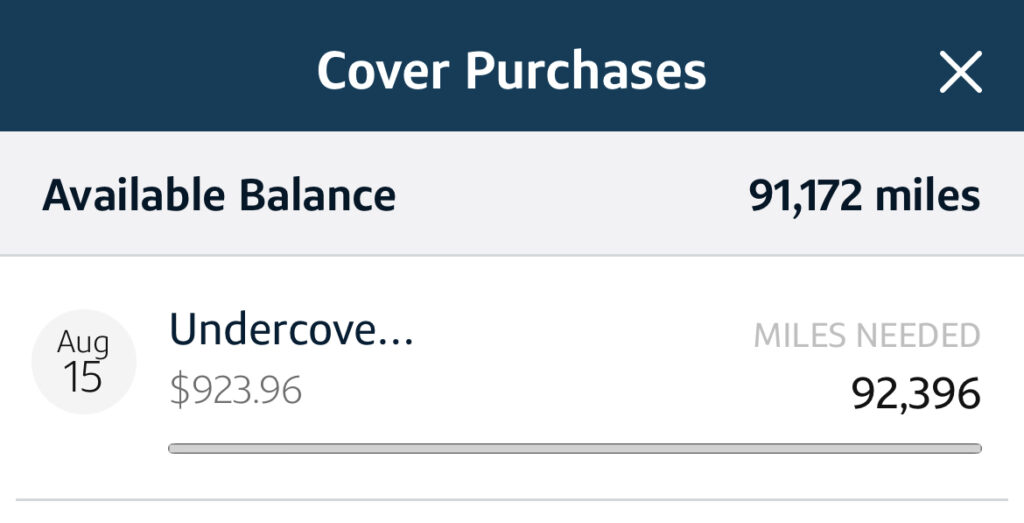

To use Capital One Miles to cover the cost of park tickets, you will need to purchase them through a third-party like Undercover Tourist so that they are considered “travel” on your card statement. We have done this many times! They are very reputable and the prices are typically a bit cheaper than buying direct from Disney.

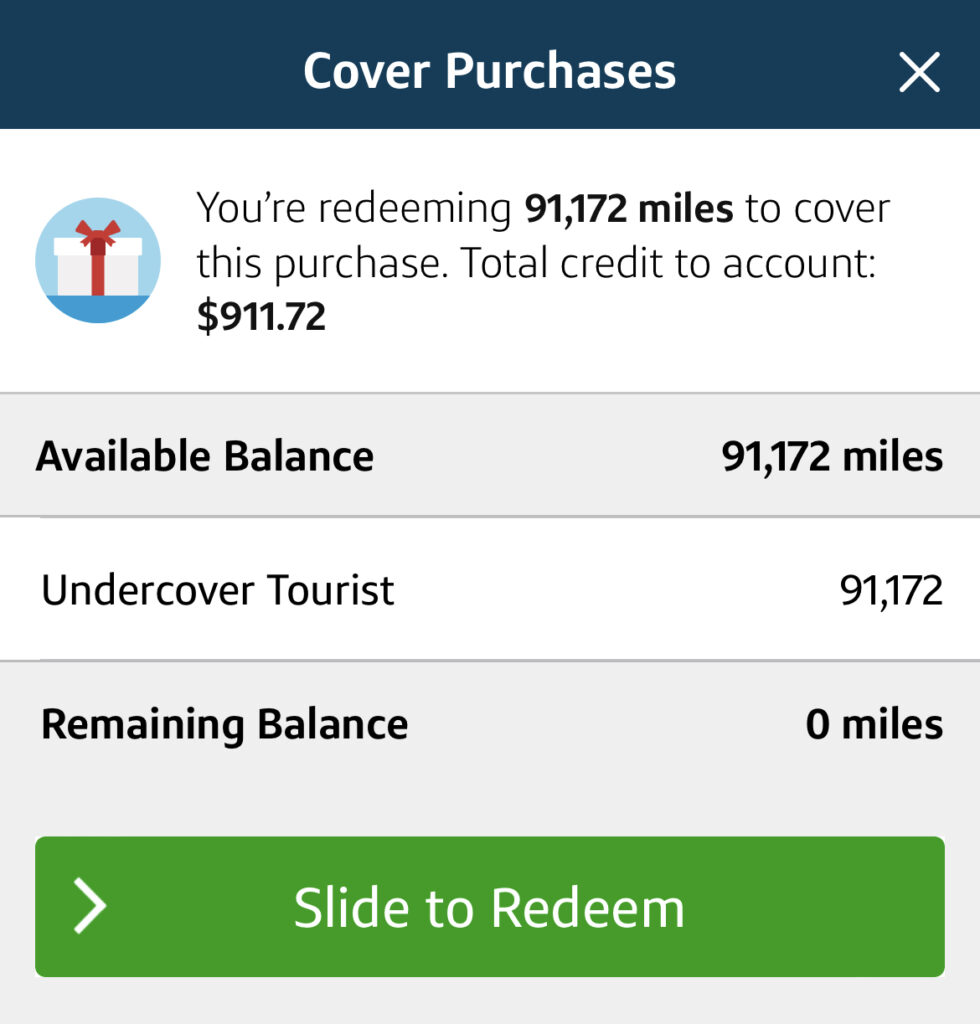

Once you’ve purchased your tickets and charged them to a Venture-family card (like the Venture or Venture X), you can cover the purchase with your miles. Every 10,000 miles equals a $100 statement credit.

Here’s what it looks like:

Log on to your Capital One account, click on your miles, and navigate to “Cover travel purchases.”

You will see a list of travel purchases made on your card within the last 90 days. Select the ticket purchase.

You can choose to use all of your miles or choose a specific amount to put toward the purchase.

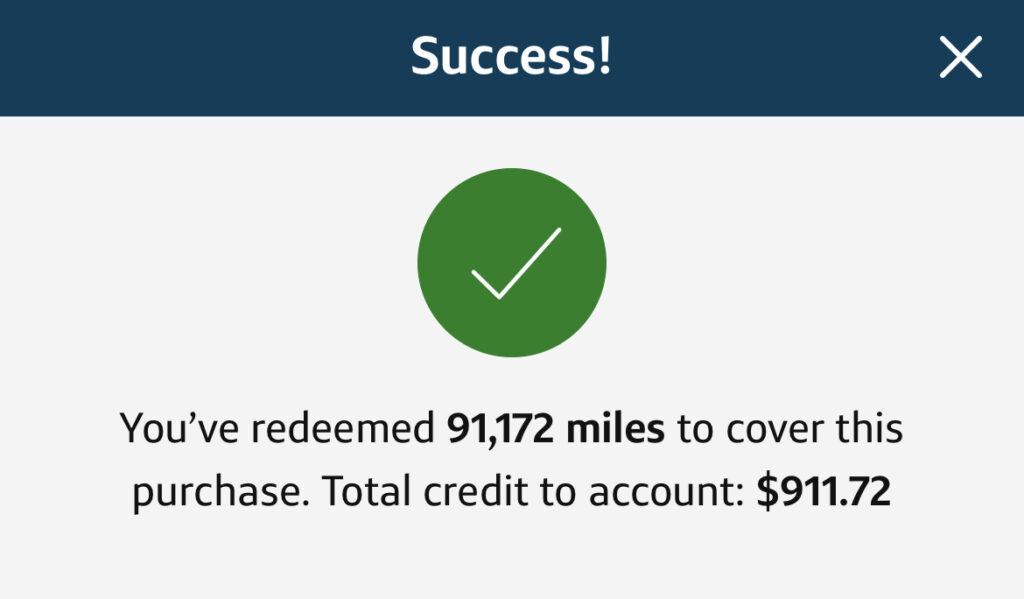

After you slide to redeem (or click redeem on a computer), you will get a confirmation that your statement credit is on the way. It usually takes a few days to show up in your account.

And that’s it! It’s very easy.

HOW TO USE ULTIMATE REWARDS®

You do not need to purchase tickets through a third party if you want to redeem Chase Ultimate Rewards® as a statement credit, although you can if you’d like to buy them at a slight discount.

To redeem your points as a statement credit, log on to your account and navigate to your points. Click “convert to cash”, then choose “cash back.”

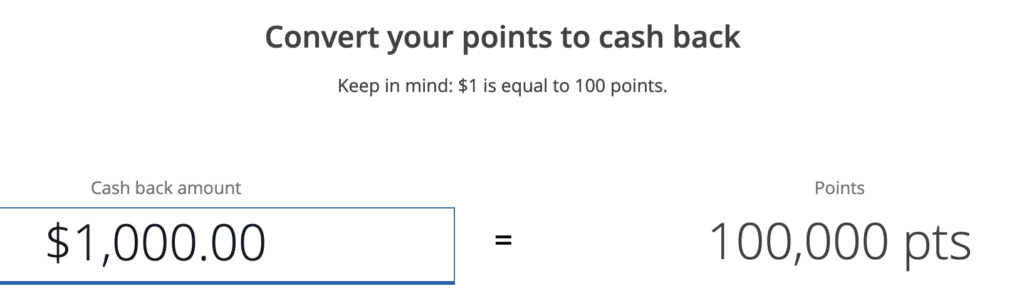

Next, choose which card you want to receive the credit, then enter how much cash back you’d like to receive. Just like with Capital One Miles, every 10,000 points is worth $100.

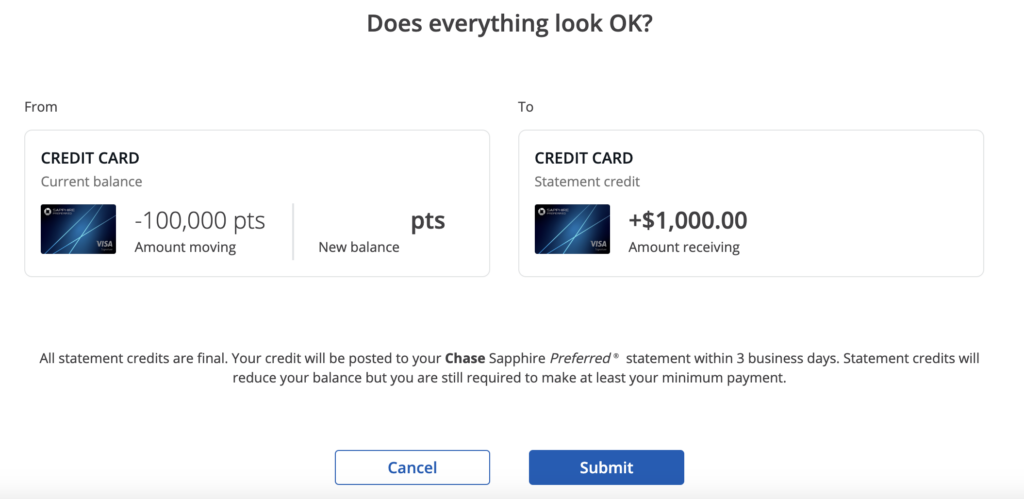

Next, confirm your transaction. The credit takes approximately three business days to show up in your account.

Rental Car

In terms of rental cars, you first need to decide if you even need one. Many hotels are either within walking distance or offer a free shuttle to the parks, so you may not need a car for your trip. To get from the airport to your hotel, you can get an Uber/Lyft or see if your hotel has an airport shuttle.

If you do decide to rent a car, you will need to use points as a statement credit to cover the cost. To do this, follow the same instructions listed above for covering ticket costs. You do not need to use a third party to cover your rental car purchase with Capital One Miles. All rental car companies should show up as a “travel” purchase.

Wrapping Up

Disney is very expensive, but thankfully, there’s a way around it. You can use points and miles to cover the majority of your travel costs so that you can save up your cash for all of that yummy Disney food!

Thank you for using our card links when applying for new cards. It helps us run our small business at no extra cost to you. We appreciate your support!

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.