While many points and miles programs get more attention, Citi ThankYou® Points often fly under the radar. However, learning how to earn, maximize, and redeem Citi ThankYou® Points can open up valuable travel opportunities. This guide will walk you through everything you need to know about this underrated rewards program.

What are Citi ThankYou® Points?

Citi ThankYou® Points are points earned from a variety of Citi credit cards. They are flexible points, which means they can be used in multiple ways, including transferring to travel partners if you hold the right card.

Ways to Earn ThankYou® Points

CREDIT CARDS

The fastest way to earn ThankYou® Points is by opening a new credit card and earning the welcome offer. While there are not as many points-earning cards as some of the other banks offer (especially Chase and American Express), there are a few to consider.

There are seven credit cards that earn these points – three earn fully flexible points, although one is not open to new applicants – while the other four are considered cash-back cards, and one of those is also not open to new applicants. If you also have one of the fully flexible cards, you can combine your points from any of the cards onto that one, essentially making them all earn flexible points.

These are the cards that earn fully flexible points:

- Citi Strata Premier℠ Card – this card is similar to the Chase Sapphire Preferred® Card and Capital One Venture Rewards Credit Card

- Citi Strata Elite® Card – a brand new premium card (great for triple-dipping benefits!)

- Citi Prestige® Card – not available to new applicants

These are the cards that earn “cash-back” but actually earn ThankYou® Points:

- Citi Double Cash® Card

- Citi Custom Cash® Card

- Citi Strata℠ Card

- Citi Rewards+® Card – not available to new applicants

SPENDING

You can also earn ThankYou® points by putting spending on your credit cards. Each card has specific spending categories that earn anywhere from 1-10X back on your spending. For example, the Strata Premier earns 3X on restaurants, grocery stores, and gas, while the Custom Cash earns 5% cash back on your top eligible spend category per billing cycle.

Ways to Redeem ThankYou® Points

TRANSFER POINTS

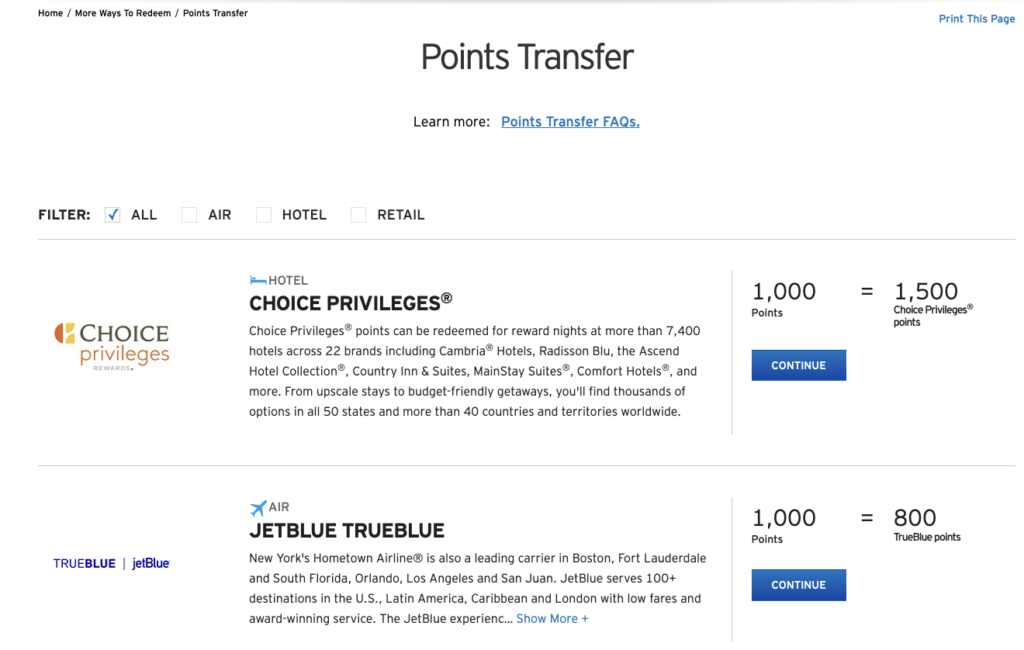

My top choice for all flexible points is to transfer them to travel partners. Most points transfer at a 1:1 ratio in increments of 1,000 unless otherwise noted below.

Here are the partners if you have one of the three cards that earn fully transferrable points:

- Aeromexico Rewards

- Accor Live Limitless (2:1)

- Air France/KLM Flying Blue

- American Airlines (new transfer partner!!)

- Avianca LifeMiles

- Cathay Pacific

- Choice Privileges (1:2 – this is a sweet spot for international hotels since many overseas properties are nicer than the Choice Hotels within the U.S.!)

- Emirates Skywards

- Etihad Guest

- EVA Air Infinity MileageLand

- I Prefer Hotel Rewards (1:4 – another great sweet spot that quadruples your points when transferred)

- JetBlue TrueBlue

- Leaders Club (5:1)

- Turkish Airlines Miles&Smiles

- Qantas Frequent Flyer

- Qatar Airways Privilege Club

- Singapore Airlines KrisFlyer

- Thai Royal Orchid Plus

- Virgin Atlantic Flying Club/Virgin Red

- Wyndham Rewards

Having American Airlines as a new transfer partner is very exciting! American has many great sweet spots like 40k round-trip to Europe, 15k one-way to the Caribbean and Mexico, and 35k one-way to Asia.

Another option for your ThankYou Points is to take advantage of airline alliances and use international airline partners to book domestic flights. For example, Delta flights booked through either Virgin Atlantic or Flying Blue.

We’ve also used the fantastic 1:2 transfer rate to double our Choice Hotels points and book rooms in Europe. This comes in extra handy since we need two rooms everywhere we go.

If you have one of the cash-back cards, you can access a limited number of transfer partners at rates different from those listed above. Here are your options if you have one of the three “cash-back” cards. These all transfer at a rate of 1000 ThankYou Points to 700 airline or hotel points, unless otherwise noted.

- Accor Live Limitless (1000 = 350)

- Aeromexico

- Avianca

- Cathay Pacific

- Choice (1000 = 1,400)

- EVA Air

- Emirates (1000 = 560)

- Etihad

- Flying Blue (Air France/KLM)

- JetBlue

- Qantas

- Qatar

- Singapore

- Thai

- Turkish

- Virgin Atlantic

- Wyndham

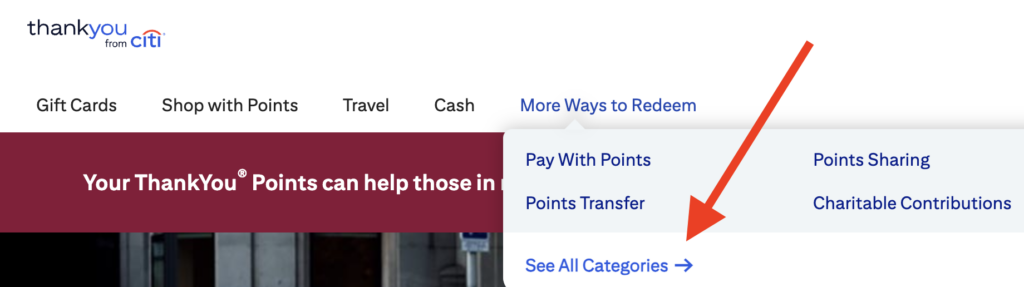

HOW TO TRANSFER POINTS

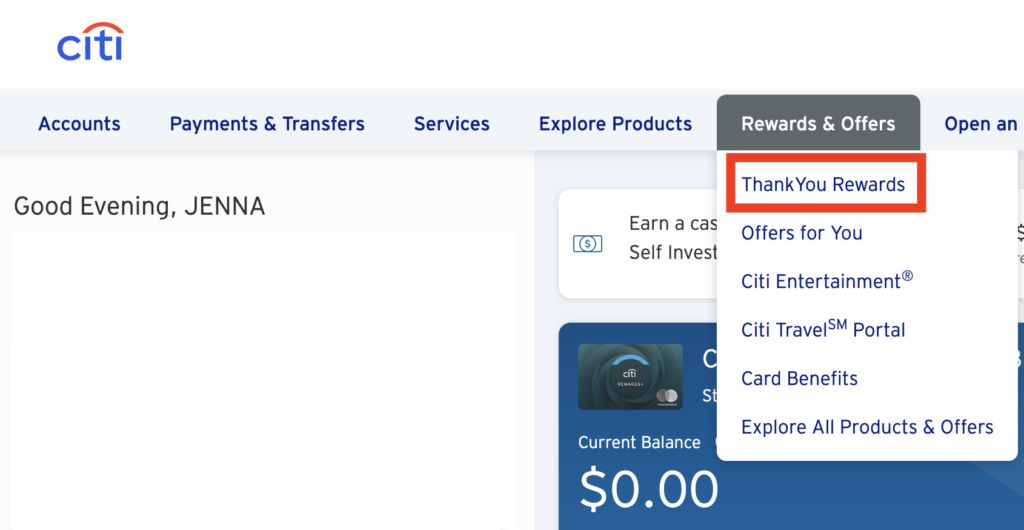

Log on to your Citi account and hover over the Rewards & Offers tab near the top, then click ThankYou Rewards.

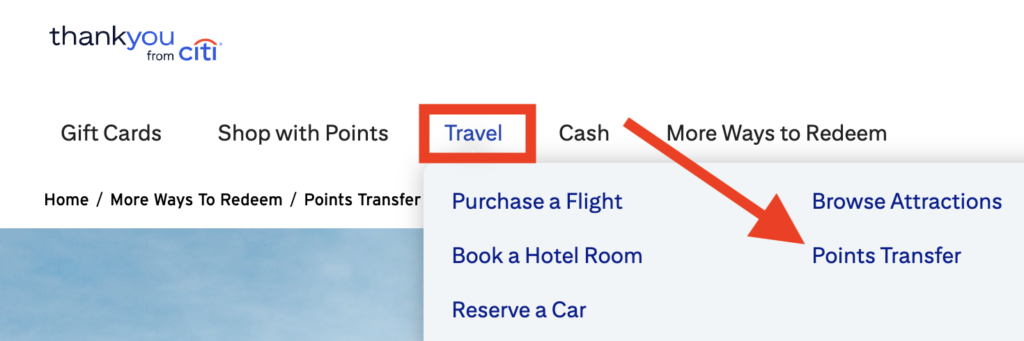

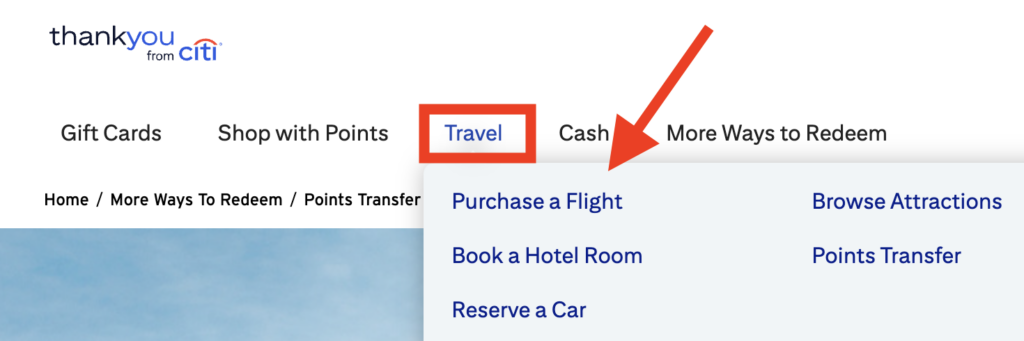

Once the ThankYou page opens, hover over Travel then choose Points Transfer.

After that, choose the partner you’d like to transfer to, then enter your loyalty account number for that hotel or airline and select how many points you’d like to transfer.

Finally, review the details then hit Submit.

USE THEM WITH CITI TRAVEL℠

Another way to use ThankYou® Points is by booking flights, hotels, or rental cars through Citi Travel℠. This works like other travel search portals, which search all airlines and hotels to find the best options.

To get to Citi Travel℠, start in your Citi account just like when you want to transfer points, but instead of choosing Points Transfer, choose either Purchase a Flight, Book a Hotel Room, or Reserve a Car. All three of these options will take you to Citi Travel℠.

CASH THEM OUT

One final option is to cash out your points. When you do this, they’re worth one cent per point, meaning every 10,000 points is worth $100. The only exception is the Rewards+ card, which has a cash-out value of .5 cents per point, so this isn’t a recommended option.

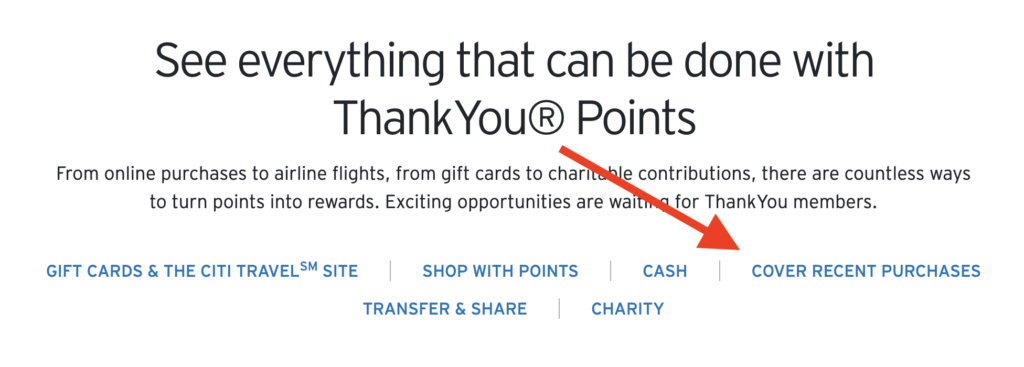

To cash out your points for a statement credit, go to your ThankYou® points and hover over More Ways to Redeem, then choose See All Categories.

Next, choose Cover Recent Purchases.

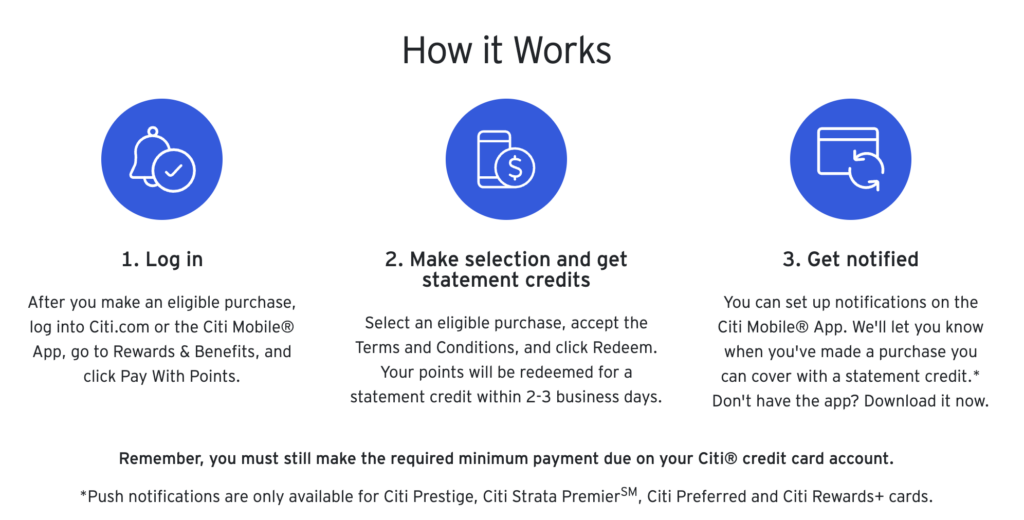

Then follow these steps.

Other important things to know

COMBINING POINTS BETWEEN CARDS

As I mentioned above, there are three cards which give you full access to all of Citi’s transfer partners. If you have one of those cards and one of the other ThankYou® Points cards that are marketed as cash back, you’ll want to combine your points.

To do this, log on to your Citi account, then choose Points Summary from the drop-down menu. Next, choose Combine My Accounts, then choose which points you want to combine and which card you want them to go to.

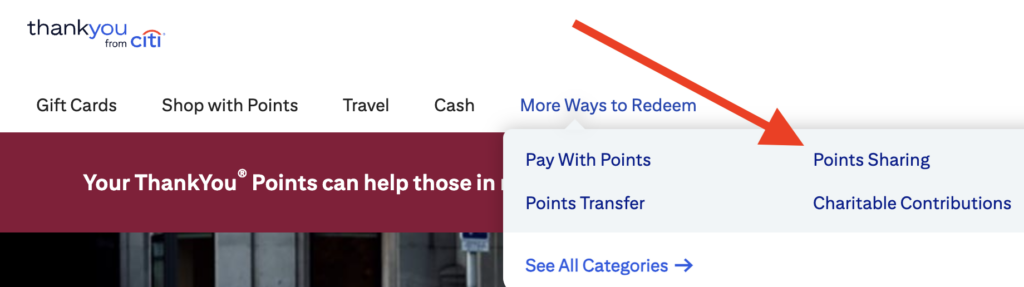

SHARING POINTS WITH OTHER CITI MEMBERS

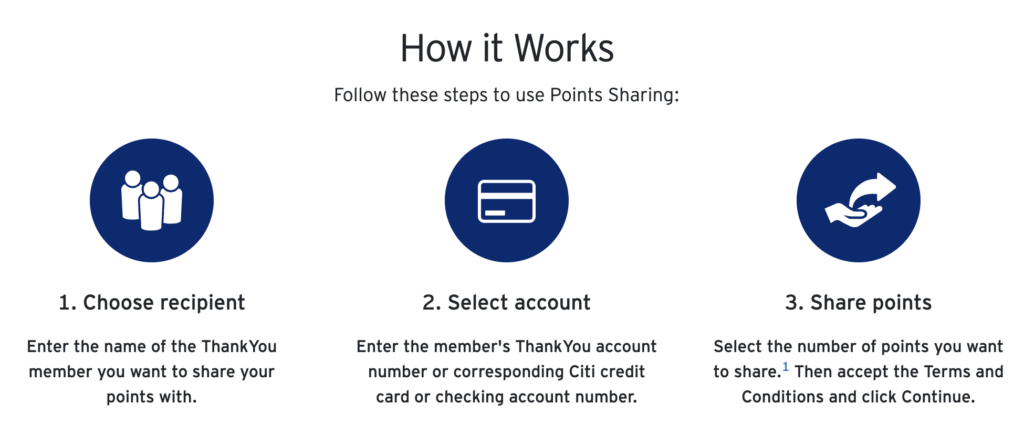

Citi also allows you to send and receive points with other Citi members. To do this, go to your ThankYou® points and hover over More Ways to Redeem, then choose Points Sharing.

Next, follow these steps.

You can transfer and receive up to 100,000 points per year. Points that are shared between members expire after 90 days, so be sure you have a plan to use them right away!

DOWNGRADING AND CLOSING CARDS

If you have a Citi Strata Elite or Citi Strata Premier and no longer want to pay the annual fee, you can downgrade to one of the other ThankYou® Points-earning cards, which all have no annual fee. Your ThankYou® points will stay with your account, but you will no longer have access to all of Citi’s transfer partners.

POINTS EXPIRATION

Points do not expire as long as you have one card open with which your points can live. If you are closing a card with points on it, you will first want to combine them with one of your other ThankYou® Points-earning cards so that you don’t lose your points.

The only exception is that points transferred to you from another Citi member will expire after 90 days.

Conclusion

Citi ThankYou® Points aren’t talked about as much due to the small number of cards that earn them, but having American Airlines as a new transfer partner is a huge boost to their usability. There is just one card currently available that earns fully flexible points. However, ThankYou Points shouldn’t be discounted, especially if you’re trying to diversify your points.

Thank you for using our card links when applying for new cards. It helps us run our small business at no extra cost to you. We appreciate your support!

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.