Navigating the world of credit card rewards can feel like a lot, but with the right strategy, it can also be incredibly rewarding – literally. There are various points and miles programs, but Chase Ultimate Rewards® is my favorite. Whether you’re new to points and miles or an experienced traveler, understanding how to earn, maximize, and redeem Chase Ultimate Rewards® is key to successful award travel. This guide will walk you through everything you need to know.

What are Chase Ultimate Rewards®?

Chase Ultimate Rewards® are points earned from a variety of Chase credit cards. They are flexible points, meaning there are multiple ways they can be used, including transferring to travel partners if you hold the right credit card. Ultimate Rewards® are both easy to earn and easy to use, making them a favorite among the points and miles crowd – myself included.

Ways to Earn Ultimate Rewards

CREDIT CARDS

The fastest way to earn a ton of Ultimate Rewards® is by opening a new credit card and earning the big welcome offer. There are seven credit cards that earn these points – the first three earn fully flexible points, while the other four are considered cash-back cards. However, Chase makes it easy to combine your points onto one of the three flexible points cards – more on that later – essentially making them all earn flexible points.

These are the three cards that earn fully flexible points:

- Chase Sapphire Preferred® Card

- Chase Sapphire Reserve®

- Sapphire Reserve for Business℠

- Ink Business Preferred® Credit Card

These are the four cards that earn “cash-back”, but actually earn Ultimate Rewards®:

- Ink Business Cash® Credit Card

- Ink Business Unlimited® Credit Card

- Chase Freedom Flex® – click the link then choose Flex

- Chase Freedom Unlimited® – click the link then choose Unlimited

Related: Business Cards Are Easier Than You Think

<All information about the Chase Sapphire Preferred and Reserve, Reserve for Business, Ink Business Preferred, Cash, and Unlimited, and Chase Freedom Flex and Unlimited has been collected independently by The Traveling Hansens. The card details on this page have not been reviewed or provided by the card issuer.>

SPENDING

You can also earn Ultimate Rewards® by spending money on your credit cards. Each card has specific spending categories that earn anywhere from 1-5X back on your spending. For example, the Sapphire Preferred earns 3X on travel, and the Ink Business Cash earns 5X at office supply stores.

REFERRING FRIENDS AND FAMILY

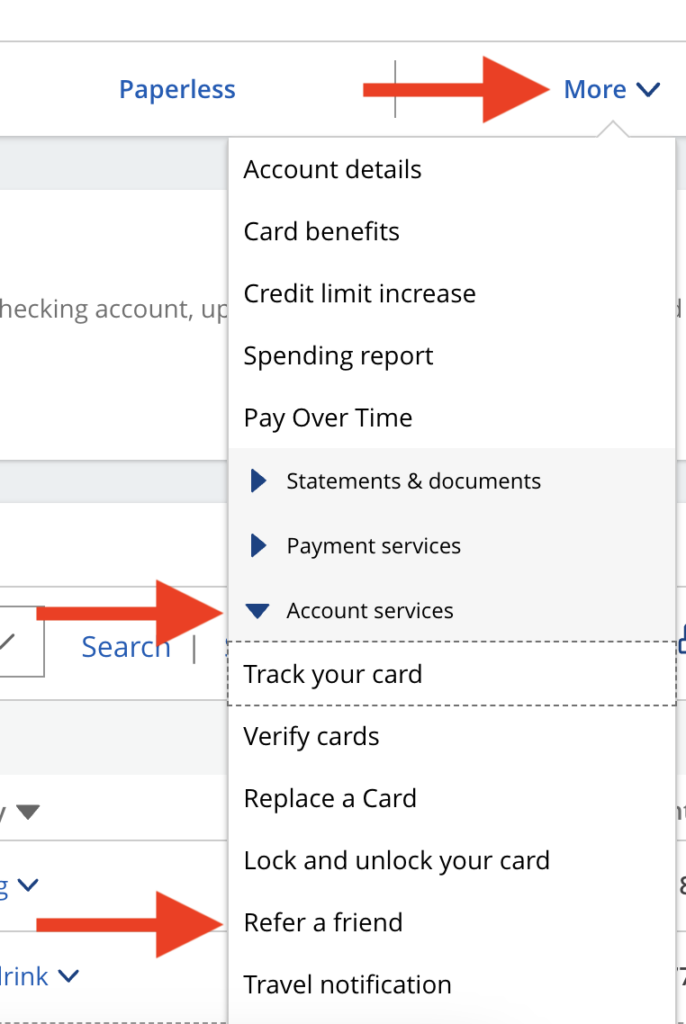

To earn additional points, you can refer your friends and family members to a Chase card. To do this, first log in to your account. Then, click on your card, then click the down arrow that says “More”, then choose “Account services”, then “Refer a friend”.

Alternatively, you can visit this direct Refer A Friend link.

You can refer friends and family to the exact same card you have or, in some cases, a card that is within the same family. For example, you can refer someone from your Ink Business card to any of the other Ink Business cards.

CHASE OFFERS

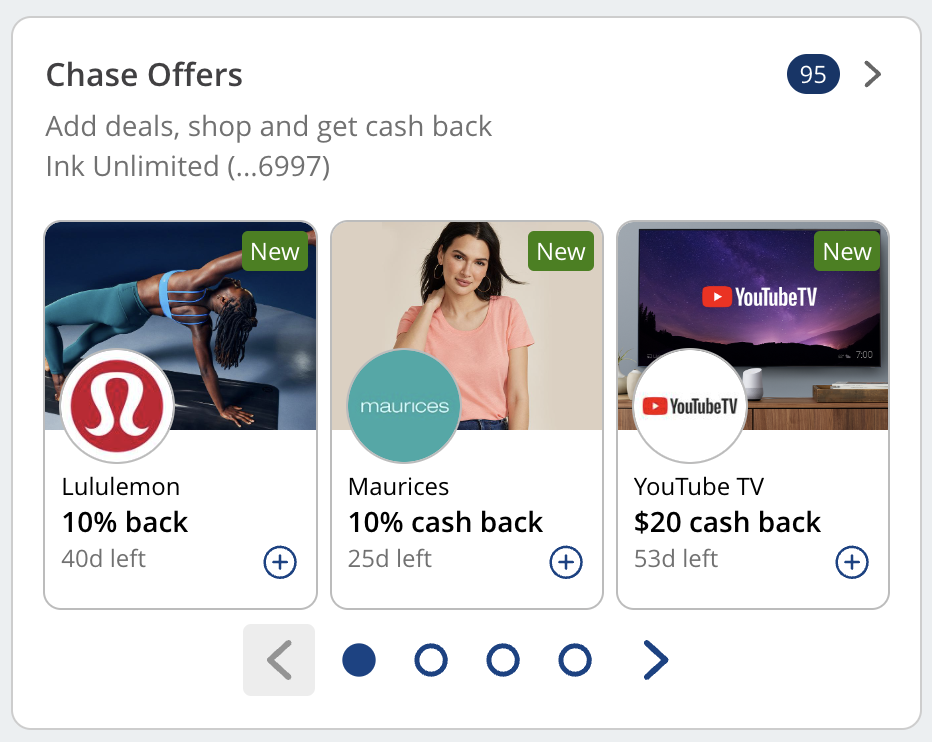

One additional way to earn extra Ultimate Rewards® is to take advantage of Chase offers. These are offers that give you a points boost for shopping with specific stores. You will first need to activate the offer to be eligible for the extra points.

Ways to Redeem Ultimate Rewards®

TRANSFER POINTS

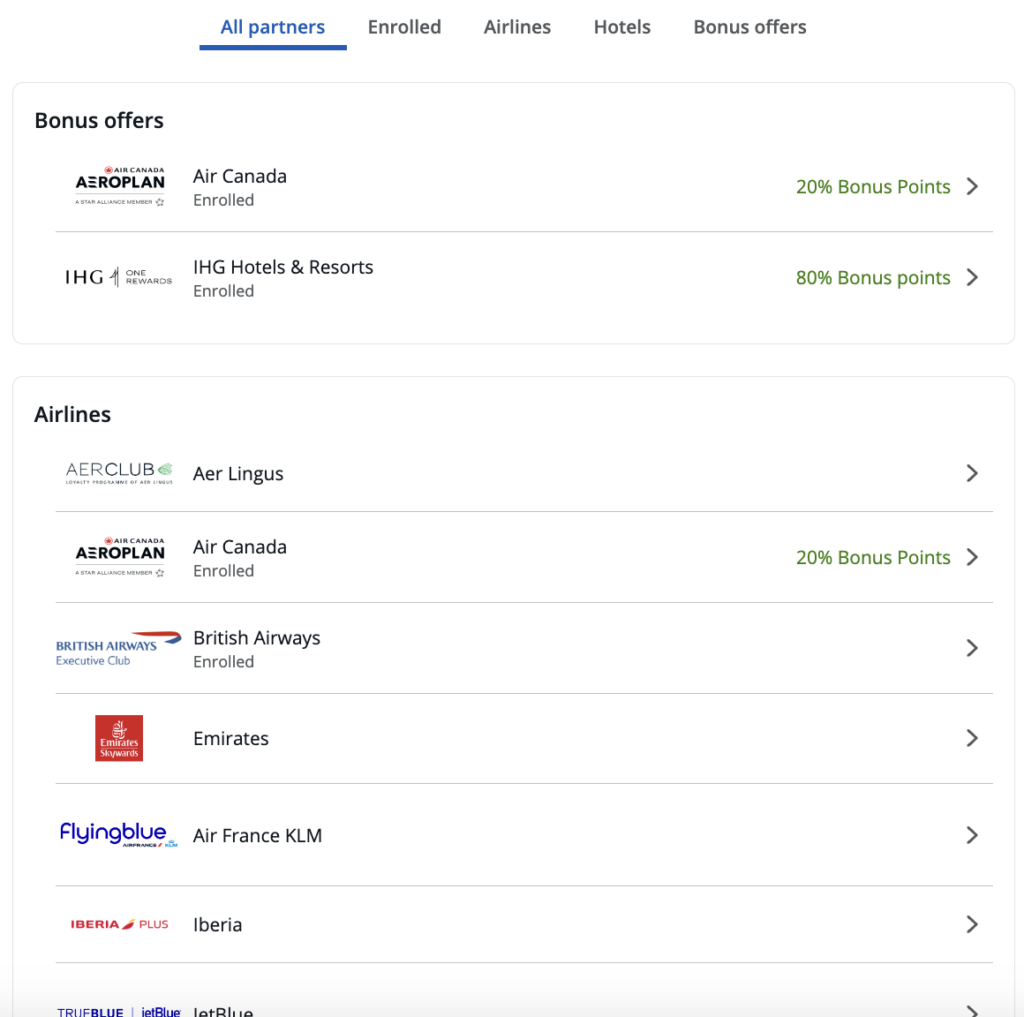

My favorite way to use Ultimate Rewards® is to transfer them to travel partners. To access Chase’s transfer partners, you will need a Sapphire Preferred, Sapphire Reserve, or Ink Preferred. All points transfer at a 1:1 ratio in increments of 1,000.

Here are the partners:

- Aer Lingus

- Air Canada

- British Airways

- Emirates

- Flying Blue (Air France/KLM)

- Iberia

- JetBlue

- Singapore

- Southwest

- United

- Virgin Atlantic

- Hyatt

- IHG

- Marriott

We often transfer our Ultimate Rewards® to Hyatt. Hyatt’s points rates are much lower than those of other hotel chains, which means we can get really great value out of them.

However, we’ve also used them for things like Flying Blue (Air France) flights to Paris, Southwest flights to Hawaii, Virgin Atlantic flights to London, and more. They really are the very best points.

HOW TO TRANSFER POINTS

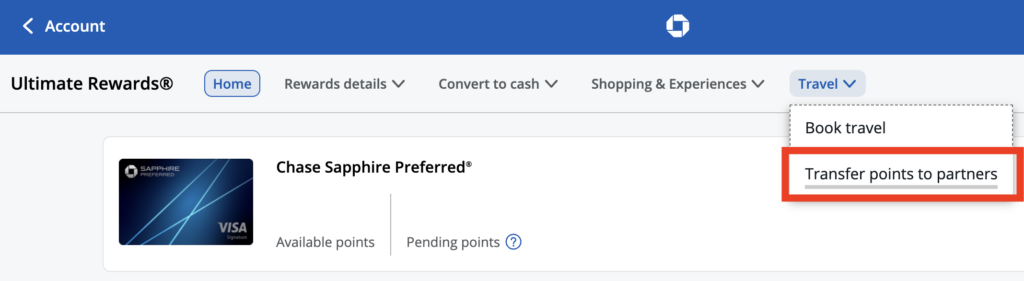

Log on to your Chase account and navigate to your Ultimate Rewards®. Next, click Travel, then Transfer points to partners.

After this, you’ll see all of the available partners. Select the partner you want to transfer to.

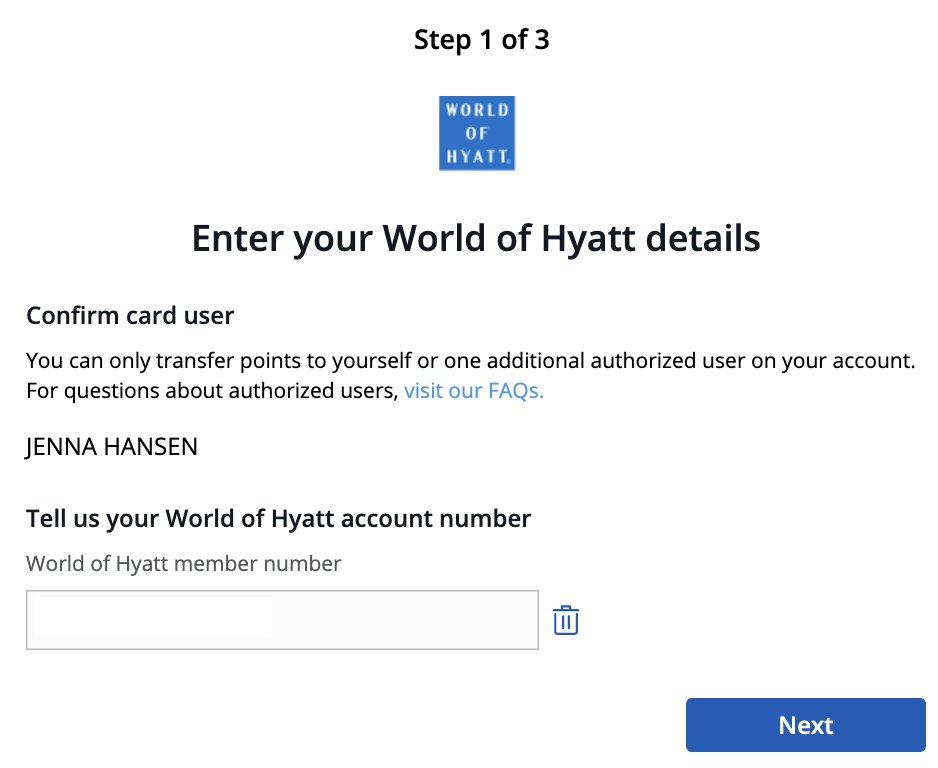

Next, enter your loyalty account information.

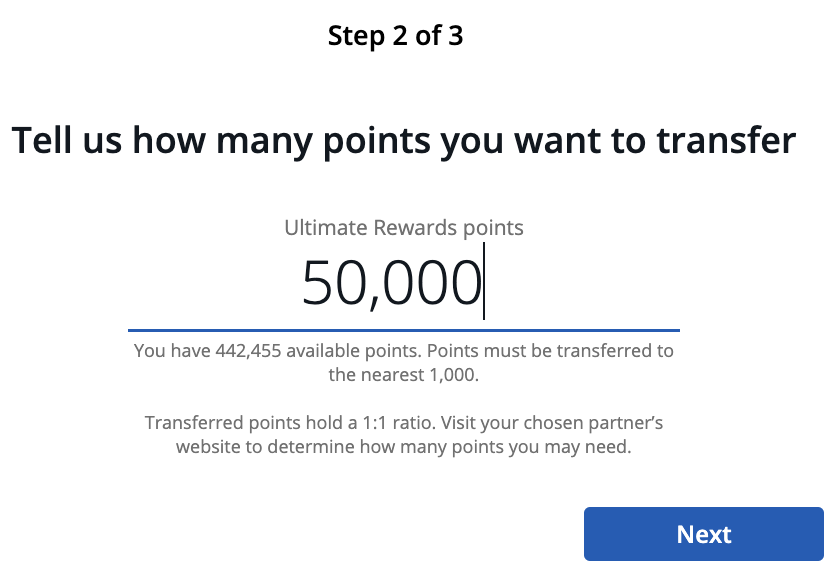

Then, enter how many points you want to transfer.

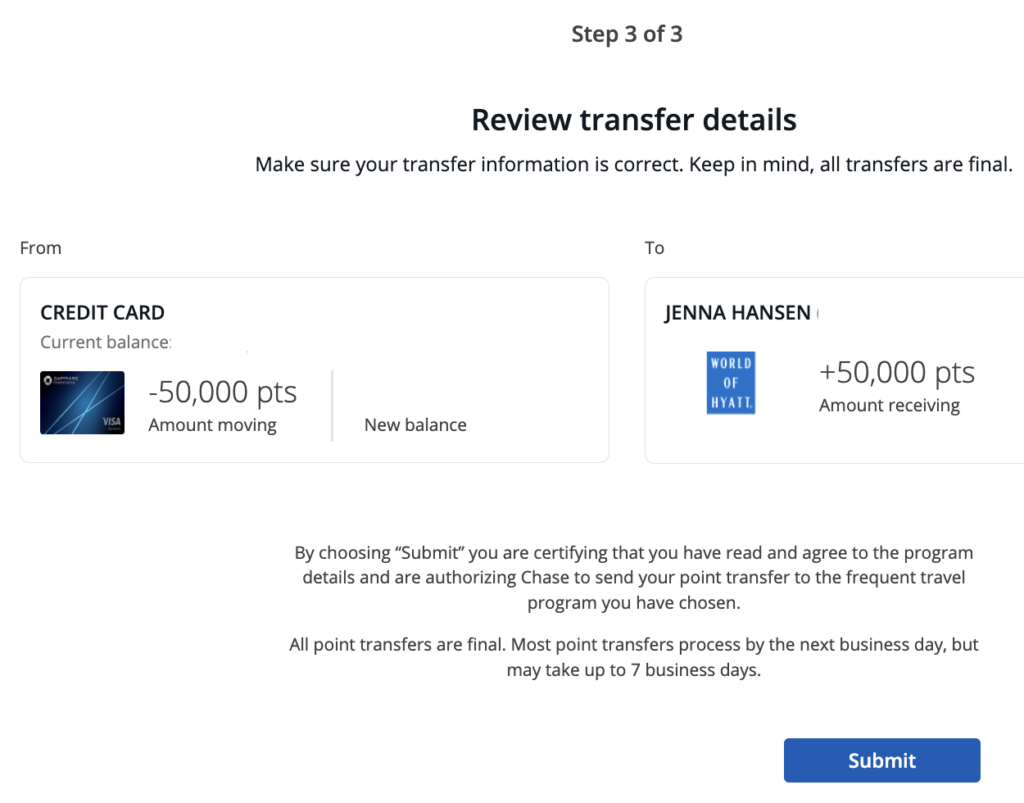

Finally, review the details then hit Submit.

USE THEM WITH CHASE TRAVEL℠

Another way to use your Ultimate Rewards® is by booking travel through Chase Travel℠. This works like any other travel search portal, like Expedia or Travelocity, and allows you to run searches across all airlines and hotels to find the best option for you.

Chase recently overhauled its Sapphire family of cards, and along with that overhaul came changes to how points can be redeemed through Chase Travel℠.

If you opened the Sapphire Preferred or Ink Business Preferred before June 23rd, 2025, and earn points on it before October 26th, 2025, your points are worth 25% more when redeemed in the portal. The same dates and rules apply to the Sapphire Reserve, but with a 50% boost. These boosted rates stay in effect until October 27th, 2027.

If you opened any of those three cards after June 23rd, 2025, or earn points on your card after October 26th, 2025, your points will be part of the new Points Boost program. This offers cardholders up to a 2% bonus on points for select hotel or airline bookings, depending on the card and redemption type.

Either way, using Chase Travel℠ is a great option for rental cars, cruises, and other activities where you can’t transfer points to book directly with those companies. It’s also a good option when booking boutique hotels that may not be part of a larger hotel program, such as Hyatt or Marriott.

CASH THEM OUT

Your final option is to cash out your points as a statement credit. If you do this, you’re getting a one-cent per point value, meaning every 10,000 points is worth $100. While this is the lowest value, it’s still a viable option if you’d rather save yourself the extra steps of the travel portal or transferring to partners. (But don’t let transferring intimidate you – I promise you that it’s easier than you think!)

Other important things to know

COMBINING POINTS

The ability to combine points is useful since there are certain cards that earn Ultimate Rewards® but don’t give you access to Chase’s transfer partners. If you earn points on one of these cards – Ink Business Cash, Ink Business Unlimited, Freedom Flex, or Freedom Unlimited – you will want to move them to one of the three cards that give you transfer partner access – Sapphire Preferred, Sapphire Reserve, or Ink Preferred. I use my Sapphire Preferred as my main card, where all of our Ultimate Rewards® live.

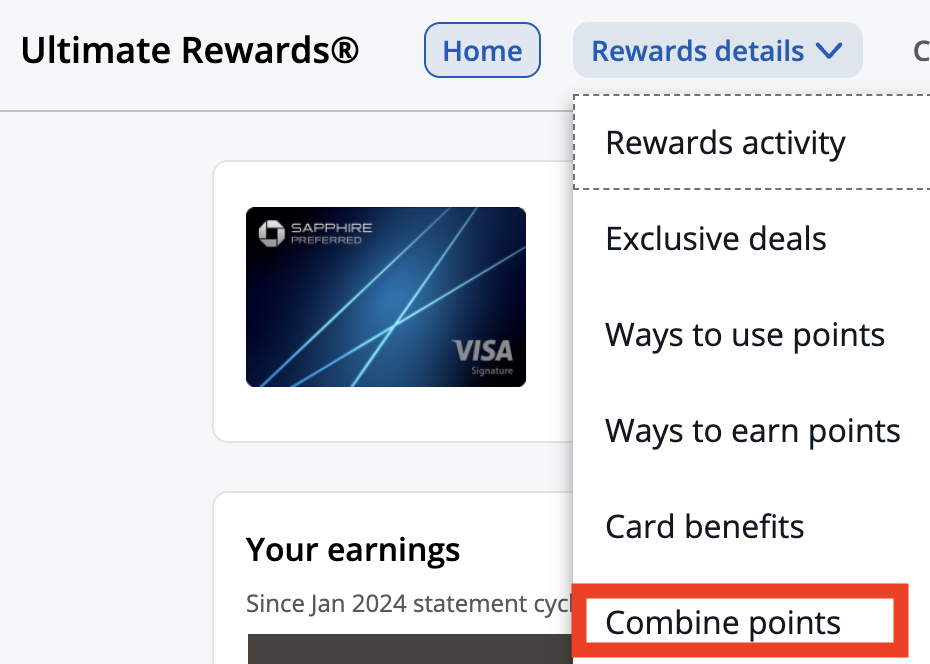

To combine your points, log in to your Chase account and go to your Ultimate Rewards®. Hover over Rewards Details, then click “Combine points.”

Choose which cards you want to move points from and to, enter the number of points you want to move, and hit confirm. Voila!

Combining points can be done between your own accounts or between you and one other member of your household. To do this, you will first need to call to have your accounts linked. Moving forward, you will be able to do it online just like you do between your own accounts.

DOWNGRADING AND CLOSING CARDS

Many cards earn Ultimate Rewards®, making it easy to transfer points, keep accounts active, and decide what to do with your cards after the first year. We always keep a Sapphire Preferred open so that we can access Chase’s transfer partners. However, we don’t both need one. So, after the first year, we downgraded Ryan’s Sapphire Preferred to a Freedom Flex since that card has no annual fee.

We have also both closed Ink Preferred accounts because we didn’t want to continue paying the annual fee after the first year. Since we have the Sapphire Preferred, we don’t need to access Chase’s transfer partners with the Ink Preferred, so it was an easy choice to close it.

POINTS EXPIRATION

Points do not expire as long as you have one card open with which your points can live. If you are closing a card that currently has points on it, you will first want to combine them with one of your other Ultimate Rewards-earning cards so that you don’t lose your points.

Conclusion

Chase Ultimate Rewards® are my favorite points for multiple reasons. They’re incredibly easy to come by, thanks to seven different cards that earn them, and they are also quite easy to use, thanks to a variety of ways to use them.

Thank you for using our card links when applying for new cards. It helps us run our small business at no extra cost to you. We appreciate your support!

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.