For years, my go-to premium travel card has been the Capital One Venture X Rewards Credit Card. It has the lowest fee of all the premium cards, and it previously gave us lounge access for our whole family. But lounge access has changed and now includes only the cardholder. This opened the door for a new premium card to top my list: the Citi Strata Elite℠ Card. This card has a mid-level annual fee for a premium card, has expanded lounge access, and comes with easy-to-use benefits and perks that offset the fee. Here’s everything you need to know.

Citi Strata Elite Basic Info

Welcome offer: Earn 100,000 ThankYou® Points after spending $6,000 within the first three months of account opening.

Annual Fee: $595, but don’t let this deter you. The benefits easily make up for it, at least for the first year.

The Citi Strata Elite is a personal card that will count toward your 5/24 number.

Citi Strata Elite Eligibility

The eligibility rules and approval rates for this card are very good. Citi doesn’t have hard and fast eligibility rules besides limiting you to one Citi card application every 8 days, and no more than two in a 65-day period.

Additionally, you aren’t eligible to earn a welcome bonus on the Citi Strata Elite if you have received a new account bonus on the card in the past 48 months. This isn’t currently an issue since this card launched in 2025.

Lastly, you are eligible for this card even if you hold another Citi Strata family card, such as the Citi Strata℠ Card or the Citi Strata Premier® Card (a great beginner card similar to the Chase Sapphire Preferred® Card).

Citi Strata Elite Benefits

Here are the earning categories and card benefits that come with the Citi Strata Elite:

- 12x on hotels, car rentals, and attractions booked through Citi Travel℠

- 6x on flights booked through Citi Travel℠

- 6x at restaurants (including food delivery) every Friday and Saturday from 6 p.m. to 6 a.m. EST, and 3x points any other time

- 1.5x on all other purchases

- Global Entry or TSA PreCheck credit

- Up to $300 annual hotel benefit

- Up to $200 annual Splurge credit

- Up to $200 annual Blacklane credit

- Four American Airlines Admirals Club passes every calendar year, including three guests under 18 per pass

- Priority Pass lounge access, including two guests

Lounge Access

As I mentioned earlier, lounge access is one of the main reasons I’ve moved this card to the top of my list of favorite premium cards. Most premium cards have cut back on lounge access for guests over the past few years. This is not the case with the Citi Strata Elite.

The card comes with a free Priority Pass membership, which gives you access to over 1,200 airport lounges around the world. This membership also includes two guests per visit. For our family, this will cover three of us, my husband will still use his Venture X for Priority Pass lounge access for himself, then we will likely pay for our other two kids to have access. The price for two of them to get into the lounge is far less than what we’d pay for one airport meal for all six of us. In the lounge, wewill have unlimited food and drinks!

Additionally, the card comes with four American Airlines Admiral’s Club passes per calendar year. These passes include three guests under 18 per pass. There are nearly 50 Admiral’s Club locations throughout the U.S., plus a few in major international cities.

Splurge Credit

This unique perk allows you to receive a $200 credit when you make purchases with select partner brands. These are:

- 1stDibs

- American Airlines (exclusions apply)

- Best Buy

- Future Personal Training

- Live Nation (exclusions apply)

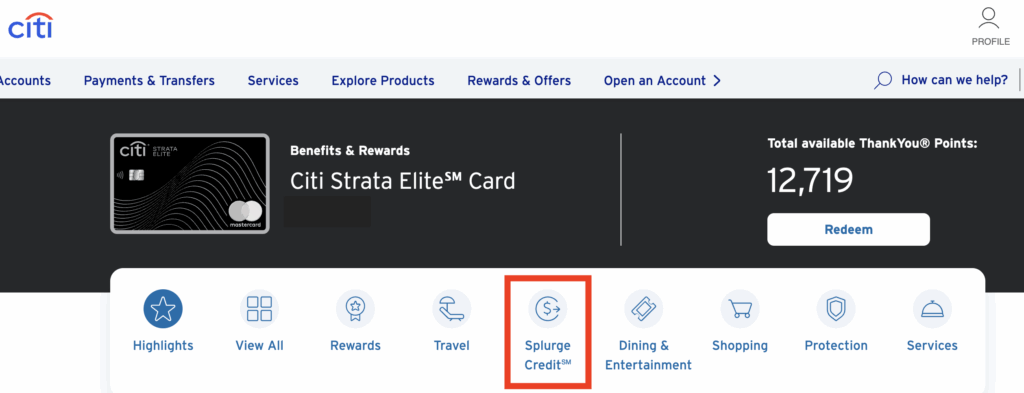

To use your credit, you must first select your preferred brand(s); you can choose up to two. To do this, go to your profile, then “Rewards and Offers”, then click Citi Strata Elite. After that, click Splurge Credit.

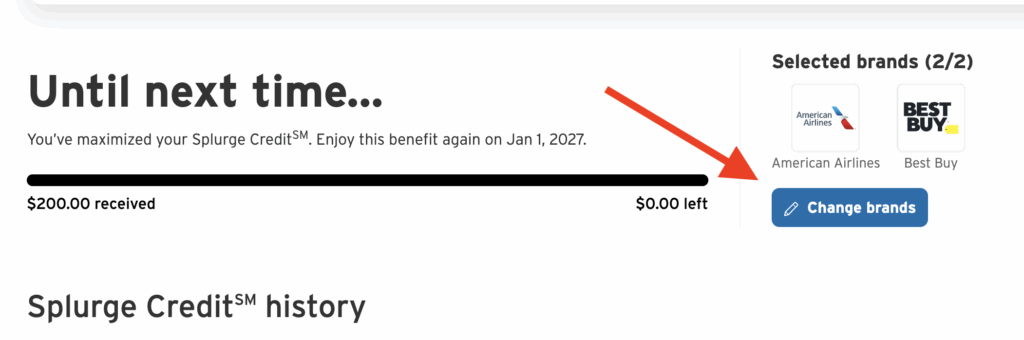

Next, choose your brands. I have American Airlines and Best Buy selected. You can change your choices at any time.

Then, just use your card to pay, and you will be automatically reimbursed up to $200 per calendar year.

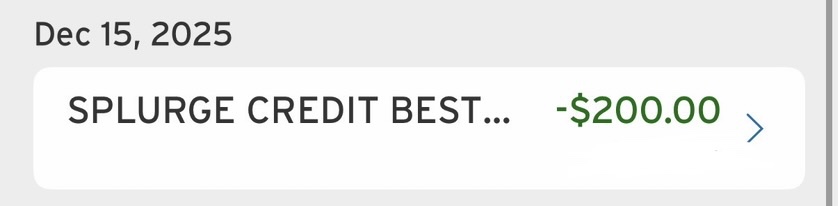

I have used my credit at Best Buy to purchase Disney and Amazon gift cards.

Hotel Credit

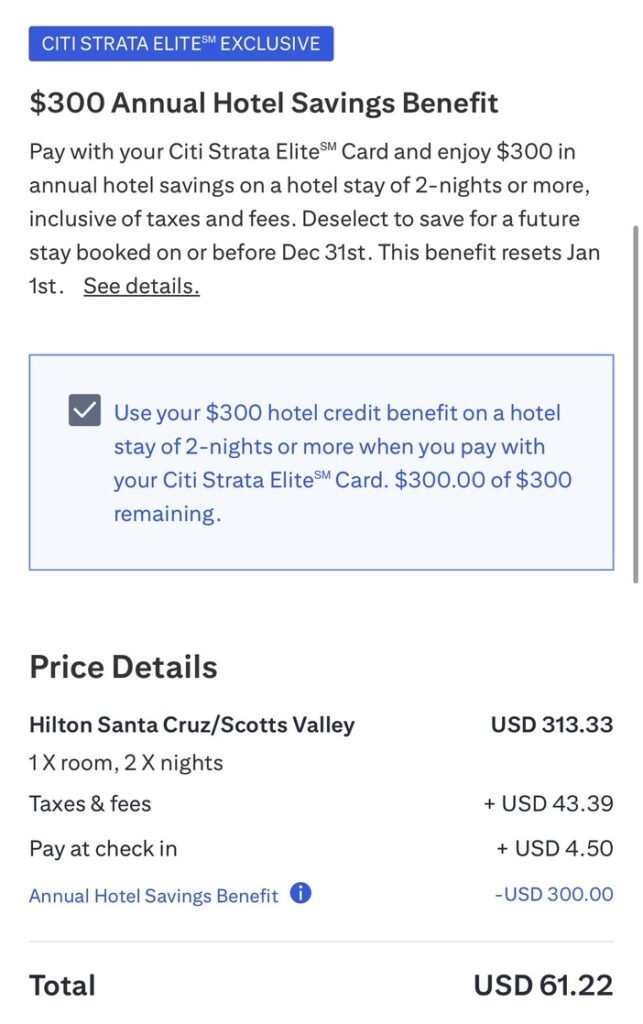

Book a two-night hotel stay through Citi Travel and get up to $300 off. The credit is applied during checkout like a coupon. It does not have to be used all at once. It works on any hotel booking, not just fancy ones, unlike Chase’s The Edit credit or Amex’s FHR credit.

I used mine last year to book a little weekend getaway for my husband and me. I paid just $61 out of pocket and also earned 12x on the money I spent, since hotels booked through Citi Travel is a spending bonus category on the card.

To use the credit, just go to Citi Travel and search for hotels. It should pop up when you search and check out. Super easy.

How to Double Dip your Credits

One of the things that makes this card great is the ability to double-dip the Splurge Credit and Hotel Credit for the first year you have your card. If you time it just right in December, you can even triple-dip these benefits! But just being able to double-dip them is pretty great.

What this means is that you open the card and use the calendar year credits at some point during the year you open it. For example, you open the card in February and use both the Splurge Credit and Hotel Credit sometime before the end of the year. This gives you $500 in value, so you’ve already nearly made up for the annual fee.

Now here’s the kicker: those credits reset on January 1. So, the next calendar year, before your second annual fee posts, you use those credits again for another $500 in value. Now you’ve received $1,000 in credits, which far outweighs the annual fee, and that’s not even considering the other benefits that come with the card. It’s a major win.

If you decide after that first year that you don’t want to keep the card open, you can close it within 30 days of the annual fee being posted to your account, and the fee will be refunded. For me, this is a card that I will likely keep long-term since the benefits outweigh the fee.

Using Your Citi ThankYou® Points

There are multiple ways you can use the ThankYou® Points earned from the Citi Strata Elite.

TRANSFER POINTS

My top choice for using flexible points earned from any card is to transfer them to travel partners. Most points transfer at a 1:1 ratio in increments of 1,000 unless otherwise noted below.

Here are Citi’s transfer partners:

- Aeromexico Rewards

- Accor Live Limitless (2:1)

- Air France/KLM Flying Blue

- American Airlines (new transfer partner!!)

- Avianca LifeMiles

- Cathay Pacific

- Choice Privileges (1:2 – this is a sweet spot for international hotels since many overseas properties are nicer than the Choice Hotels within the U.S.)

- Emirates Skywards

- Etihad Guest

- EVA Air Infinity MileageLand

- I Prefer Hotel Rewards (1:4 – another sweet spot with that quadruples your points when transferred)

- JetBlue TrueBlue

- Leaders Club (5:1)

- Turkish Airlines Miles&Smiles

- Qantas Frequent Flyer

- Qatar Airways Privilege Club

- Singapore Airlines KrisFlyer

- Thai Royal Orchid Plus

- Virgin Atlantic Flying Club/Virgin Red

- Wyndham Rewards

Having American Airlines as a new transfer partner is very exciting! American has many great sweet spots like 40k round-trip to Europe, 15k one-way to the Caribbean and Mexico, and 35k one-way to Asia.

There aren’t many domestic U.S. airline partners, but this could be a great time to take advantage of airline alliances to book partner flights.

We’ve also used the great 1:2 transfer rate to double our Choice Hotels points and book rooms in Europe. This comes in extra handy since we need two rooms everywhere we go.

USE THEM WITH CITI TRAVEL℠

Another way to use your points is by booking flights, hotels, or rental cars through Citi Travel℠. This works like other travel search portals, which search all airlines and hotels to find the best options.

CASH THEM OUT

One final option is to cash out your points. When you do this, they’re worth one cent per point, meaning every 10,000 points is worth $100.

Wrapping Up

The Citi Strata Elite has earned a top spot in my wallet and is a card I will likely keep long-term thanks to its many benefits, including lounge access that includes guests. Earning the big welcome offer and being able to double-dip some of the credits is the icing on the cake that makes this card a no-brainer, at least for the first year.

Thank you for using our card links when applying for new cards. It helps us run our small business at no extra cost to you. We appreciate your support!

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.