American Express Membership Rewards® offer a ton of value and flexibility. You can earn points through multiple cards and redeem them for all kinds of things — with travel being our top choice, of course. Amex cards are a great way to diversify the points you earn and open up your travel options. Let’s take a look at everything you need to know about earning and using Amex Membership Rewards®.

What are American Express Membership Rewards®?

American Express Membership Rewards® are points earned from a variety of American Express credit cards. They are flexible points, which means they can be used in multiple ways — such as booking with Amex Travel, transferring to Amex’s 21 airline and hotel partners, or even using them as a statement credit.

Ways to Earn Membership Rewards®

CREDIT CARDS

The easiest way to earn a large number of points is by opening a new credit card and earning the big welcome offer. Several American Express cards earn Membership Rewards® points. These are all cards with no preset spending limit. Instead, the spending limit is flexible, and the amount you can spend adapts based on factors such as your purchase, payment, and credit history.

Personal cards that earn Membership Rewards®:

- The Platinum Card® from American Express

- American Express® Gold Card

- American Express® Green Card*

*All information about American Express® Green Card has been collected independently by The Traveling Hansens. American Express® Green Card is no longer available through The Traveling Hansens.

Business cards that earn Membership Rewards®:

- The Business Platinum Card® from American Express

- American Express® Business Gold Card

- The Blue Business® Plus Credit Card from American Express

Don’t skip over the business cards. They are much easier to get than you might think, and they’re a great way to earn a big stash of points without affecting your 5/24 number.

SPENDING

You can also earn Membership Rewards® by spending on your American Express credit cards. Each card offers specific bonus categories, allowing you to earn extra points. For example, the Amex Gold earns 4X points at restaurants worldwide (on up to $50,000 in purchases per calendar year), while the Amex Platinum offers 5X points on flights booked directly with airlines or through Amex Travel.

Another way to maximize your spending and earn Membership Rewards® is through Rakuten. This is a shopping portal that lets you earn extra cash or points on your regular online shopping purchases. You will start in the Rakuten portal, then choose the store where you want to shop. You’ll be taken to that store’s website and shop like normal, then you’ll earn a percentage of your total back as Rakuten points. If you link a Membership Rewards®-earning card to your Rakuten account, your cash back will be awarded as Amex Membership Rewards®.

REFERRING FRIENDS AND FAMILY

Another way to earn additional points is through the Amex Refer a Friend program. You can refer friends and family members to sign up for American Express cards and earn bonus points when they are approved. Simply log into your Amex account, find the “Refer a Friend” section, and share your referral link.

Ways to Redeem Membership Rewards®

Transfer points

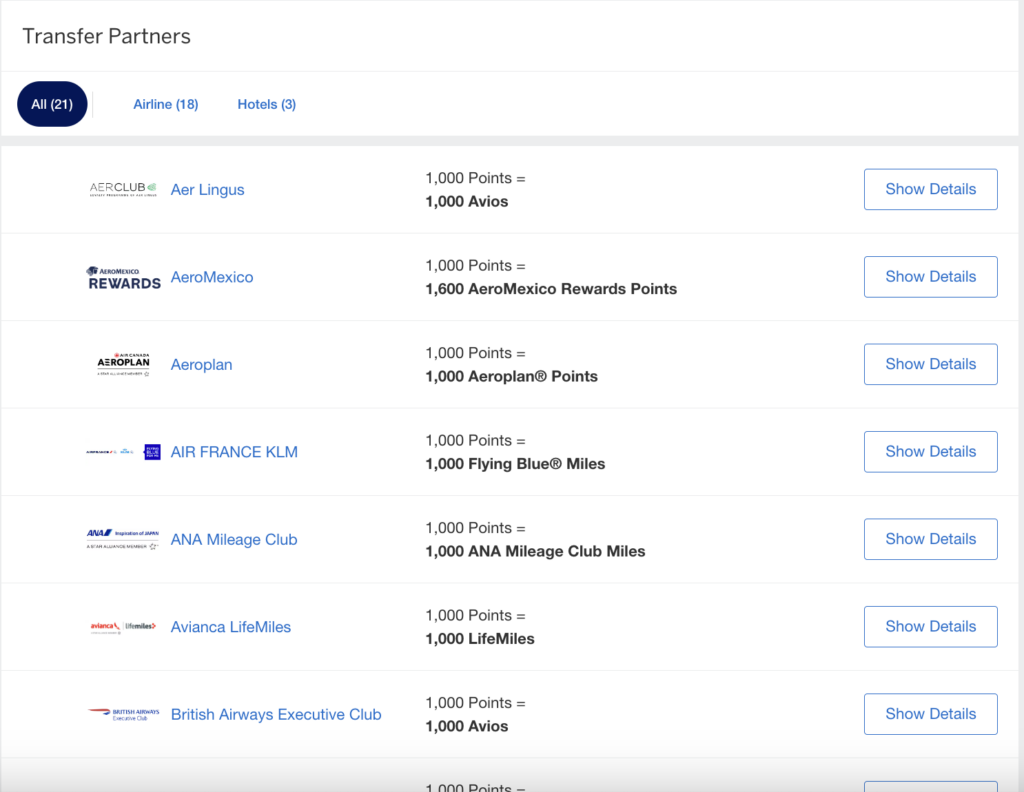

One of the most valuable ways to use Membership Rewards® points is by transferring them to travel partners. Amex has an impressive list of 21 airline and hotel transfer partners. All points generally transfer at a 1:1 ratio, although a few partners have different rates which are noted below.

Here are Amex’s transfer partners.

Airlines:

- Aer Lingus AerClub

- Aeromexico Rewards (1:1.6)

- Air Canada Aeroplan

- Air France–KLM Flying Blue

- All Nippon Airways (ANA) Mileage Club

- Avianca LifeMiles

- British Airways Executive Club

- Cathay Pacific Asia Miles

- Delta SkyMiles

- Emirates Skywards

- Etihad Guest

- Hawaiian Airlines HawaiianMiles

- Iberia Plus

- JetBlue TrueBlue (1.25:1)

- Qantas Frequent Flyer

- Qatar Airways Privilege Club

- Singapore Airlines KrisFlyer

- Virgin Atlantic Flying Club

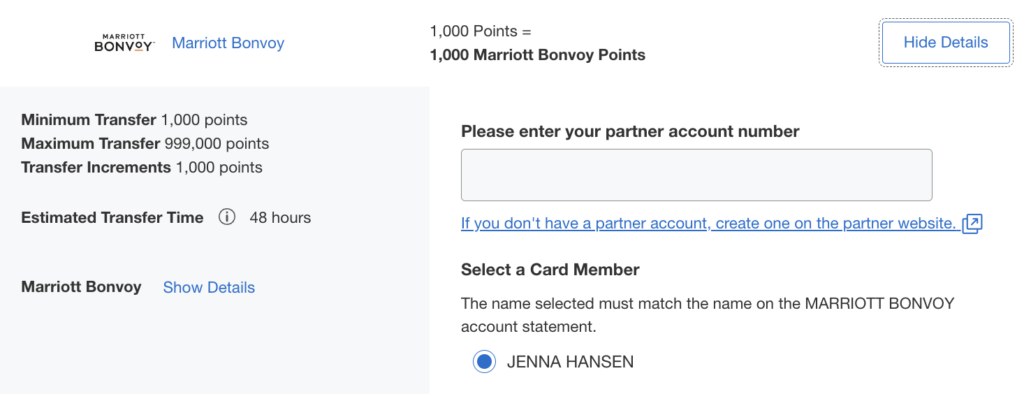

Hotels:

- Hilton Honors (1:2)

- Marriott Bonvoy

- Choice Privileges

There are some great sweet spots with Amex transfer partners. Flying Blue is our favorite way to get to Europe – tickets are just 20,000 points per person per way, and kids’ tickets are 25% off.

We love booking domestic United flights through Air Canada (since they’re Star Alliance partners) for just 12,500 points per person per way.

Additionally, Alaska Airlines recently merged with Hawaiian Airlines, which means you can now transfer Amex points to Hawaiian and then move them to Alaska. Both airlines have excellent prices from the West Coast to Hawaii.

Amex points also transfer to Hilton at a 1:2 ratio, which means you can find some great deals. Hilton award nights tend to cost more than other hotel brands, but doubling your points by transferring from Amex means that you can still find good prices.

HOW TO TRANSFER POINTS

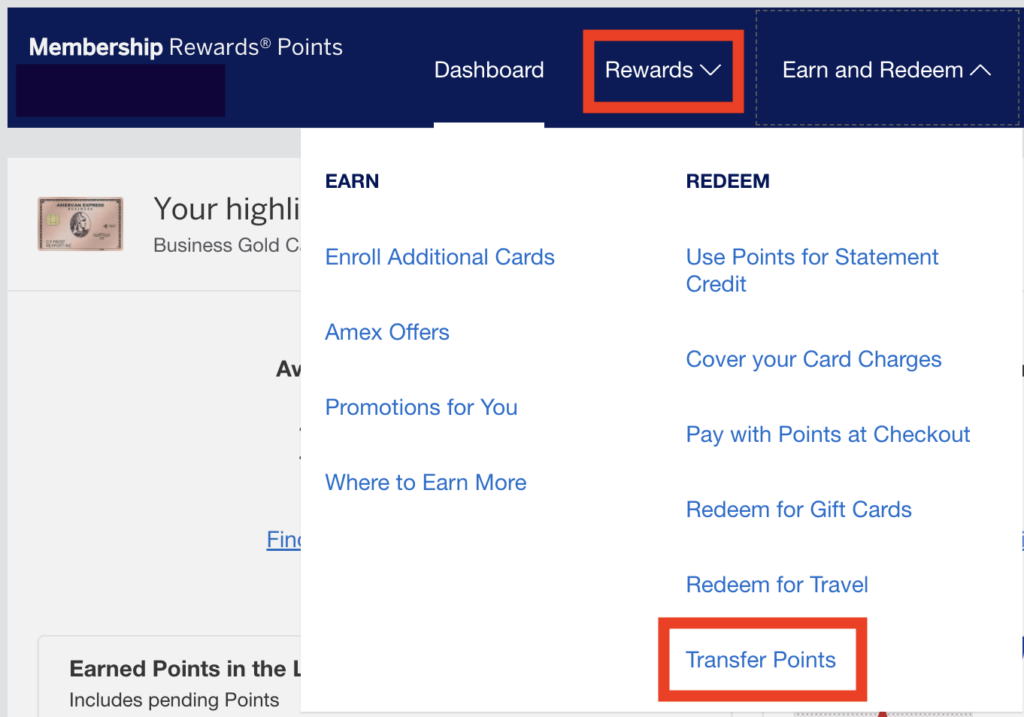

Transferring your Membership Rewards® to partners is pretty simple. First, log on to your Amex account and navigate to your Membership Rewards®. Then, choose Rewards, then Transfer Points.

After this, choose which partner you’d like to transfer to.

Next, enter your loyalty account information. If you haven’t signed up for a free loyalty account with the hotel or airline, do that first.

Finally, enter how many points you want to transfer, then confirm the transaction. Most transfers are instant. However, there are rare times when it can take a few days. Remember to always find availability with the airline or hotel before you transfer your points.

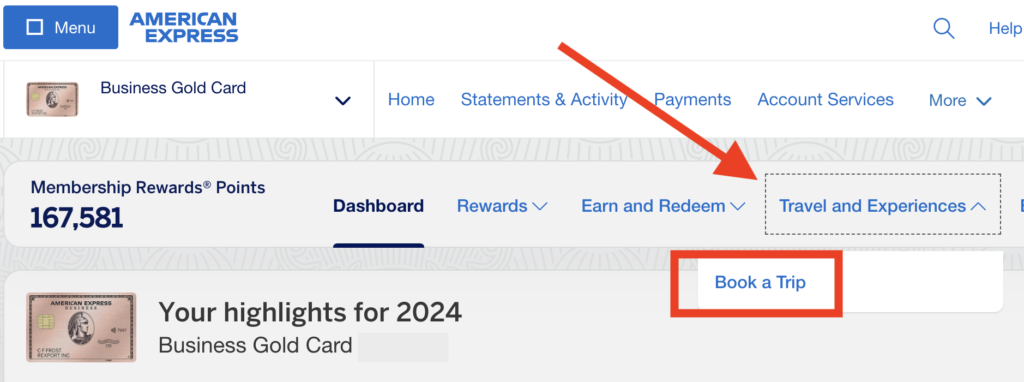

Use them with Amex Travel

Another way to redeem your points is through the Amex Travel portal. When you use points with Amex Travel, they are typically worth 1 cent per point, although values can vary.

My top choice for using Amex points is through transferring to travel partners, however, using them directly in the portal is a decent option. You just may not get as great of value compared to transferring.

Other uses

You can also redeem Membership Rewards® points as a statement credit to offset charges on your card. However, this offers a lower redemption value of just 0.6 cents per point, so I wouldn’t recommend it. Additionally, you can redeem points for gift cards or merchandise, but again, this is a very low value and it’s not something I would recommend. You’ll get much more value from your points by using them with transfer partners!

Other important things to know

FAMILY LANGUAGE

Amex personal cards include terms that prevent you from getting a lower card if you already have (or had) a higher card. For example, you cannot get the Amex Green* if you already have (or had) the Amex Gold or Amex Platinum. If you want to get all three of these cards, you must start with the bottom card (smallest welcome offer and annual fee) and work your way up. This is the order I recommend so that you can potentially earn the welcome offer on all three of these cards:

- American Express® Green Card*

- American Express® Gold Card

- The Platinum Card® from American Express

*All information about American Express® Green Card has been collected independently by The Traveling Hansens. American Express® Green Card is no longer available through The Traveling Hansens.

LIFETIME LANGUAGE

All Amex cards include lifetime language that states, “Welcome offer not available to applicants who have or have had this Card or previous versions of this Card.” This means you can technically only earn the welcome offer once per card. However, there are some ways around this.

First, there are many data points saying that a “lifetime” is approximately seven years. Second, there are some offers that don’t include the lifetime language I quoted above. If you can find one of these offers, you may be eligible to open the card and get the bonus again – even if you just recently opened one. The offers that don’t include lifetime language are often targeted offers that arrive in your mailbox or in your Amex account online (if you have one).

The nice thing about Amex card applications is that you will get a pop-up notification when you apply that lets you know if you are ineligible for the welcome offer. If you get that pop-up, you can back out of the application and try again in the future.

COMBINING POINTS ACROSS CARDS

If you hold multiple American Express cards that earn Membership Rewards®, points are automatically combined into your Membership Rewards® account. No need to move them between cards.

DOWNGRADING AND CLOSING CARDS

You can downgrade from a higher card (like the Platinum) to a lower card (like the Gold or Green), but there are no options for downgrading to a no-annual-fee card. If you no longer want to pay an annual fee on your card and choose to close it, you will need to transfer your points to travel partners to avoid losing them.

American Express Membership Rewards® points do not expire as long as you keep at least one Membership Rewards®-earning card open.

Conclusion

American Express Membership Rewards® are some of the most valuable points out there thanks to their flexibility and the range of cards that earn them. Whether you’re booking travel through the portal or transferring to partners, there’s no shortage of ways to get great value from your Membership Rewards® points.

Thank you for using our card links when applying for new cards. It helps us run our small business at no extra cost to you. We appreciate your support!

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.