When it comes to racking up Chase Ultimate Rewards®, the Ink Business Unlimited® Credit Card and Ink Business Cash® Credit Card are two of the best travel cards out there. With big welcome offers, no annual fee, and the ability to earn more of the best points, they’re excellent cards that all points and miles enthusiasts love.

But which one is right for you? Let’s break it down so you can decide for yourself.

Why Business Cards Are Worth Your Attention

Before we compare them, here’s why it’s important to pay attention to business cards:

- Easier than you think: You don’t need a big company or even a registered business. Even side hustles like selling on Facebook Marketplace, babysitting, tutoring, or freelancing can qualify you. Just apply as a sole proprietor using your Social Security number.

- Don’t use up 5/24 slots: These cards don’t count against Chase’s 5/24 rule, which makes them perfect if you want to keep your personal card options open.

- Point flexibility: Both Ink cards earn flexible Ultimate Rewards®, which can be combined with a Chase Sapphire Preferred® Card, Chase Sapphire Reserve®, or Ink Business Preferred® Credit Card for access to airline and hotel transfer partners.

Learn more about qualifying for business cards here.

<All information about the Ink Business Cash® Credit Card, Ink Business Unlimited® Credit Card, Chase Sapphire Preferred® Credit Card, Chase Sapphire Reserve®, and Ink Business Preferred® Card has been collected independently by The Traveling Hansens. The card details on this page have not been reviewed or provided by the card issuer.>

The Offers

Both cards are currently offering $750 cash back when you spend $6,000 in the first three months.

They are marketed as cash-back cards, but they actually earn Ultimate Rewards®. To make those points fully flexible and use them with one of Chase’s 14 transfer partners, you will need to combine them onto an additional card, like a Chase Sapphire Preferred® Card, Chase Sapphire Reserve®, or Ink Business Preferred® Credit Card.

Note: You can no longer receive a personal referral bonus by referring someone to one of these cards unless they’re a new Chase Business customer. My affiliate links (which are different than personal referrals) haven’t changed, and I’d be so appreciative if you used my link to apply instead!

HOW TO COMBINE POINTS

So, how do you combine the points between cards? It’s pretty simple!

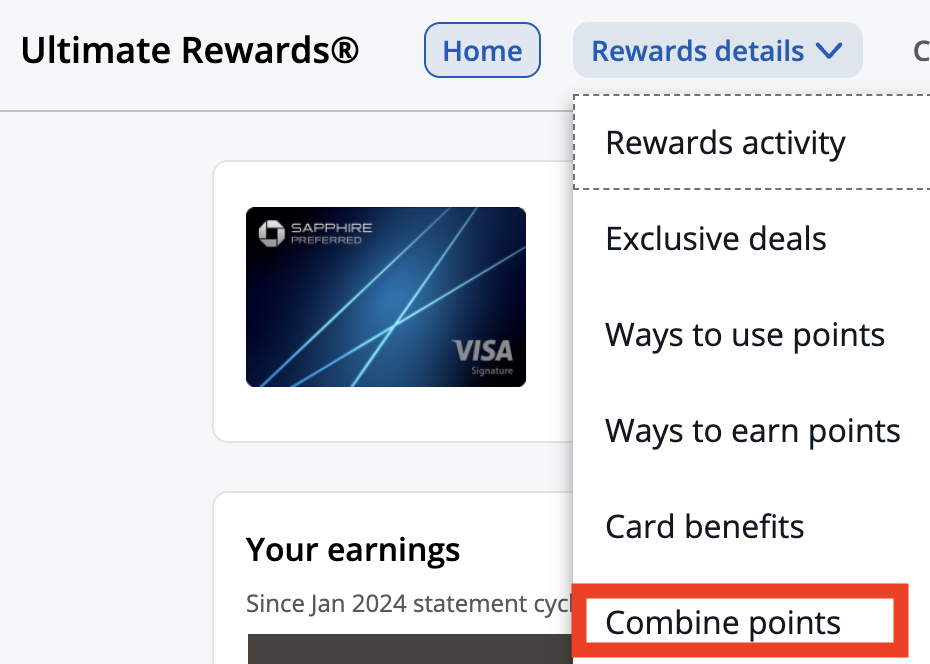

To combine points from multiple cards, log in to your Chase account, and go to your Ultimate Rewards. Click Rewards Details, then click “combine points”.

Choose which cards you want to move points from and to, enter how many points you want to move, and hit confirm. It’s easy and instant!

Comparing the Ink Unlimited and Ink Cash

Okay, back to comparing the cards. While both cards currently come with the same welcome offer and no annual fee, they earn points differently.

The Ink Business Unlimited is the simpler of the two, earning 1.5% cash back (1.5x points) on every purchase with no specific categories to track. This makes it a great fit if your spending is spread across lots of areas or you simply want a “set-it-and-forget-it” card that consistently earns a solid return.

The Ink Business Cash, on the other hand, is all about maximizing bonus categories. You’ll earn 5% cash back at office supply stores and on internet, cable, and phone services (on up to $25,000 in combined purchases each year), plus 2% cash back at gas stations and restaurants (also up to $25,000 annually). Everything else earns 1%. If you spend regularly in these categories, the returns can really add up, especially when you factor in the elevated welcome offer.

Both cards earn Chase Ultimate Rewards® and neither counts toward your 5/24 limit, so from a strategic standpoint, they’re equally flexible.

Qualifying For The Ink Unlimited and Ink Cash

Chase recently added lifetime language to these two cards, meaning you are not eligible for either of these cards if you’ve previously had one. This is a major bummer! Previously, these were cards that could be opened semi-regularly to earn more Chase points. This is no longer the case.

Chase has also started limiting how many business cards they’ll approve you for, depending on how many you currently have open. Your chances of approval are much higher if you have two or less open. If you have more than two Chase business cards currently open, I recommend closing your oldest one and waiting a few weeks before applying for one of these cards. Just be sure it’s been open for at least a year.

Check out this post for tips on what to do with your cards after the first year.

How to Fill Out a Business Card Application

Ready to grab one of these cards? If you have a registered business, you will use all of that information. If you’re applying as a sole proprietor (using any small side hustle income), here’s how to fill out the application. You will first fill out your personal information, like your name, address, social security number, etc. Then you will fill out the business information section like this:

- Legal name of business: Your name

- Business name on card: Your name

- Business mailing address: Your address

- Type of business: Sole proprietor

- Tax ID type: Your SSN, unless you have an EIN

- Business type: Pick a category that is closest to what you do. It does not have to match exactly. In fact, I’ve found that it’s quite hard to get it to match exactly.

- Number of employees: Zero

- Annual business revenue: This is your projected income for the whole year, even if you haven’t made it yet.

- Years in business: Put the number of years you’ve been operating your business, even if you weren’t making any money at first.

- Gross annual income: This is your total household income, including all business and W2 income from you and a player two (if you have one).

Which Ink Card Should You Get?

- Go with Ink Business Unlimited if…

You want a card that earns well on all purchases without thinking about categories. It’s especially good for high monthly spend across a variety of areas. - Go with Ink Business Cash if…

You have consistent spending in office supplies, internet/phone, gas, or dining. The 5% and 2% bonus categories make this card an easy way to earn extra points.

Read my full post about the Ink Unlimited here.

Read my full post about the Ink Cash here.

Final Thoughts

With offers worth at least $750 on each, the Ink Business Unlimited and Ink Business Cash are two of the best cards.

If you’ve been holding off on business cards because you thought you weren’t eligible – don’t! They’re easier to get than you think, and they can make a huge difference in how quickly you earn points toward your next big trip.

Thank you for using our card links when applying for new cards. It helps us run our small business at no extra cost to you. We appreciate your support!

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.