Capital One Miles is one of my favorite award programs, just behind Chase Ultimate Rewards®. Capital One Miles are easy to earn through a variety of cards and spending, and they offer a range of redemption opportunities – from transferring to travel partners to covering travel purchases to booking trips through Capital One Travel.

What Are Capital One Miles?

Capital One Miles are the award currency earned through certain Capital One credit cards. These miles can be redeemed for various things, including travel, statement credits, gift cards, and more. However, I would not recommend redeeming them for gift cards or anything not travel-related, since you will get a very low value.

How to Earn Capital One Miles

CREDIT CARDS

Earning Capital One Miles is straightforward if you hold the right credit cards. Here are the cards that earn them:

- Capital One VentureOne Rewards Credit Card – a good card for those with lower credit or no credit history.

- Capital One Venture Rewards Credit Card – an excellent beginner card.

- Capital One Venture X Rewards Credit Card – this is my favorite option on this list!

- Capital One Venture X Business – The business version is nearly identical to the personal version, but it has a much higher welcome offer and a higher spending requirement.

- Capital One Spark Miles for Business – This is my last choice for a Capital One card because it will count against your 5/24 status. However, if that’s of no concern to you, it’s a great way to earn a big stash of miles!

All of the above cards earn 2X on all spending, except the VentureOne, which earns 1.25. This is great because you don’t have to worry about specific bonus categories. Instead, you know you’re getting a solid return on all purchases.

Related: Compare the Venture and Venture X

Eligiblity

Capital One recently added family language to the three Venture cards, meaning you’re not eligible for a “higher” card if you’ve earned any “lower” card bonuses in the last 48 months. Previously, the 48-month rule applied to each card individually. Now, it applies to each card in order.

For example, if you open a Venture X card today, you won’t be eligible for a VentureOne, Venture, or another Venture X for 48 months. However, if you open a Venture card first, you will still be eligible for a Venture X in six months (the minimum time between Capital One cards) because you’re opening the lower card first.

So, I recommend starting with a VentureOne or Venture, then opening a Venture X later. If you do it in reverse order, you won’t be eligible for 48 months!

Note: This does not include the Venture X Business card.

Additionally, Capital One is sensitive to how many recent accounts you’ve opened. You may not be approved for another Venture/Venture X card if you’ve opened 4+ cards in the previous 24 months. This is why I recommend opening one of these cards at the beginning of your points and miles journey.

Furthermore, if you have a Capital One card that earns cash back, it can be turned into miles if you also have one of the miles-earning cards listed above. Here are your cash back card options:

- Capital One Quicksilver Cash Rewards Credit Card

- Capital One Quicksilver Secured Cash Rewards Credit Card

- Capital One Savor Cash Rewards Credit Card

- Capital One Spark Cash Plus

OTHER WAYS TO EARN MILES

There are a few other ways to earn Capital One Miles

- Card Referrals: You can refer friends or family members to the same Capital One card that you have. There is a refer-a-friend link listed in your card account. Just note that you will not earn a referral bonus if the person is already a Capital One member.

- Capital One Travel: When you book hotels, airfare, or rental cars through Capital One Travel, you can earn extra miles. The miles you earn depend on the card you have. For VentureOne and Venture cardholders, you’ll earn 5X on hotels and rental cars; for Venture X and Venture X Business cardholders, you’ll earn 10X on hotels and rental cars and 5X on flights.

How to Use Capital One Miles

Once you have your miles in hand, you have several redemption options.

Transfer to partners

This is my number one choice for using miles! You will get the highest value when using them this way.

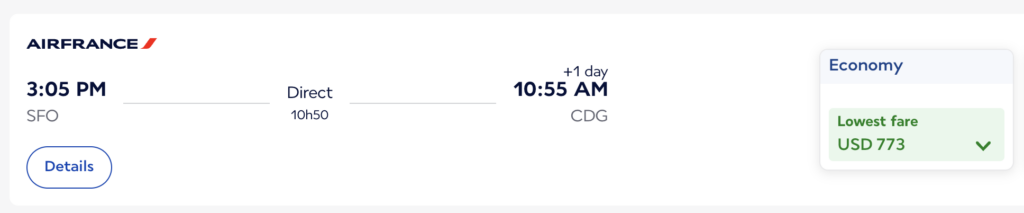

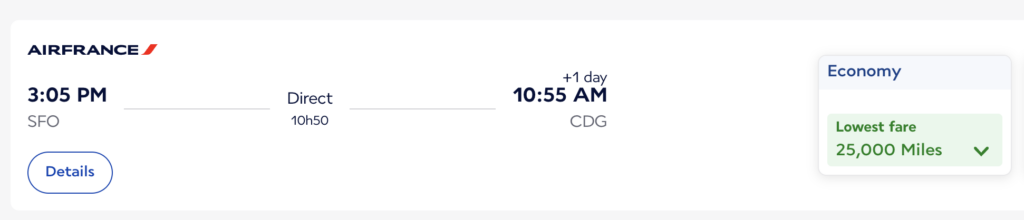

For example, this flight on Air France from San Francisco to Paris costs $773. At a one cent per point value (the lowest basic value of points), this is 77,300 miles.

Instead, I can transfer points to Flying Blue (the award program for Air France) and book the exact same flight for 25,000 miles. So I’d be getting more than double the value!

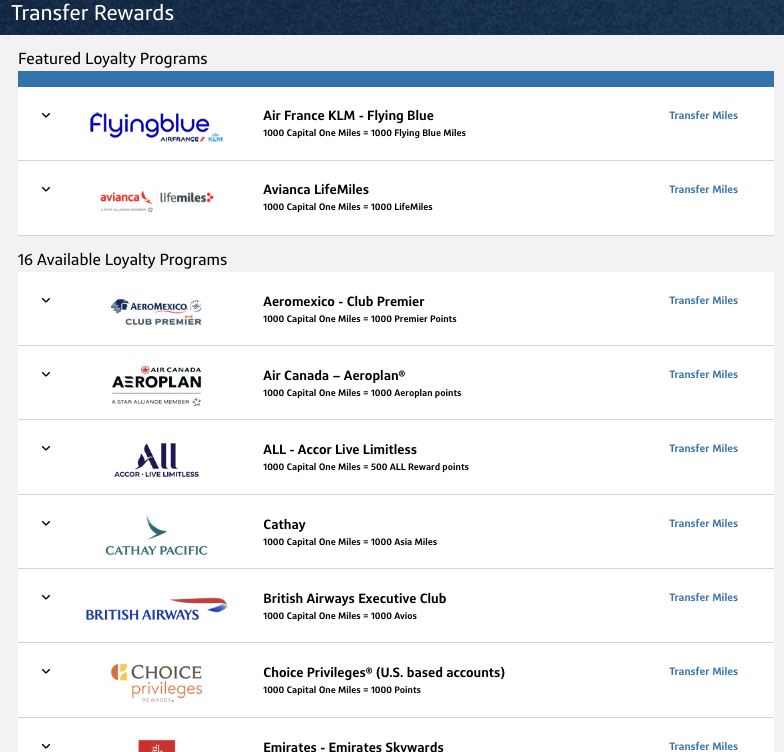

Capital One has 15+ airline and hotel travel partners. They are:

- Aeromexico Club Premier

- Air Canada Aeroplan

- Cathay Pacific Asia Miles

- Avianca LifeMiles

- British Airways Executive Club

- Choice Privileges

- Emirates Skywards

- Etihad Guest

- Finnair Plus

- Flying Blue (Air France/KLM)

- I Prefer hotels – transfer ratio 1:2, so 1,000 Capital One Miles equals 2,000 I Prefer hotel points

- Japan Airlines (JAL) Mileage Bank – transfer ratio 1:.75, so 1,000 Capital One Miles equals 750 Mileage Bank miles

- JetBlue TrueBlue – transfer ratio 5:3, so 1,000 Capital One Miles equals 600 TrueBlue points

- Qantas Frequent Flyer

- Qatar Airways Privilege Club

- Singapore Airlines KrisFlyer

- TAP Miles&Go

- Turkish Airlines Miles&Smiles

- Virgin Red

- Wyndham Rewards

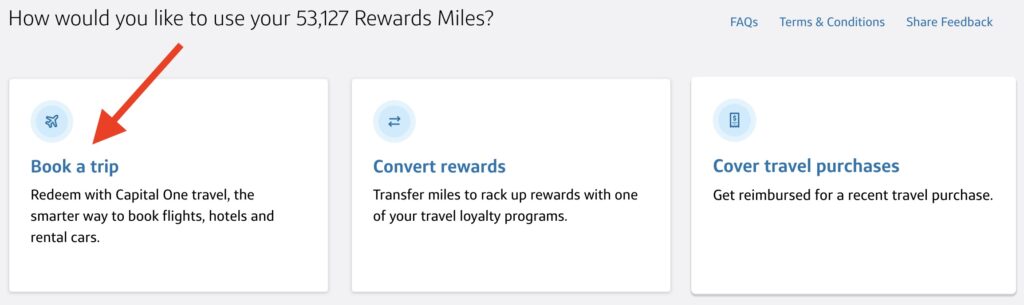

HOW TO TRANSFER CAPITAL ONE MILES

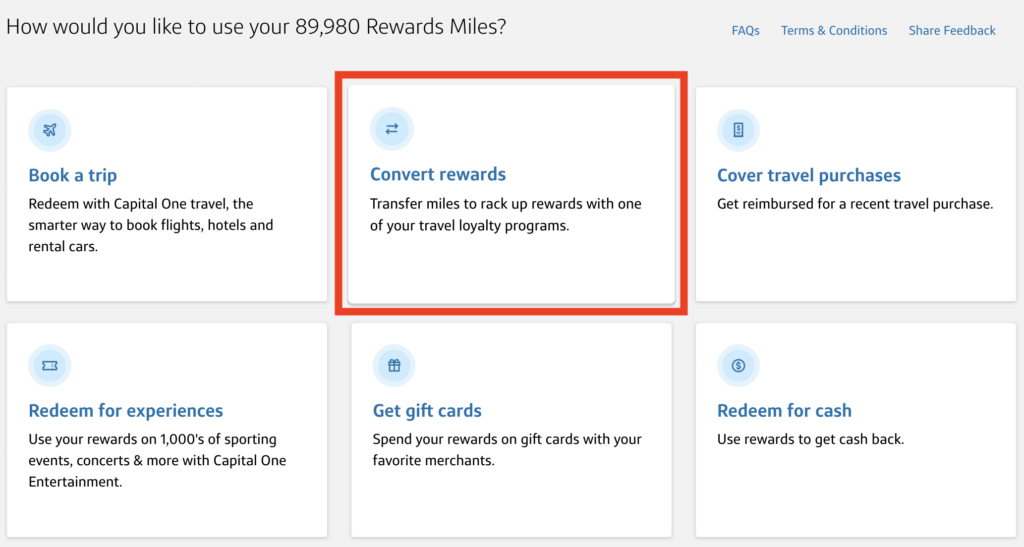

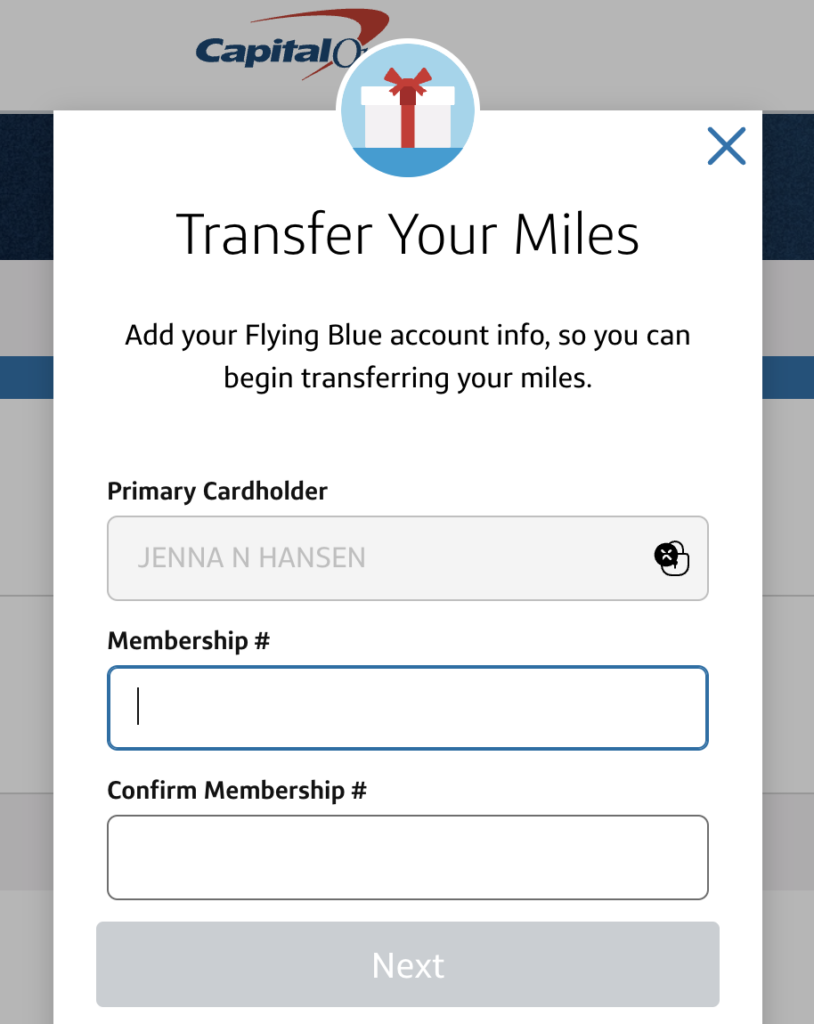

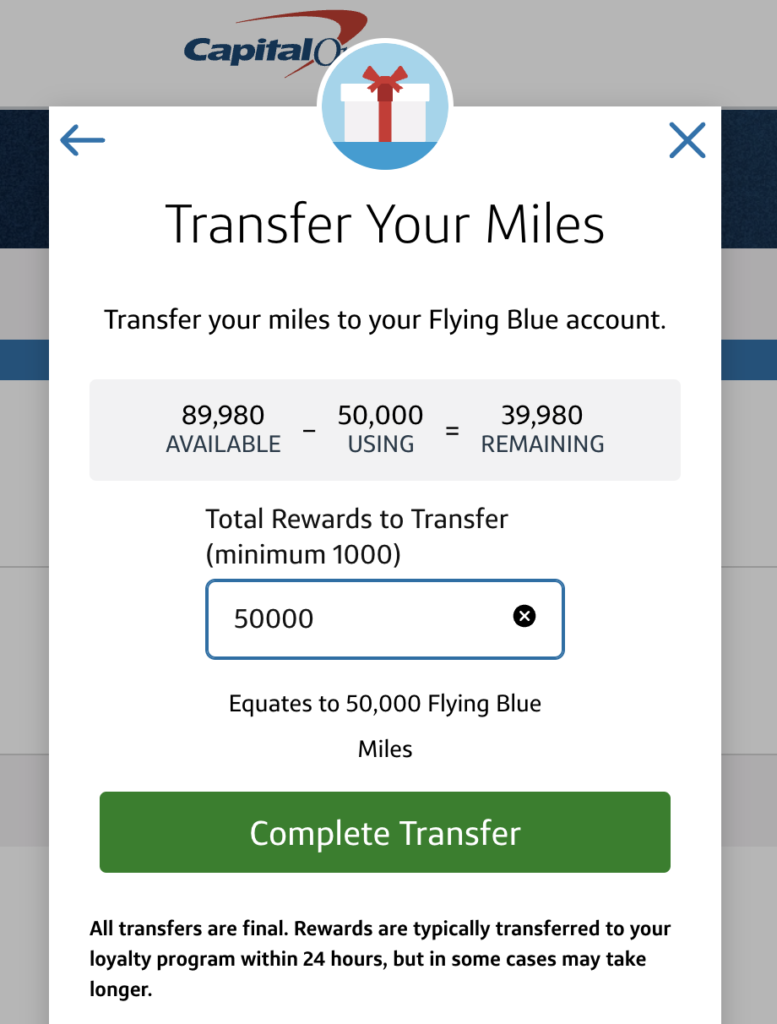

Here are the steps for transferring Capital One Miles to travel partners.

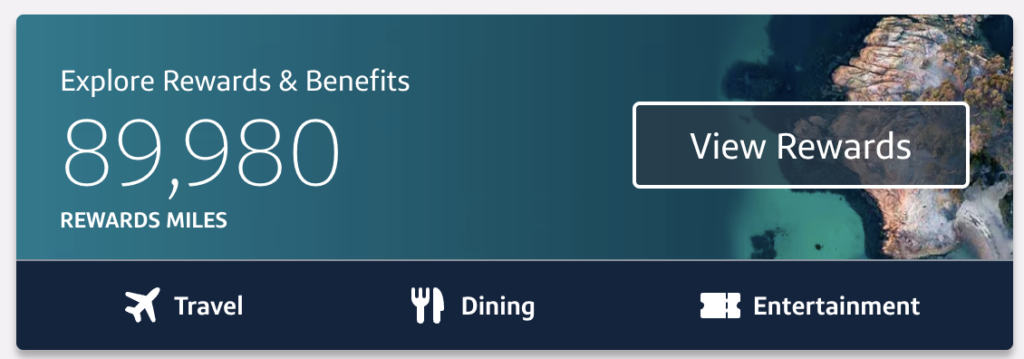

First, log on to your Capital One account and navigate to the Rewards section.

Next, choose Convert Rewards.

After that, choose which program you’d like to transfer miles to.

Finally, enter your loyalty account info and the amount of miles.

Then choose Complete Transfer.

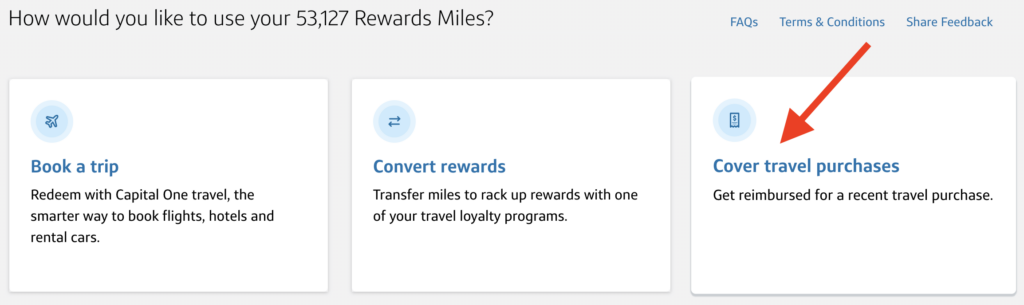

Cover travel purchases

Another way to use Capital One Miles is to cover travel purchases. This option allows you to use miles to cover the cost of flights, hotels, rental cars, and anything else deemed “travel” on your credit card statement. When redeemed this way, miles are worth one cent per point, meaning every 10,000 miles is worth $100.

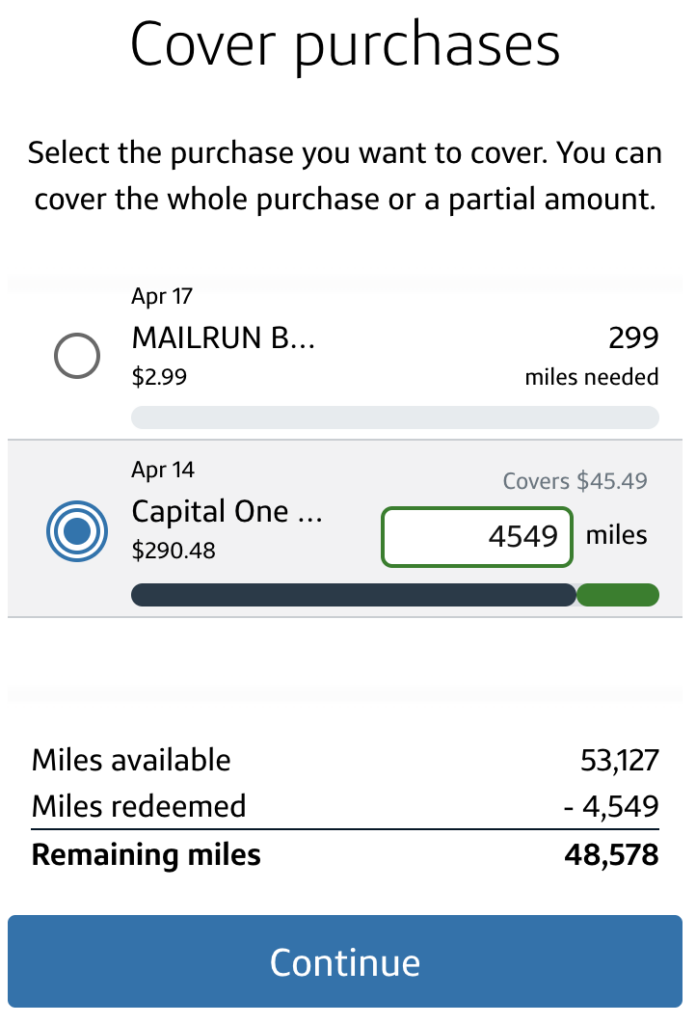

HOW TO COVER TRAVEL PURCHASES

First, log on to your account then click on your rewards. Choose Cover Travel Purchases.

A box will pop up with any purchases that are eligible to be covered with miles. Choose which travel purchase and how many miles you want to use. You can cover a portion of the purchase or all of it. Select continue, then confirm the transaction. It takes 1-3 days for the credit to post to your account.

The travel purchase must be booked with your card to be eligible to be covered with miles.

We like to use this option for things that are harder to cover with miles- like rental cars, cruises, and theme park tickets. If you want to use them for theme park tickets, you’ll need to purchase through a third-party site like Undercover Tourist so that the purchase codes as travel on your credit card statement. We’ve done this multiple times for Disney tickets!

Capital One Travel

Lastly, you can book flights, hotels, and rental cars through Capital One Travel. This works like any other travel search website where you’ll see options from many different hotels and airlines. Your miles are worth one cent per point when used this way, so again, this means every 10,000 miles is worth $100.

You can use your miles to pay within the Capital One Travel portal, but I do not recommend this! Instead, book your trip and use your miles-earning card to pay. That way, you earn 5-10X back thanks to the cards’ earning categories.

Then, turn around and cover the purchase with miles. This way, you’re still able to use miles for the trip, but you’re first earning miles on your purchase.

You can also use your Venture X annual travel credit to pay for some or all of your trip.

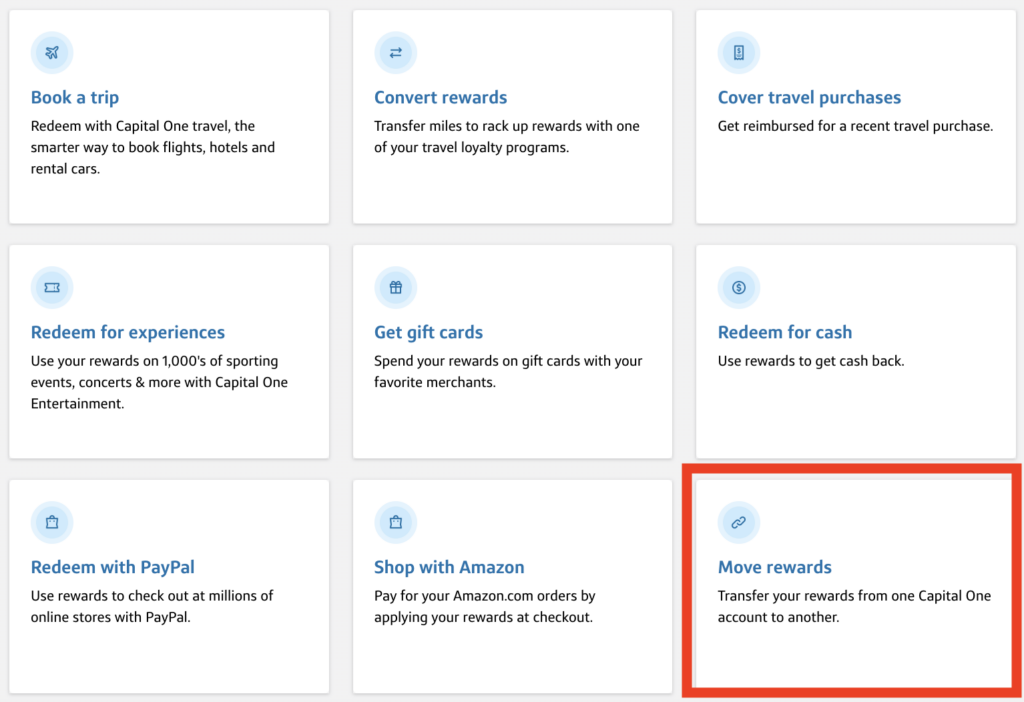

How to Combine Capital One Miles

Capital One allows you to combine miles between your cards or with any other Capital One member for free. If you’re combining miles between cards you hold, you can simply log on to your account, go to your rewards, then choose Move Rewards.

If you’d like to combine miles with another member, you will need to call customer service. You will need the name and full card number of the person you are combining miles with. The transfer is instant.

Conclusion

Capital One Miles are straightforward and valuable. They’re easy to earn thanks to the simple 2X earning structure on all cards, and there are many ways to use them. They do not expire as long as your account is open, so you have time to plan out the trip (or trips!) of your dreams.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Thank you for using our card links when applying for new cards. It helps us run our small business at no extra cost to you. We appreciate your support!

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.