If you’re into maximizing points and miles, then you need to learn more about Bilt Rewards. Bilt has quickly become one of the most talked-about programs in the travel rewards world. It started as a company that allowed renters to earn points on rent payments, and it has evolved into something much bigger.

Now, there are three brand new Bilt credit cards, you can earn points with both rent and mortgages, you can link your Bilt and Rakuten accounts to boost your points even further, and they have one of the most robust lists of airline and hotel partners.

Here’s what you need to know about Bilt.

Credit Cards

One of the biggest and most exciting changes to Bilt Rewards this year is the launch of three new Bilt credit cards, aka Bilt Card 2.0. The original Wells Fargo Bilt Mastercard was phased out and replaced with a brand-new lineup of cards.

Instead of one single card, Bilt now has three different options, so you can choose what best fits your lifestyle:

- Bilt Blue Card

- $0 annual fee

- $100 Bilt Cash when you apply and are approved

- 1 point per dollar on all purchases

- Up to 1 point per dollar on rent and mortgage

- 4% Bilt Cash on everyday spending, use Bilt Cash to earn fee-free points earning on rent/mortgage payments. For every $30 of Bilt Cash, unlock 1,000 points on rent or mortgage with no fees.

- No foreign fees

- Bilt Obsidian Card

- $95 annual fee

- $200 Bilt Cash when you apply and are approved

- 3 points per dollar on dining or grocery purchases, up to $25,000 per year

- 2 points per dollar on travel

- 1 point per dollar on everything else

- Up to 1 point per dollar on rent and mortgage

- 4% Bilt Cash on everyday spending, use Bilt Cash to earn fee-free points earning on rent/mortgage payments. For every $30 of Bilt Cash, unlock 1,000 points on rent or mortgage with no fees.

- $100 annual Bilt Travel hotel credit: $50 bi-annually

- Bilt Palladium Card

- 50,000 Bilt points plus Gold elite status after spending $4,000 in the first three months, plus earn $300 in Bilt Cash

- Unlimited 2 points per dollar on all purchases

- Up to 1 point per dollar on rent and mortgage

- 4% Bilt Cash on everyday spending, use Bilt Cash to earn fee-free points earning on rent/mortgage payments. For every $30 of Bilt Cash, unlock 1,000 points on rent or mortgage with no fees.

- $400 annual Bilt Travel portal hotel credit: $200 bi-annually

- $200 Bilt Cash annually

- Priority Pass membership (cardmember plus two guests)

These cards are currently available for pre-order for current Bilt cardholders and will be available for new applicants on February 7th, 2026.

Using Bilt to Pay Your Rent/Mortgage

There are now two options for ways to earn points when using Bilt to pay your housing payment. The first comes with a 3% fee that can be offset using Bilt’s new “Bilt Cash” system. The second is a tiered earning chart based on your spending. Here are the details of both.

Option One: Bilt Cash

Think of Bilt Cash as a second rewards balance that works alongside Bilt Points. You earn it from your everyday spending, and it acts like money inside the Bilt system.

Its main purpose? Covering the 3% fee that comes with earning points on rent or mortgage payments.

How it works:

- You earn Bilt Cash from non-housing purchases

- That Bilt Cash can be applied to your rent or mortgage payment

- The more Bilt Cash you have, the more of your payment earns points without paying the 3% fee

If you have enough Bilt Cash, you can earn 1 point per dollar on your full rent or mortgage payment with no out-of-pocket cost. Every $30 in Bilt Cash covers the fee to earn 1,000 points.

If you have some Bilt Cash (but not enough to cover the full amount), you’ll earn points fee-free on part of your payment. The rest either won’t earn points or would require paying the 3% fee.

I know this is confusing. Here’s a helpful rule of thumb: you generally need to spend about 75% of your rent or mortgage amount on your Bilt card (on non-housing purchases) to earn enough Bilt Cash to fully offset the fee.

So if your mortgage is $2,000, you’d need roughly $1,500 in everyday spending to earn enough Bilt Cash to cover the fee and earn 2,000 points on that payment.

This can vary depending on which Bilt card you have and whether you earned Bilt Cash from opening the card.

Alternatively, if you don’t want to use your Bilt Cash to help offset rent/mortgage points-earning fees, it can also be used toward:

- Select lifestyle experiences

- Dining

- Fitness classes

- Travel bookings

Option Two: Earn based on spending

After some heavy negative feedback about the Bilt Cash system and 3% fee when the Bilt cards launched, Bilt has added this second option. Cardholders can choose which option they prefer. Option two lets you automatically earn points each month when you pay your rent/mortgage. The amount you will earn depends on the non-housing amount you spend on your Bilt card each month.

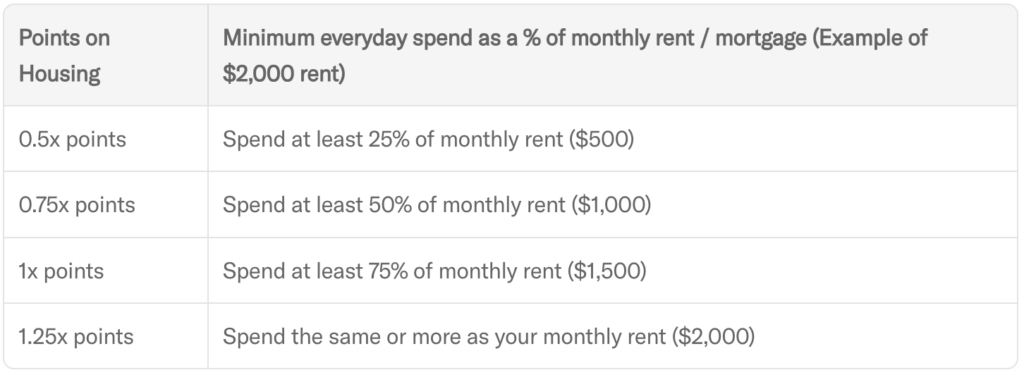

Here is a chart that Bilt released:

The Bilt app will track your spending so you can see your progress each month. If you don’t spend the minimum 25% of your housing payment, you will still earn an automatic 250 points each month.

Bilt is still working out the kinks with these systems, and hopefully, over time, things will be clearer, and data points will start rolling in to help customers figure out what works best for them.

Transfer Partners

Bilt’s transfer partners are where they really shine. They partner with multiple airline and hotel programs that have few/no other partners, like Atmos Rewards and Hyatt.

Here are Bilt’s transfer partners:

- Accor Live Limitless – 3:2 transfer ratio

- Aer Lingus AerClub

- Air Canada Aeroplan®

- Air France/KLM Flying Blue®

- Atmos Rewards (Alaska Airlines + Hawaiian Airlines)

- Avianca Lifemiles

- British Airways Executive Club

- Cathay Pacific

- Emirates Skywards®

- Etihad Airways

- Hilton Honors

- Iberia Plus

- IHG® One Rewards

- Japan Airlines

- Marriott Bonvoy™

- Qatar Airways Privilege Club Avios

- Southwest Airlines

- Spirit

- TAP Miles&Go

- Turkish Airlines Miles&Smiles

- United MileagePlus®

- Virgin Red®

- Virgin Atlantic Flying Club

- World of Hyatt®

All points transfer at a 1:1 ratio unless otherwise noted. If you’re not familiar with transferring points and why it’s valuable, check out this article.

Other Bilt Programs

Bilt partners with local restaurants and shops to allow members to earn points in other ways, including:

- Dining and local restaurants

- Fitness studios

- Wellness brands

- Walgreens Pharmacy

- And more

Learn more about Bilt neighborhood here.

Wrapping Up

Bilt has been making big waves in the travel world, and I am here for it. If you haven’t yet, make sure you sign up for a free Bilt loyalty account. You don’t need any of their credit cards to start earning Bilt points that can be used for travel.

Thank you for using our card links when applying for new cards. It helps us run our small business at no extra cost to you. We appreciate your support!

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.