One of the most common questions I get is, “Do you keep all of these cards open?” and the answer is no! We keep a lot of them open, but not all of them. There are things to consider when deciding what to do with each of your cards.

First of all, we always keep cards open for a full year. This helps protect our credit scores and our relationships with the banks. After one year, you have a few options and considerations.

Keep It Open

The simplest option is to keep your card open. There are a few things to think about when deciding if you want to keep it open.

- Does the card have an annual fee? If not, it doesn’t hurt to keep it open.

- Does the card have enough benefits (that you’ll actually use) that make up for the annual fee? Many times, the benefits more than make up for the fee!

- Is it your oldest card? You always want to keep your oldest card open to help protect your credit history and credit score.

Product Change/Downgrade

The second option is to downgrade or product change your card. These generally mean the same thing but the terms are used interchangeably.

Downgrading your card is changing the card you have to a different version of the card, or a similar card, that has a lower or no annual fee. For example, you can change your Chase Sapphire Reserve® to a Chase Sapphire Preferred® Credit Card. This way, you preserve your account’s history and credit, but you lower or eliminate the fees involved.

This is a good option if you feel like the benefits are no longer worth it. If there is a downgrade/product change option, we always choose it over closing a card.

<All information about the Chase Sapphire Preferred® Credit Card and Chase Sapphire Reserve® has been collected independently by The Traveling Hansens. The card details on this page have not been reviewed or provided by the card issuer.>

Cancel

Finally, you can close the card if there are no downgrade options and you feel like the fee is no longer worth it. Just remember, it’s very important to keep your account open for a full year. Once you’ve hit the one-year mark, you can either call ot message/chat with the bank to discuss closing the account.

Start by asking if there are any retention offers. You can say something like, “I am thinking about closing this account because I feel like the benefits are no longer useful to me, and the fee isn’t worth it anymore. Are there any offers available that would help me keep the account open and avoid the fees?” There may not be, but it’s always worth asking!

If no retention offers are available, you can proceed with closing the account. Before you do so, make sure that you don’t lose your points! If you have another card within the same bank that earns the same points, then your points are safe. If you have a co-branded card that earns hotel or airline points – like a Southwest card or Marriott card – then your points are safe within that program.

However, if neither of those situations applies to the card you’re planning to close, you have a few options:

- Combine your points with another person- Capital One lets you do this with any other Capital One member for free; you’ll just need to call to do it. Chase lets you do this for free with one other member of your household. You will need to call to get your accounts linked, but after that, you can do it online.

- Transfer your flexible points to a hotel or airline. For example, if you have a Chase Sapphire Preferred® Card, you could transfer your points to Hyatt, and they will live in your Hyatt account.

- Open another card that earns the same points from the same bank. For example, if you want to close your Capital One Venture X Rewards Credit Card, you could open a Capital One Venture Rewards Credit Card first so that your points live there. This is a better option than downgrading because you’ll still get the new card’s welcome offer. After that, you could close your Venture X.

Related: Compare the Venture and Venture X

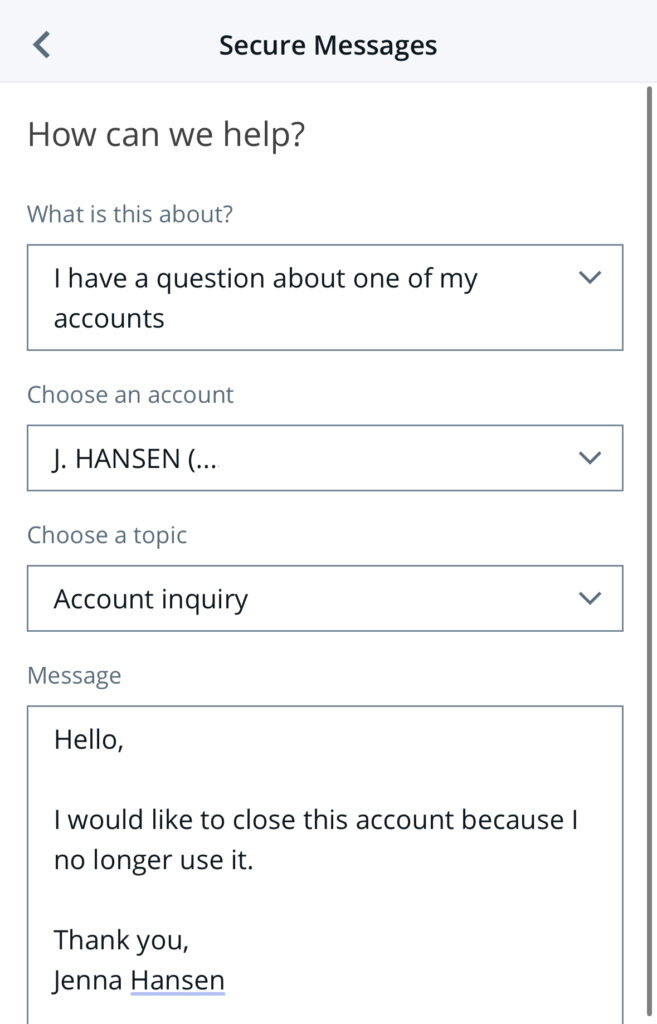

If you have a Chase card, most can be closed through Chase’s secure messaging on their website or in the app. Here’s what I say.

I typically get a response within a few days saying that my account has been closed.

Note: If you close a personal card, your credit score may temporarily drop, but don’t panic. This usually recovers within a month or so, as long as you continue good credit habits, like paying your cards on time and in full each month.

In Conclusion

As you can see, you have several options to consider when deciding what to do after the first year. Just go through the questions listed above to help you decide which option is best for you.

Thank you for using our card links when applying for new cards. It helps us run our small business at no extra cost to you. We appreciate your support!

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.