Paying your taxes with a credit card might seem crazy. Did you even know it was possible? And why would you want to do that since there’s always a fee?

Well, I have two words for you: welcome offer.

Yes, there is a fee involved, but many times it’s well worth it for that huge welcome offer. Think of all the points you could earn with that (not-so-fun) tax payment each year!

So, let’s break down exactly how to pay your taxes with a credit card, plus go over the pros and cons, and some card recommendations for you.

How to pay your taxes with a credit card

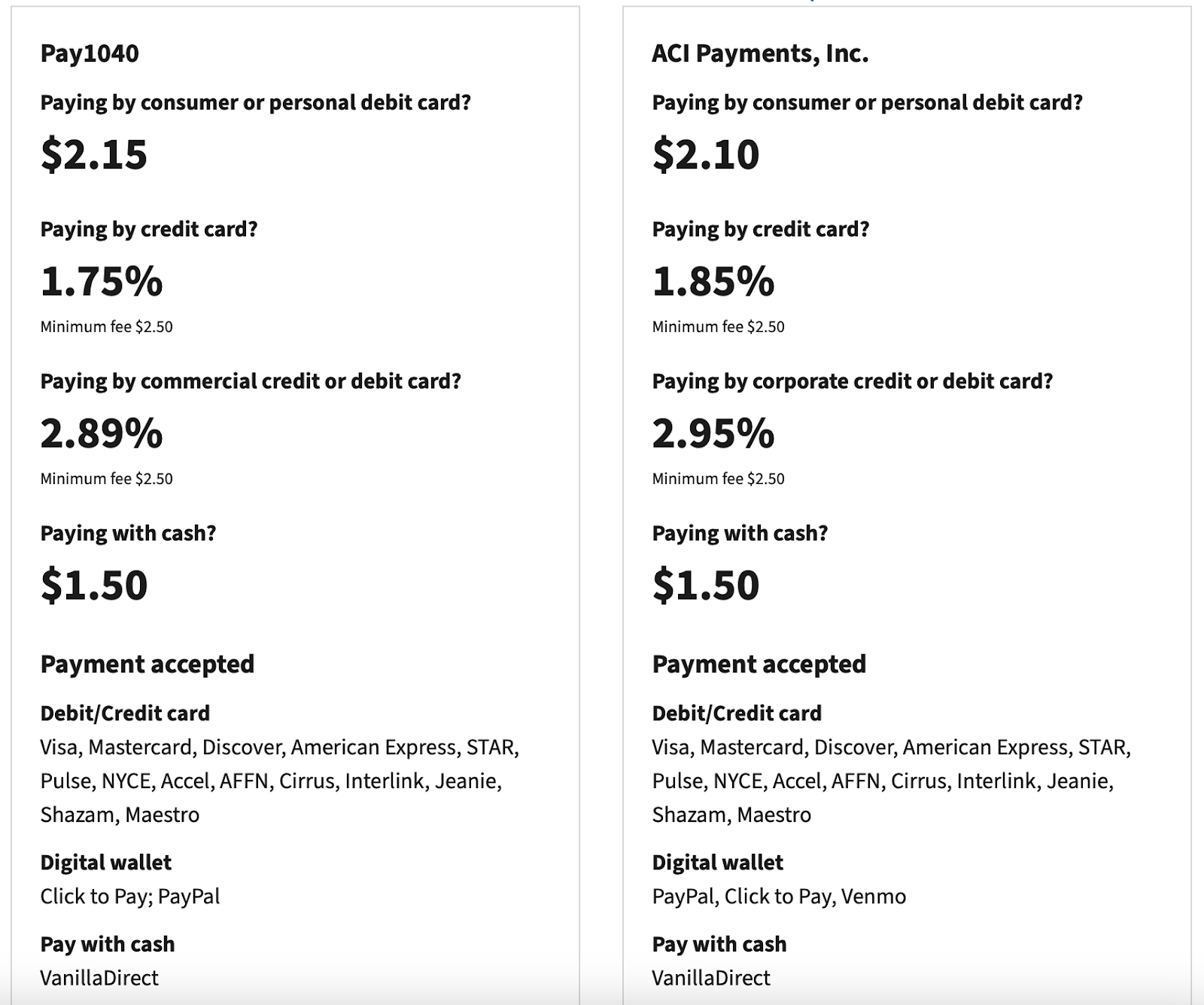

First things first: the IRS does not directly accept credit card payments. However, there are approved third-party payment processors that you can use instead. When paying your taxes with a credit card, you’ll want to pay close attention to the processor you choose and ensure that it is one of the approved IRS partners.

Here is a chart from the IRS.gov website that outlines the fees when paying through these approved processors. I recommend going directly to the linked IRS page because you can choose “Make Payment” from there.

Do the math

It’s important to factor in the processing fee when paying your taxes with a credit card. However, in my experience, the fee has always been worth it!

Let’s say you owe a tax bill of $6,000, and you opt to pay with a credit card through Pay1040. The fee is 1.75% with a personal credit card or 2.89% with a business credit card, which means you will be paying $105 or $173 for the processing fee.

This is not a small amount, but let’s consider the value of a new card’s welcome offer.

If you were to open an Ink Business Unlimited® Credit Card and charge the payment to it, you would meet the welcome offer with that one payment and earn $750 cash back! That means you’re already coming out ahead by $577.

Furthermore, if you combine these points with a card like the Chase Sapphire Preferred® Card, you’ll end up with 75,000 flexible points (from the welcome offer) that can be transferred to airline and hotel transfer partners for maximum value.

What can 75,000 points get you?

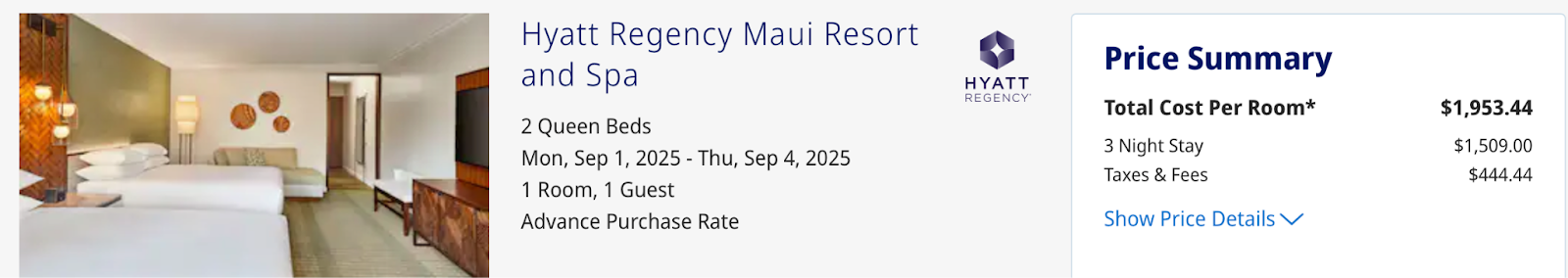

You could book three off-peak nights at the Hyatt Regency Maui for 25,000 points per night. The cash rate for those same three nights would be $1,953.

So, was the processing fee worth it in that case? I would emphatically say YES.

Make the most of paying your taxes with a credit card

Now that we know how to actually pay your taxes with a credit card and how to do the math to see if it’s worth it, the most important question is, which card will you choose?

This will depend on how much you owe for your taxes.

If you owe $6,000 or less, here are the cards I’d recommend:

- Chase Sapphire Preferred® Card

- Capital One Venture Rewards Credit Card

- Capital One Venture X Rewards Credit Card

- Ink Business Unlimited® Credit Card

- Ink Business Cash® Credit Card

<All information about Chase Sapphire Preferred® Card, Ink Business Unlimited® and Ink Business Cash® has been collected independently by The Traveling Hansens. The card details on this page have not been reviewed or provided by the card issuer.>

RELATED: Business Cards Are Easier Than You Think

If you owe a larger amount, anywhere from $8,000 – $30,000+, here are the cards I recommend:

- Ink Business Preferred® Credit Card

- Sapphire Reserve for Business℠

- Capital One Venture X Business

- Capital One Spark Cash Plus

- The Business Platinum Card® from American Express

- American Express Platinum Card®

- American Express® Business Gold Card

<All information about Ink Business Preferred® Card, Sapphire Reserve for Business, The Business Platinum Card from American Express, The Platinum Card from American Express, and the American Express Business Gold Card has been collected independently by The Traveling Hansens. The card details on this page have not been reviewed or provided by the card issuer.>

I typically plan to open a new card at least 2-3 weeks before needing to pay my taxes, so I can allow plenty of time for the card to arrive in the mail!

Booking the trip

If you’re unsure how to use all of those points to get a trip booked, here are a few resources for you:

Bottom line

Paying your taxes with a credit card can be very rewarding if you know how to maximize welcome offers and boost your earning potential. Of course, it’s important to weigh the pros and cons to make sure it aligns with your financial and travel goals. Paying taxes is never fun, but the silver lining is earning more points to use for deeply discounted vacations!

**I am not a tax professional, and this is not financial or tax advice. Please refer to your tax expert for financial questions and tax assistance.

Thank you for using our card links when applying for new cards. It helps us run our small business at no extra cost to you. We appreciate your support!

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.