The big brother to my favorite beginner card just got a huge overhaul. The Chase Sapphire Reserve® now has revamped benefits, different eligibility requirements, and a hefty new annual fee to go along with it.

Not only that, there’s a new Sapphire-family card on the market, the Sapphire Reserve for Business℠.

There’s a lot to digest with all of these changes and new card offerings, so let’s take a look at everything there is to know about these two cards.

<All information about the Chase Sapphire Reserve® and Sapphire Reserve for Business℠ has been collected independently by The Traveling Hansens. The card details on this page have not been reviewed or provided by the card issuer.>

Sapphire Reserve card details

The welcome offer for the Sapphire Reserve (personal card) is for 125,000 points when you spend $6,000 in the first three months from account opening. This is the best offer we’ve ever seen for this card! This is worth at least $2,500 in travel.

The welcome offer for the Sapphire Reserve for Business is 150,000 points when you spend $30,000 in the first six months from account opening. This is much better than similar premium business cards, which also have a spending requirement of $20,000 – $30,000, but only give you three months to do it.

These cards have huge annual fees of $795, formerly $550 for the Sapphire Reserve. The fee is enormous, but is worth considering when you look at the big welcome offers and the benefits.

Want to learn more about how to decide if annual fees are worth it? Check out this post.

If you are a new applicant, you’ll pay the $795 annual fee during your first billing cycle.

If you’re an existing cardholder of the Sapphire Reserve, you’ll get the new perks added to your account starting October 26, 2025, and will pay the higher annual fee starting with your next card renewal date.

The Sapphire Reserve card will count against Chase’s 5/24 rule, but the Sapphire Reserve for Business will not, since it’s a business card.

Card benefits

Sapphire Reserve benefits:

- $300 annual travel credit: This credit is not changing and still applies broadly to any travel purchases with no new restrictions. This easily makes up for almost half of the annual fee!

- $500 annual statement credit for The Edit: Split into two $250 credits for stays at Chase’s curated collection of luxury hotels and resorts.

- 300 additional hotel credit: One-time statement credit for eligible prepaid hotel stays at IHG Hotels & Resorts, Minor Hotels, Montage Hotels & Resorts, Omni Hotels & Resorts, Pan Pacific Hotels and Resorts, Pendry Hotels & Resorts, or Virgin Hotels booked through Chase Travel.

- $300 annual statement credit for StubHub or Viagogo purchases: Split into two $150 biannual credits for concert and event tickets (activation required).

- $300 annual dining credit and exclusive OpenTable reservations: Split into two $150 biannual credits automatically applied within the Sapphire Reserve Exclusive Tables program.

- $250 annual statement credit for Apple TV+ and Apple Music subscriptions: A one-time activation is required in your Chase account online or through the mobile app.

- $120 in annual statement credits toward Peloton memberships: $10 per month through Dec. 31, 2027.

- $120 in annual Lyft in-app credits: Up to $10 monthly through Sept. 30, 2027.

- Up to $120 credit for Global Entry, TSA PreCheck, or Nexus: Available once every four years.

- Airport lounge access: Includes Chase Sapphire Lounges by The Club, Priority Pass Select, and 20+ Air Canada Maple Leaf Lounges and Cafés when flying Star Alliance. Two guests are included in this benefit.

- Complimentary IHG One Rewards Platinum Elite Status through Dec. 31, 2027

- Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance, and more.

- No foreign transaction fees.

Sapphire Reserve for Business benefits:

- $300 annual travel credit: This credit applies automatically to any travel purchases with no restrictions.

- $500 annual statement credit for The Edit: Split into two $250 credits for stays at Chase’s curated collection of luxury hotels and resorts.

- $300 additional hotel credit: One-time statement credit for eligible prepaid hotel stays at IHG Hotels & Resorts, Minor Hotels, Montage Hotels & Resorts, Omni Hotels & Resorts, Pan Pacific Hotels and Resorts, Pendry Hotels & Resorts, or Virgin Hotels booked through Chase Travel.

- $400 ZipRecruiter credit: Split into two statement credits of up to $200 each – one from January to June and one from July to December – for purchases made directly with ZipRecruiter.

- $200 Google Workspace credit: Annual statement credit for purchases made directly with Google Workspace, including AI business tools.

- $100 Giftcards.com credit: Split into two statement credits of up to $50 each – one from January to June and one from July to December – for purchases made directly with giftcards.com/reservebusiness.

- $300 annually in DoorDash benefits: Includes a 12-month DashPass membership (must be activated by Dec. 31, 2027).

- $25 in monthly DoorDash promos: Includes a $5 restaurant promo and two $10 promos toward groceries, beauty, electronics, and more; promos are applied at checkout and do not roll over month to month.

- Up to $120 Global Entry, TSA PreCheck, or Nexus credit: Available once every four years.

- Complimentary lounge access for the primary cardholder and two guests: Includes Chase Sapphire Lounge by The Club and Priority Pass lounges.

- Complimentary IHG One Rewards Platinum Elite Status through Dec. 31, 2027

Additionally, if you spend more than $120,000 in one calendar year, you receive Southwest A-List status and $500 flight credit when booking Southwest flights through Chase Travel.

As you can see, both cards have a ton of benefits that can help offset the annual fee. The thing is, it’s important that you actually use them.

My general philosophy is that the benefits don’t truly make up for the fee if they consist of things that you wouldn’t be spending money on anyway. If you don’t use Lyft, OpenTable, or ZipRecruiter, those benefits may not be particularly useful.

The flipside is that these huge new welcome offers may make the fee worth it for the first year! It’s important to decide what works best for you and your own specific situation.

Earning Rates

The earning rates for the Sapphire Reserve has been shaken up. Here’s the new breakdown:

- 10x points on eligible Peloton equipment and accessory purchases

- 8x points on all Chase Travel℠ purchases

- 5x points on Lyft rides

- 4x points on flights and hotels booked directly

- 3x points on all dining purchases worldwide

- 1x points on all other purchases

Here’s the breakdown for the Sapphire Reserve for Business:

- 8x on all Chase Travel℠ purchases

- 5x on eligible Lyft rides (through Sept. 30, 2027)

- 4x on flights and hotels booked directly

- 3x on advertising purchases made via social media sites and search engines

- 1x on all other purchases

Furthermore, redeeming your points for 1.5x through Chase Travel℠ is going away and being replaced by something called Points Boost. This allows you to receive up to 2x for your points on certain flight and hotel bookings made through Chase Travel℠.

Eligibility

Along with all of the other changes, eligibility for the Sapphire family of cards has undergone an overhaul as well. Previously, you could earn the bonus on each card once every 48 months. Now, you can only earn the bonus once. Chase also recently clarified that you’re eligible to earn the bonus on both personal Sapphire cards, whereas before you could only earn it on one card.

Chase also says, “Consumers applying through most channels will be notified during the application process if they are not eligible for a bonus offer and given the choice to continue the application or cancel the application with no impact to their credit score.” This is nice because if you’re ineligible and get a pop-up, you can back out of the application without any hit to your credit.

These cards are also subject to Chase’s 5/24 rule. You must be under 5/24 to qualify.

Transfer partners

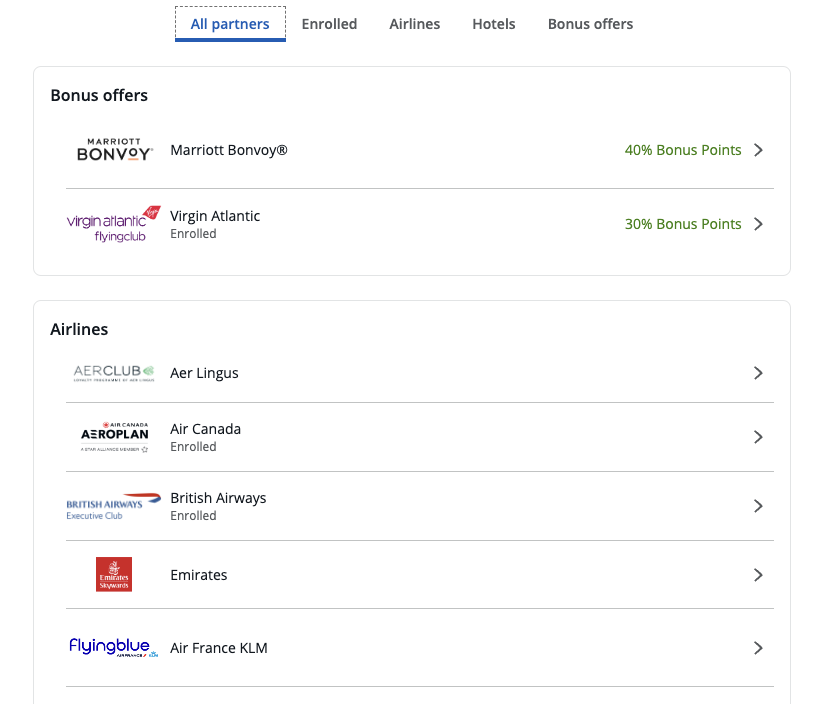

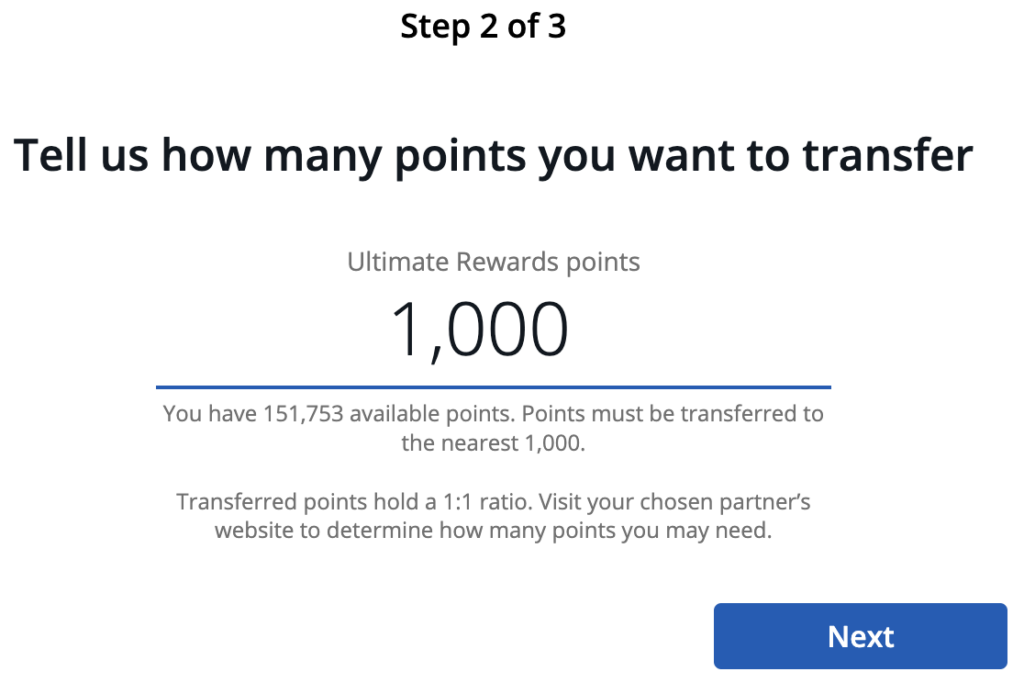

Nothing about cardholder access to Chase’s 11 airline partners and 3 hotel partners is changing. If you’re unfamiliar with transferring your Chase points, here’s a breakdown. All points transfer at a 1:1 ratio in increments of 1,000.

The transfer partners are:

- Aer Lingus

- Air Canada

- Air France-KLM

- British Airways

- Emirates

- Iberia

- JetBlue

- Singapore

- Southwest

- United

- Virgin Atlantic

- Hyatt

- IHG

- Marriott

How to transfer your points

Here are the steps for transferring your points from Chase to one of its transfer partners.

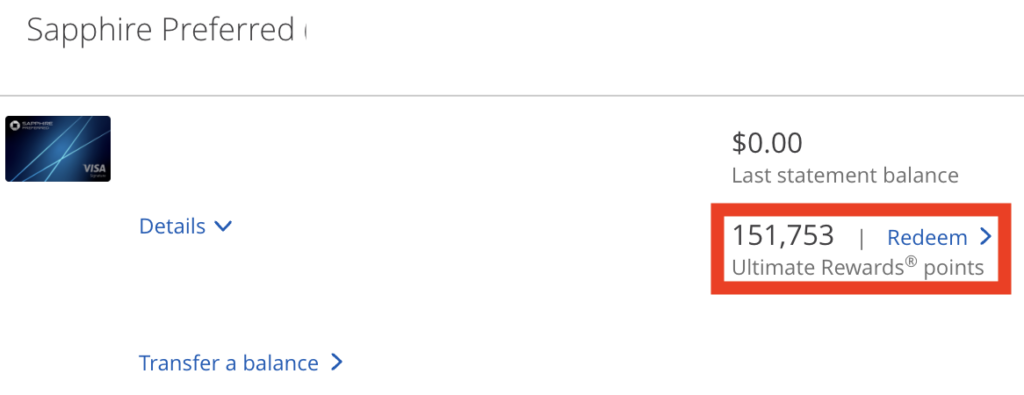

First, log on to your Chase account, choose your Sapphire card, then click on your Ultimate Rewards® and hit “redeem”.

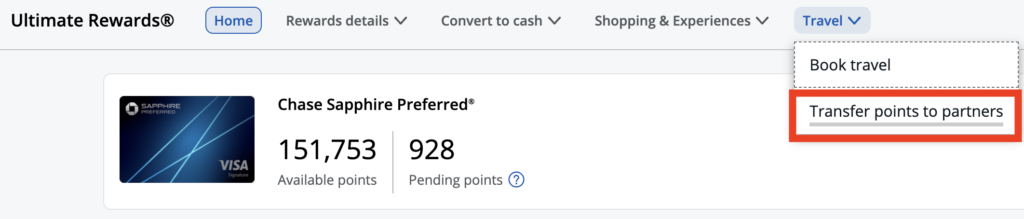

Next, hover over “travel” at the top of the page and select “transfer points to partners”.

All of Chase’s travel partners will pop up, with any current transfer bonuses listed at the top. Choose the one you’d like to transfer to. In this case, we’ll choose Hyatt (of course).

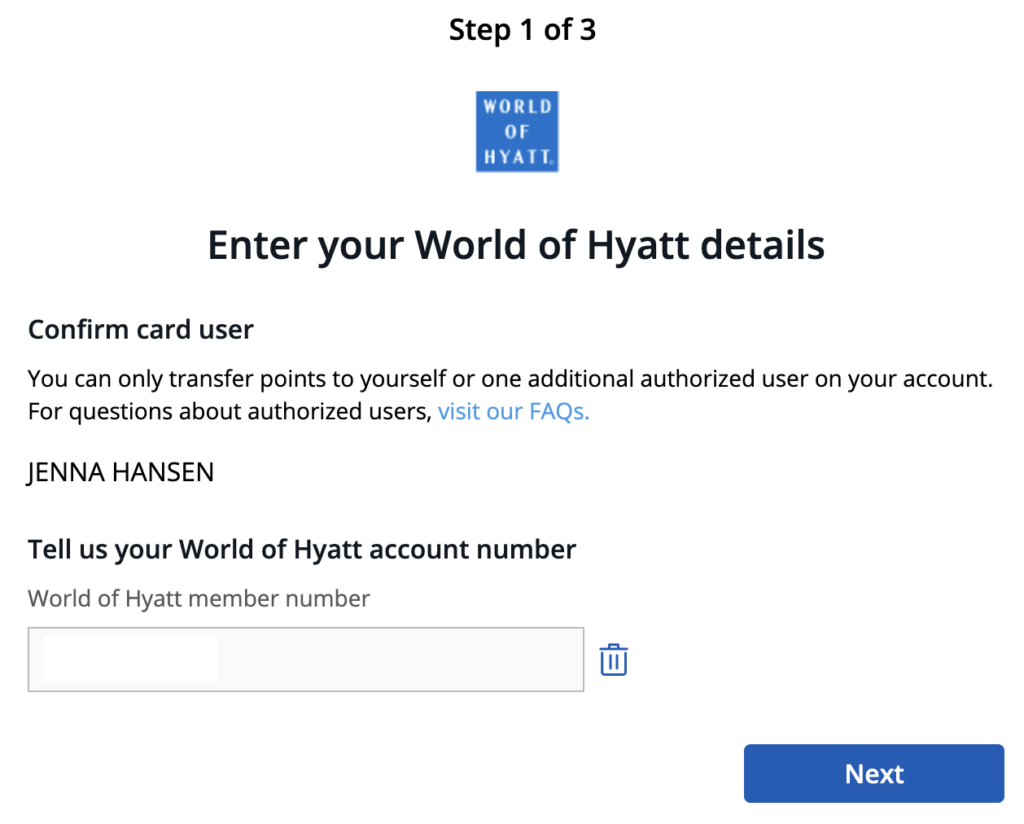

After that, you’ll go through three steps. First, you’ll confirm your name and loyalty account information. If you haven’t set up a free loyalty account with the hotel or airline, make sure you do that first!

Next, enter how many points you’d like to transfer in increments of 1,000.

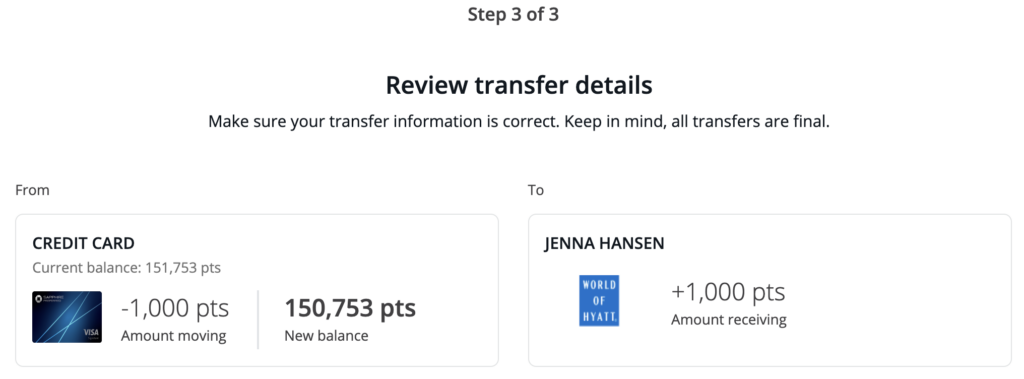

Finally, confirm the details and hit submit.

Generally, transfers are instant, although there can be unexpected delays. You may need to log out and log back into your hotel or airline account to see the points available.

One important note- do not transfer points until you have found the available flights or hotel nights! Once you’ve transferred your points, they’re stuck in that program. You wouldn’t want your points to be stuck with no way to use them as you intended.

Other ways to use your points

Transferring to travel partners is the main way that we use our points. However, there are a few other options.

- You can book flights, hotels, and more through Chase Travel℠.

- You can cash out your points to cover expenses.

- You can combine your points with one other family member in your same household. To do this, you will first need to call Chase to link your accounts. After that, you can easily combine them online.

Wrapping it up

These changes are a huge shake-up for the premium end of the Sapphire lineup. With major changes to the Chase Sapphire Reserve – including new benefits, updated eligibility rules, and a higher annual fee – plus the debut of the brand-new Sapphire Reserve for Business, there’s a lot to take in for both personal and business travelers.

Take a look at the cards and the benefits to decide if one (or both) might be right for you.

Thank you for using our card links when applying for new cards. It helps us run our small business at no extra cost to you. We appreciate your support!

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.