We recently returned from a Caribbean cruise worth over $5,000, which we almost completely offset with points and miles! Let’s go over exactly you can use credit card points and miles to pay for a cruise.

Cashing out points

The way to use points to pay for a cruise is to cash them out. This isn’t always the most popular option in the points and miles world because it has a basic one-cent-per-point value. This means that every 10,000 points is worth $100. It’s not as popular a way to use points because you can transfer points to travel partners and potentially get a much higher value.

However, I’m a firm believer that the best way to use your points is to use them in a way that helps you travel more for less. I don’t focus a lot on getting the best value. Instead, I focus on saving as much money as possible, opening up more travel opportunities for my family.

Capital One Miles

We used Capital One Miles to cover the cost of our six-night Carnival cruise. We needed two rooms (big family problems), and the total cost was just over $5,000. In miles, this equals 500,000 miles, which is a ton!

We earned these miles through a combination of opening new cards, referring friends and family members to cards, and putting all of our spending on these cards.

Here are the cards that earn Capital One Miles which can be used to cover the cost of travel expenses:

- Capital One VentureOne Rewards Credit Card

- Capital One Venture Rewards Credit Card

- Capital One Venture X Rewards Credit Card

- Capital One Venture X Business

- Capital One Spark Miles for Business

We each opened a Venture card, and I also opened a Venture X for a total of 250,000 miles. This breaks down to 75,000 miles for each welcome offer, plus another 8,000 miles per card for the required spending to earn the welcome offer. This covered half of the cruise cost.

The other half was covered by miles earned from referrals and spending.

Using miles to cover the cost

We did not earn all of these miles at once! Instead, we earned them over a year and a half. Every time I had a big chunk of miles built up, I made a payment toward the cruise. Be sure to use your card to pay so that the cost can be covered with your miles! Then, once the payment was posted, I went into my account and used miles to cover the cost.

Here’s how to do it.

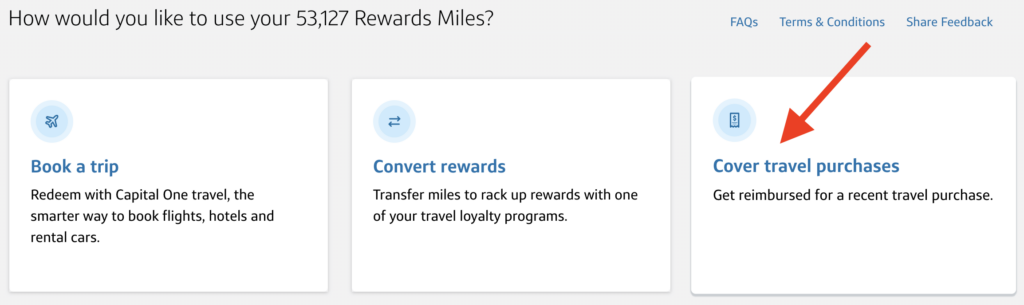

First, log on to your account then click on your rewards. Choose Cover Travel Purchases.

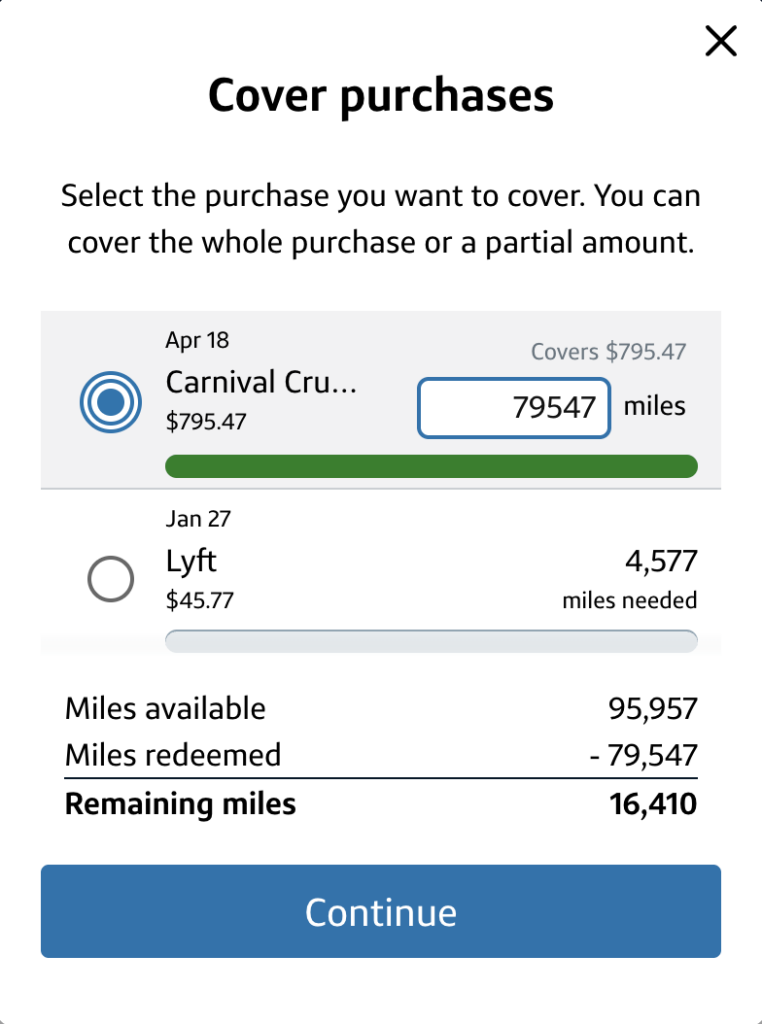

A box will pop up with any purchases that are eligible to be covered with miles. Choose which travel purchase and how many miles you want to use. You can cover a portion of the purchase or all of it.

Select continue, then confirm the transaction. It takes 1-3 days for the credit to post to your account.

How to Combine Capital One Miles

Capital One allows you to combine miles between your own Capital One cards or with any other Capital One member for free. This is very helpful when both people are earning miles toward a cruise. There were a few times when I combined our miles before making a cruise payment, but more often than not, I just made a payment with one of our cards and then used that person’s miles to cover it.

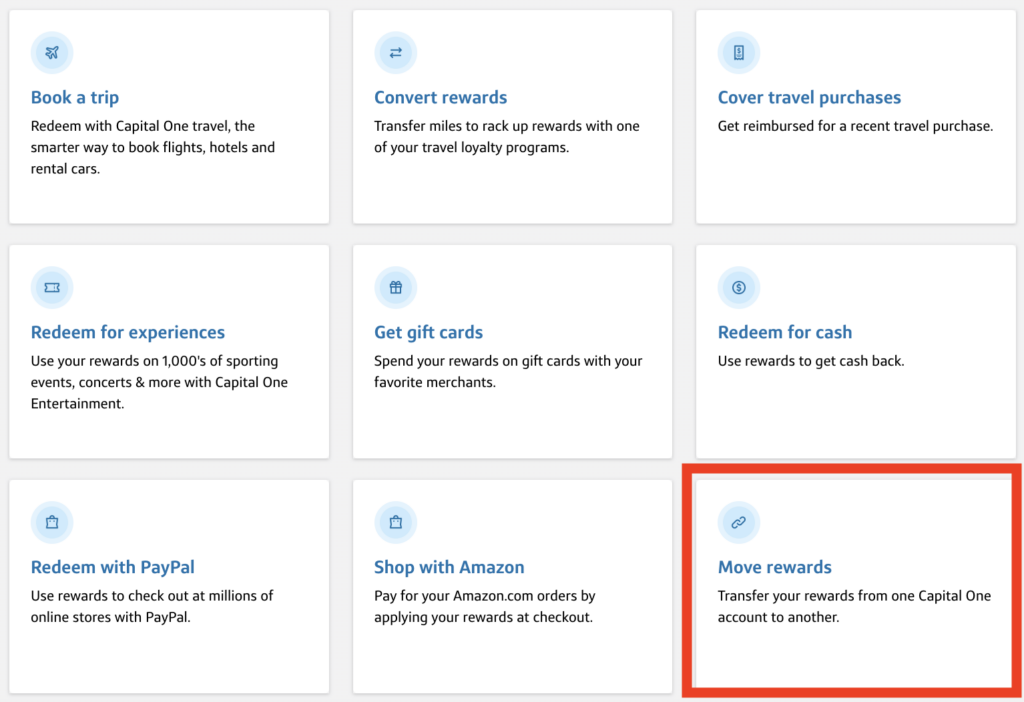

If you’re combining miles between cards you hold, you can simply log on to your account, go to your rewards, then choose Move Rewards.

If you’d like to combine miles with another member, you will need to call customer service. You will need the name and full card number of the person you are combining miles with. The transfer is instant.

Other ways to cover cruise costs

Capital One Miles are not the only points currency that can be cashed out to cover travel expenses. Chase Ultimate Rewards® can also be used in this way. The nice thing about Ultimate Rewards® is that they can be cashed out for any expense, not just travel. However, I don’t typically recommend using them for anything besides travel since we like to get a good value from them!

Most of the time, we transfer our Chase points to travel partners since Chase has some unique partners that no other banks have. However, if you find yourself with Chase points and want to offset the cost of a cruise, you can absolutely do it!

Here are the cards that earn Ultimate Rewards® which can be cashed out:

- Chase Sapphire Preferred® Card

- Chase Sapphire Reserve®

- Chase Freedom Flex® – click the link then choose Flex

- Chase Freedom Unlimited® – click the link then choose Unlimited

- Ink Business Preferred® Credit Card

- Ink Business Cash® Credit Card

- Ink Business Unlimited® Credit Card

Related: Business Cards Are Easier Than You Think

<All information about Chase Sapphire Preferred, Reserve, Freedom Flex, Freedom Unlimited, and Ink Preferred, Cash, and Unlimited has been collected independently by The Traveling Hansens. The card details on this page have not been reviewed or provided by the card issuer.>

How to cash out Ultimate Rewards

Here are the steps for cashing out your Chase points.

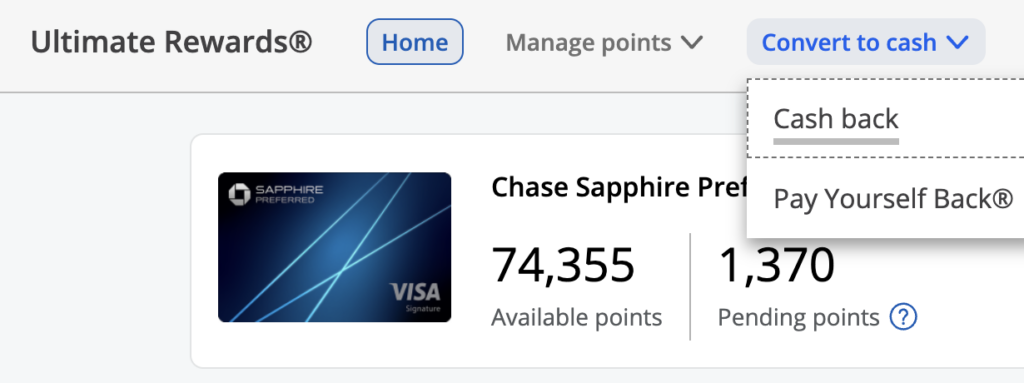

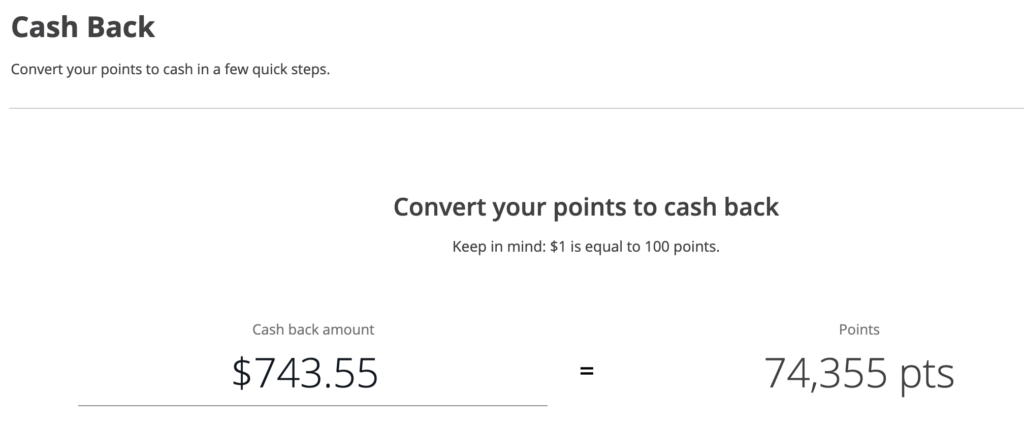

First, log on to your account and navigate to your rewards. Next, click on “Convert to cash” on the top menu bar and choose “Cash back”.

Then, choose how many points you want to cash out and to which card account you want them to go. Notice that it’s a one cent per point value.

Finalize your choice and the cash will show up as a statement credit within a few days.

Wrapping Up

As you can see, there are multiple ways to use points to pay for a cruise. You can pay for all of it or some of it and you can even pay it in increments over time. No matter how you do it, you’re using your points to book an amazing vacation and that is winning!

Thank you for using our card links when applying for new cards. It helps us run our small business at no extra cost to you. We appreciate your support!

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.