The Chase Sapphire Preferred® Card is the G.O.A.T of all the points and miles cards for many reasons. It is the best all-around, easy-to-use, beginner-friendly card that earns flexible points and gives you access to some of the very best transfer partners. Here’s everything you need to know about it.

<All information about the Chase Sapphire Preferred® Card has been collected independently by The Traveling Hansens. The card details on this page have not been reviewed or provided by the card issuer.>

Sapphire Preferred details

The welcome offer for the Sapphire Preferred is for 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. This is up from the previous offer of 60,000 points.

There is a $95 annual fee, which is SO worth it for this workhorse card.

This card will count against Chase’s 5/24 rule, but it is 100% worth a spot!

Sapphire Preferred Benefits

- $50 annual hotel credit when booked through Chase Travel℠.

- 5X on travel booked through Chase Travel℠, 3X on dining, 2X on other travel, 1X on everything else.

- Eligibility for Points Boost – elevated redemption rate for certain hotels and flights booked through Chase Travel℠.

- Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- No foreign transaction fees.

Eligibility

Previously, you could earn the bonus on this card every 48 months. Now, you can only earn the bonus for this card one time.

There was some confusion about whether you could earn the bonus on this card and the Chase Sapphire Reserve®. Chase has clarified their eligibility rules, and you can earn the bonus on both cards, though you can’t have them both open at the same time.

Furthermore, you can also earn the bonus on the Sapphire Reserve for Business℠ and can have it open at the same time as either personal card.

Additionally, you must be under 5/24 to be eligible for this card.

<All information about the Chase Sapphire Reserve® and Sapphire Reserve for Business℠ has been collected independently by The Traveling Hansens. The card details on this page have not been reviewed or provided by the card issuer.>

Using your points

You have three options for using your points – transferring them to travel partners, using them with Chase Travel, or cashing them out.

Here’s an explanation of all three.

Transfer partners

This is where the Sapphire Preferred really shines! Chase has 11 airline partners and 3 hotel partners. All points transfer at a 1:1 ratio in increments of 1,000.

Here are the partners:

- Aer Lingus

- Air Canada

- Air France-KLM

- British Airways

- Emirates

- Iberia

- JetBlue

- Singapore

- Southwest

- United

- Virgin Atlantic

- Hyatt

- IHG

- Marriott

Chase is the only bank that has so many domestic partners- many other banks only have international partners. This means it can be a bit harder to find the best redemptions (although not at all impossible, so definitely don’t count them out!). But you won’t have this problem with Chase!

More often than not, we transfer our Ultimate Rewards to Hyatt. Hyatt points rates are so much lower than the other hotel chains, which means we can get really great value out of them.

However, we’ve also used them for things like Flying Blue (Air France) flights to Paris, Southwest flights to Hawaii, Virgin Atlantic flights to Cabo, and more. They really are the very best points.

How to transfer your points

Here are the steps for transferring your points from Chase to one of its transfer partners.

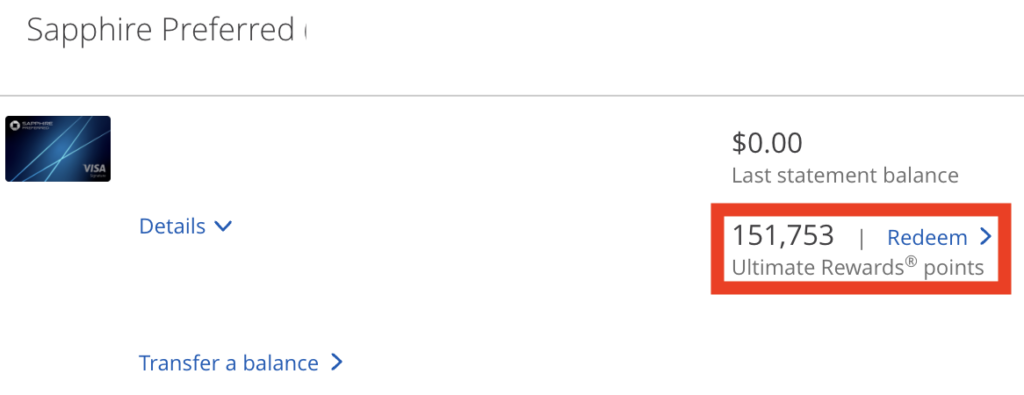

First, log on to your Chase account, choose your Sapphire Preferred card, then click on your Ultimate Rewards® and hit “redeem”.

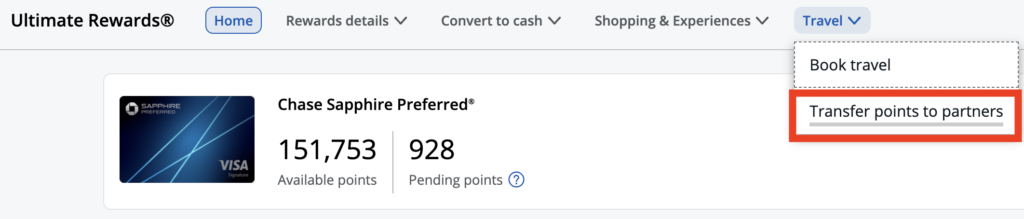

Next, hover over “travel” at the top of the page and select “transfer points to partners”.

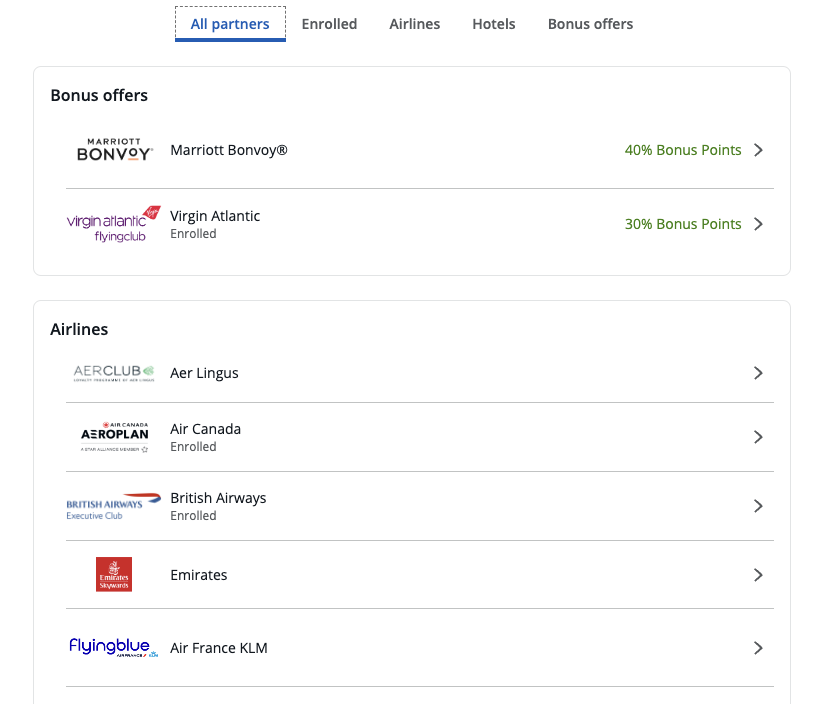

All of Chase’s travel partners will pop up, with any current transfer bonuses listed at the top. Choose the one you’d like to transfer to. In this case, we’ll choose Hyatt (of course).

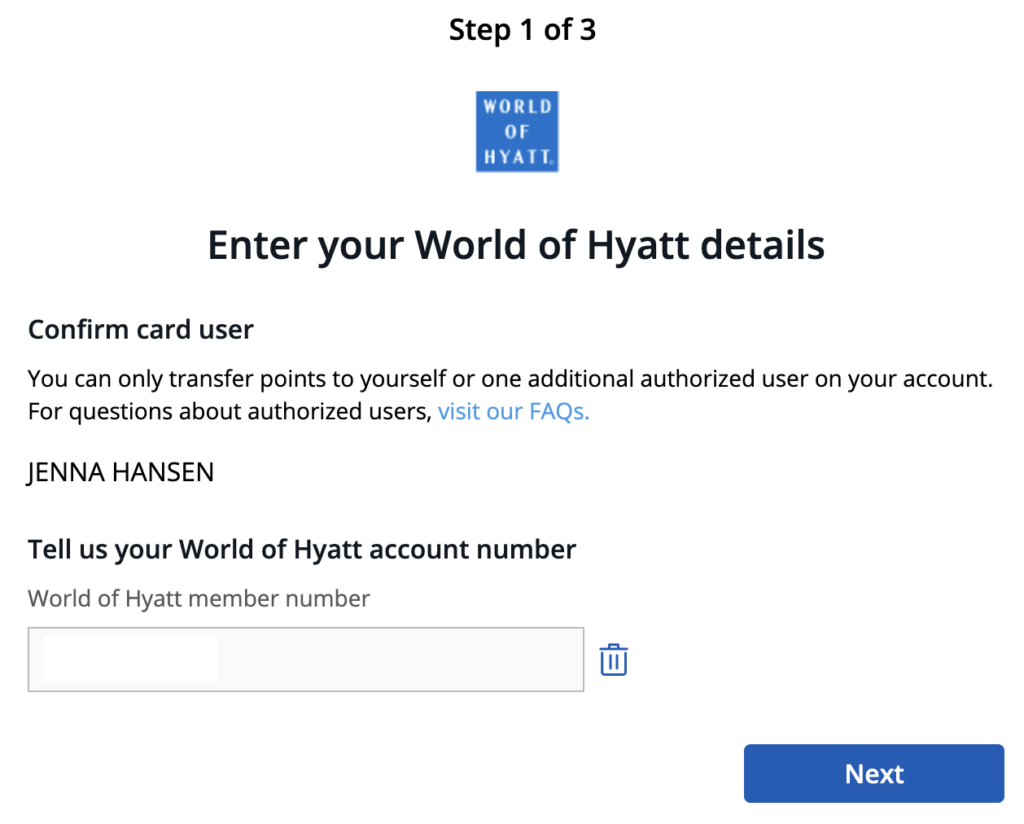

After that, you’ll go through three steps. First, you’ll confirm your name and loyalty account information. If you haven’t set up a free loyalty account with the hotel or airline, make sure you do that first!

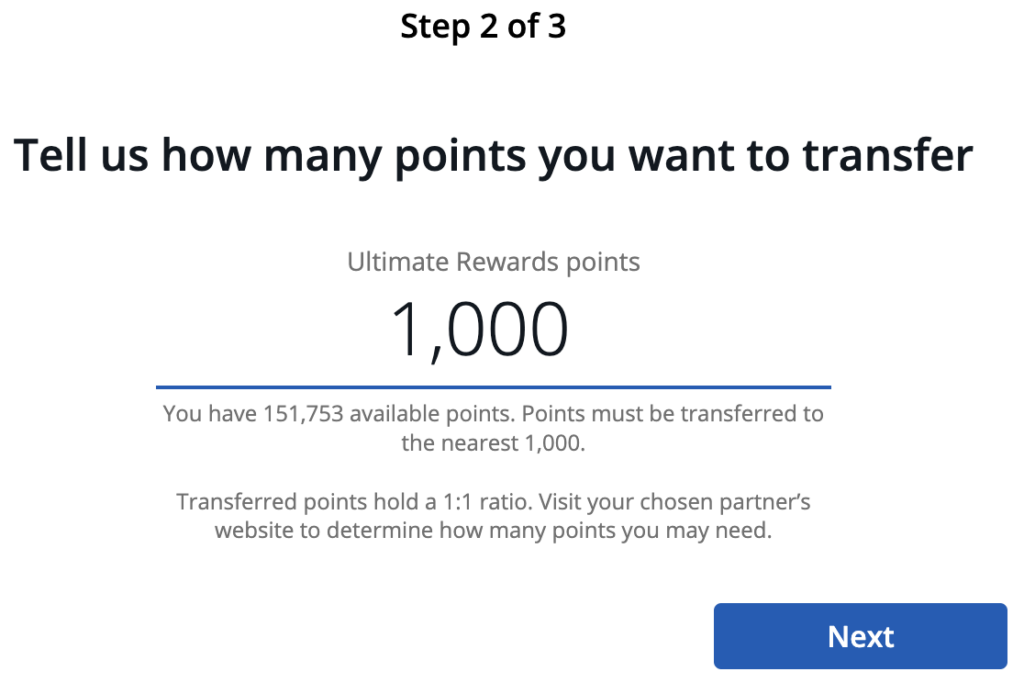

Next, enter how many points you’d like to transfer in increments of 1,000.

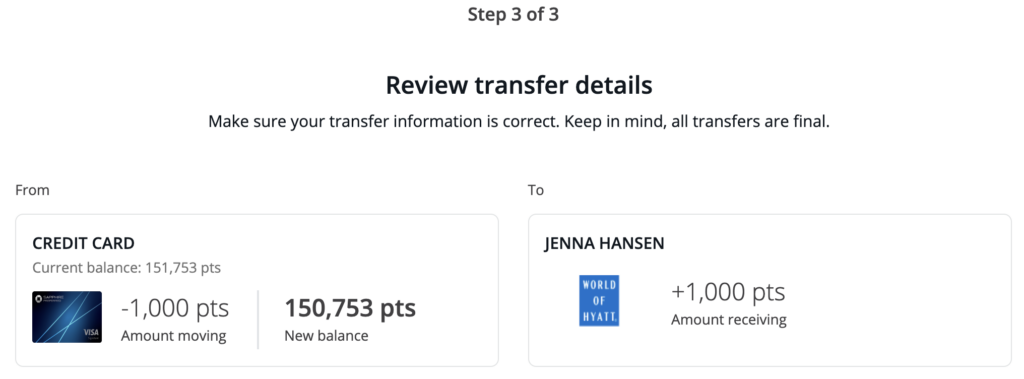

Finally, confirm the details and hit submit.

Generally, transfers are instant, although there can be unexpected delays. You may need to log out and log back into your hotel or airline account to see the points available.

One important note: do not transfer points until you have found the available flights or hotel nights! Once you’ve transferred your points, they’re stuck in that program. You wouldn’t want your points to be stuck with no way to use them as you intended.

Use them with Chase Travel℠

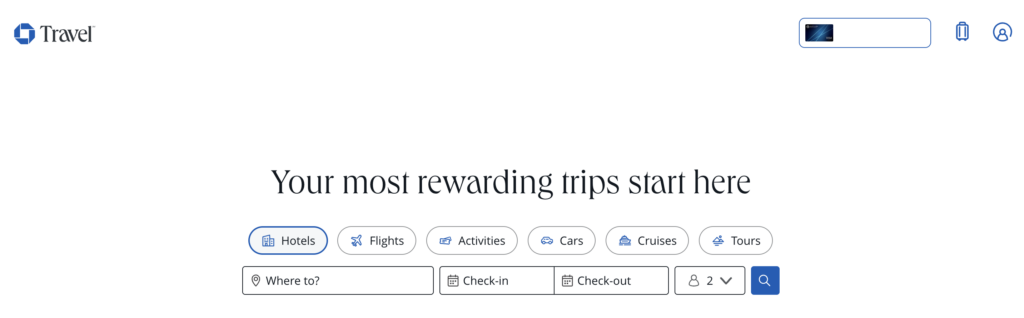

Another way to use your Ultimate Rewards® is by booking travel through Chase Travel℠. This works like any other travel search portal, like Expedia or Travelocity, and allows you to run searches across all airlines and hotels to find the best option for you.

Chase recently overhauled its Sapphire family of cards, and along with that overhaul came changes to how points can be redeemed through Chase Travel℠.

If you opened the Sapphire Preferred or Ink Business Preferred before June 23rd, 2025, and earn points on it before October 26th, 2025, your points are worth 25% more when redeemed in the portal. The same dates and rules apply to the Sapphire Reserve, but with a 50% boost. These boosted rates stay in effect until October 27th, 2027.

If you opened any of those three cards after June 23rd, 2025, or earn points on your card after October 26th, 2025, your points will be part of the new Points Boost program. This offers cardholders up to a 1.75% bonus on points for select hotel or airline bookings, depending on the card and redemption type. There is a toggle button within Chase Travel℠ that lets you choose to filter search results by Points Boost.

Either way, using Chase Travel℠ is a great option for rental cars, cruises, and other activities where you can’t transfer points to book directly with those companies. It’s also a good option when booking boutique hotels that may not be part of a larger hotel program, such as Hyatt or Marriott.

Cash them out

Your final option is to cash out your points as a statement credit. If you do this, you’re getting a one cent per point value, meaning every 10,000 points is worth $100. While this is the lowest value, it’s still a viable option if you’d rather save yourself the extra steps of the travel portal or transferring to partners. However, I promise you that it’s easier than you think!

Earning more points and combining

There are many cards that earn Ultimate Rewards®, but not all of them give you access to Chase’s transfer partners.

You will need a Sapphire Preferred, Sapphire Reserve®, Sapphire Reserve for Business℠, or Ink Business Preferred® Credit Card to transfer your points. The Sapphire Preferred is my top choice since it’s the most beginner-friendly and has the lowest fee of all those cards.

Here are some of the other cards that earn Ultimate Rewards:

- Chase Sapphire Reserve®

- Chase Freedom Flex® (advertised as cash back, but it actually earns Ultimate Rewards®)

- Chase Freedom Unlimited® (advertised as cash back, but it actually earns Ultimate Rewards®)

- Ink Business Cash® Credit Card (advertised as cash back, but it actually earns Ultimate Rewards®)

- Ink Business Unlimited® Credit Card (advertised as cash back, but it actually earns Ultimate Rewards®)

- Ink Business Preferred® Credit Card

<All information about the Chase Freedom Flex and Unlimited, and Chase Ink Business Cash, Unlimited, and Preferred has been collected independently by The Traveling Hansens. The card details on this page have not been reviewed or provided by the card issuer.>

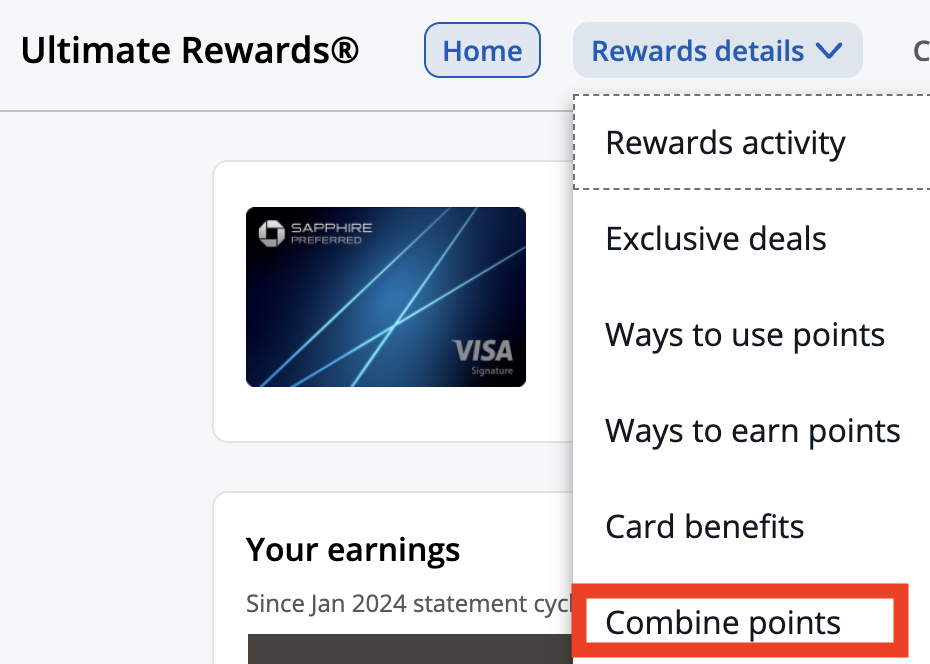

Points earned from any of these cards can be combined onto your Sapphire Preferred and then transferred to travel partners. To combine your points, log in to your Chase account and go to your Ultimate Rewards®. Hover over Rewards Details, then click “combine points”.

Choose which cards you want to move points from and to, enter how many points you want to move, and hit confirm. Voila! Easy peasy!

Other card options

If you already have this card or feel like it’s not a good fit (even though I think everyone should have one!), here are some other great beginner card recommendations:

If you’re looking for a no-annual-fee card, click here.

<All information about the American Express Green Card has been collected independently by The Traveling Hansens. The card details on this page have not been reviewed or provided by the card issuer.>

Wrapping it up

Like I said, the Sapphire Preferred is one of the very best cards. It’s a staple in our wallet for so many reasons and should absolutely be a staple in yours! If you don’t have one, what are you waiting for??

Thank you for using our card links when applying for new cards. It helps us run our small business at no extra cost to you. We appreciate your support!

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.