As a mom of four, managing our cards and making sure to maximize each card’s credits has felt like a full-time job I didn’t have time for. Between homeschooling, playing mom taxi, and ensuring my kids get fed, keeping track of which card to use at which store – and when the statement credits expire – has been overwhelming. And honestly, it’s the reason why I haven’t tried very hard to maximize every purchase. It’s just too much.

However, I then discovered CardPointers, and it completely changed everything. It’s made it SO easy to keep track of credits, rewards, best cards for each purchase, and more.

What Is CardPointers?

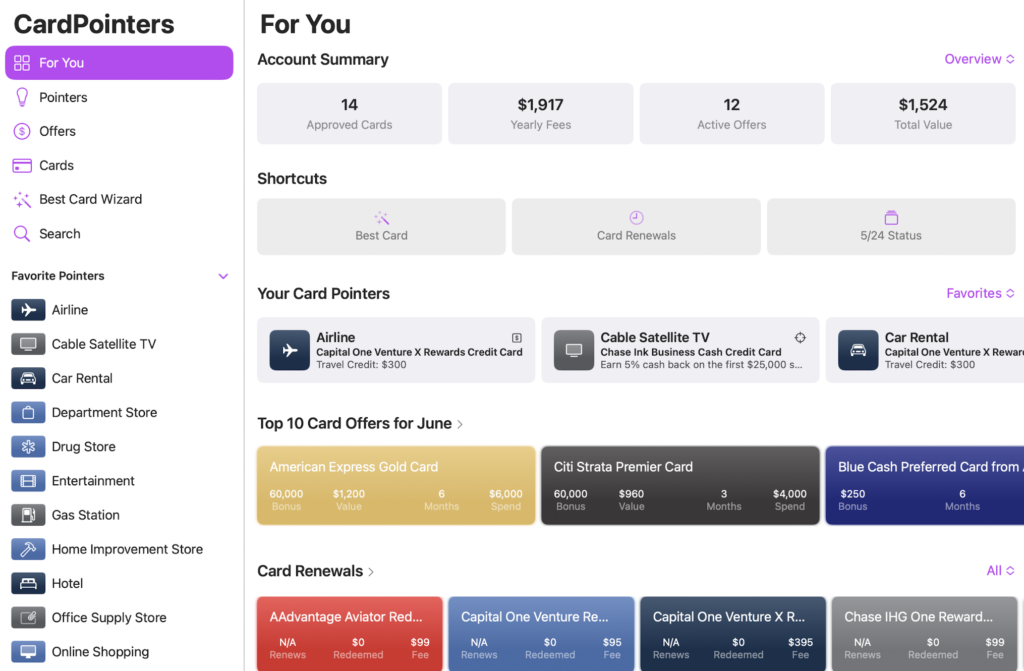

CardPointers is an app designed to help you effortlessly maximize your credit card rewards. It tracks your cards, highlights the best one to use for each purchase category or at each store, and reminds you of expiring credits and offers. It’s like having a personal assistant dedicated to optimizing your spending.

Why it’s a game-changer for busy families

Here’s how CardPointers has made my life easier:

- Tracks all our cards, including personal, business, and store cards (although we don’t recommend opening those) in one place.

- Best card recommendations: Whether I’m buying groceries, filling up the gas tank, or shopping online, CardPointers tells me which card will give me the most return for that spending.

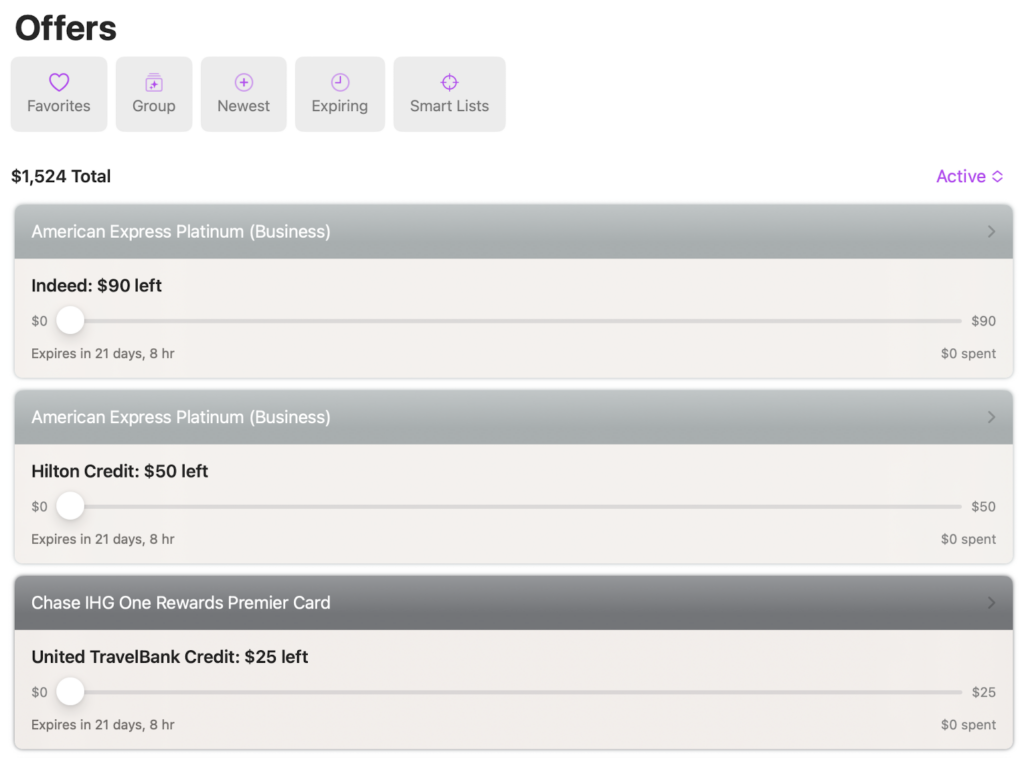

- Offer reminders: It alerts me about expiring statement credits, limited-time offers, and bonuses so we never miss out.

- Organizes Amex and Chase offers: Once you’ve added the browser extension, Chase and Amex offers are automatically added to your cards every time you log in to the bank’s website. This is super helpful so you don’t have to manually go through and individually add each offer.

- 5/24 status tracking: Helps me keep track of where I’m at with Chase’s 5/24 rule.

- Browser extensions and widgets: The app offers browser extensions for online shopping and widgets for quick access on my phone, so I never miss an offer or deal.

Free vs. paid: which one works best?

CardPointers has both a free and paid version. The free version has some decent benefits, and I’d absolutely recommend it for some basic features.

Free

- Track all of your cards

- View your offers

- Access one location reminder per month

The paid version has far more features, including those auto-added offers, which may be my favorite thing.

CardPointers+

- Unlimited location reminders

- Best Card Wizard searches

- Use AutoPilot, widgets, AR (augmented reality) tools, and Siri shortcuts to find the best card to use

- Auto‑add Amex and Chase offers

- Annual fee reminders, renewal insights, and full 5/24 tracking

It’s only $79 for the whole year. Plus, if you use my link, you get 30% off, making it just $55! Well worth it for all of the features!

Real-life savings with CardPointers

How does it work in real life? Well, when I visit a store like Target or Home Goods, I pull up the app, and it uses my location to recommend which card should be used during checkout. I’ve also used the AR feature to scan stores around me, and it will automatically pop up with suggestions for which card would be best.

When online shopping, the extension recommends cards to use based on which website I’m on. I like to stack this with Rakuten for even more savings.

And don’t worry, all of the AR and location features are local, meaning they aren’t stored anywhere else. No need to fret about hackers getting your personal information because it’s saved somewhere in the app or on the servers.

Final Thoughts

Juggling four kids and a million errands doesn’t leave room for chasing extra points. CardPointers freed up my brain space and added hundreds of dollars in savings – without me lifting more than a finger.

If you’re tired of wondering which card to use, CardPointers is one of the smartest, easiest tools you can add to your routine, especially for busy families like mine.

Start with the free plan to test the waters. If you love the perks, like we did, dive into CardPointers+ and watch it pay for itself with smarter spending.

Thank you for using our card links when applying for new cards. It helps us run our small business at no extra cost to you. We appreciate your support!

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.