The Capital One Venture Rewards Credit Card is an excellent card with a solid welcome offer, a low annual fee, and flexible miles. It’s an excellent beginner card for people who are just getting into points and miles. Beyond that, it’s a great card for anyone who is looking to diversify their points stash with other flexible options.

Venture Basic Info

**ELEVATED OFFER**

The Venture card currently has an elevated welcome offer of 75,000 Capital One miles PLUS a $250 Capital One Travel credit when you spend $4,000 in the first three months of the account being open. The travel credit addition makes this card worth at least $1,000 in travel, but potentially more when you use your miles with hotel and airline partners.

It has a $95 annual fee.

The Venture card will count against Chase’s 5/24 rule, but it’s definitely worth a spot.

➡️ Check out the best travel rewards cards

Eligibility

Capital One recently added family language to these cards, meaning you’re not eligible for a “higher” card if you’ve earned any “lower” card bonuses in the last 48 months. Previously, the 48-month rule applied to each card individually. Now, it applies to each card in order.

This means you’ll want to get this card before getting the Venture X. If you’ve earned a bonus on the Venture or Venture X in the last 48 months, you won’t be eligible for this card.

Additionally, it’s important to note that Capital One limits all card applications to one every six months. So, if you have recently opened any other Capital One card, you will need to wait until it’s been a full six months before applying for this one.

Related: Comparing the Venture and Venture X Cards

Venture Benefits

- TSA PreCheck or Global Entry statement credit when you use your card to pay the enrollment fee

- Access to Capital One transfer partners

- No foreign transaction fees

- Travel insurances- primary rental car coverage, lost luggage reimbursement, trip delay reimbursement, trip interruption/cancelation insurance, travel accident insurance

- Shopping protections- purchase protection, extended warranty, cell phone insurance

- Hertz Five Star status

- 5X on hotels and rental cars booked through Capital One Travel

- 2X on all other purchases

Eligibility

Capital One recently added family language to the Capital One Venture and Venture X Rewards Credit Cards, meaning you can only open one at a time, and they must be 48 months apart. Previously, the 48-month rule applied to each card individually. Unfortunately, it now applies to both cards together. For example, if you open a Venture card today, you won’t be eligible for another Venture OR Venture X for 48 months.

Additionally, Capital One is sensitive to how many recent accounts you’ve opened. You may not be approved for another Venture card if you’ve opened 4+ cards in the previous 24 months.

Earning More Miles

Capital One has a decent-sized lineup of cards that earn Capital One miles. Beyond that, if you have a Capital One card that earns cash back, it can be turned into miles if you also have a miles-earning card.

Furthermore, Capital One lets you combine miles with any other Capital One member for free; you just have to call to do it. So, if you and a player two each open cards, all of the miles you earn can be combined into one of your accounts.

Here are your card options for earning more Capital One miles:

- Capital One VentureOne Rewards Credit Card

- Capital One Venture X Rewards Credit Card

- Capital One Venture X Business

- Capital One Spark Miles for Business

Here are the cards that earn cash back, which can be turned into miles as long as you have one of the cards listed above (or the Venture):

- Capital One Quicksilver Cash Rewards Credit Card

- Capital One Quicksilver Secured Cash Rewards Credit Card

- Capital One Savor Cash Rewards Credit Card

- Capital One Spark Cash Plus

Using Miles From Your Venture

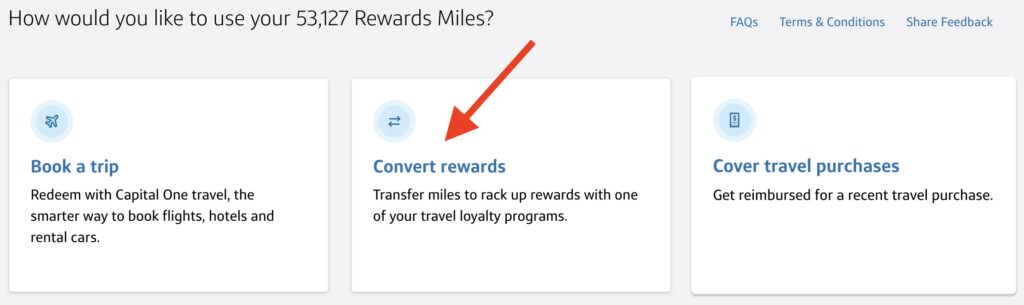

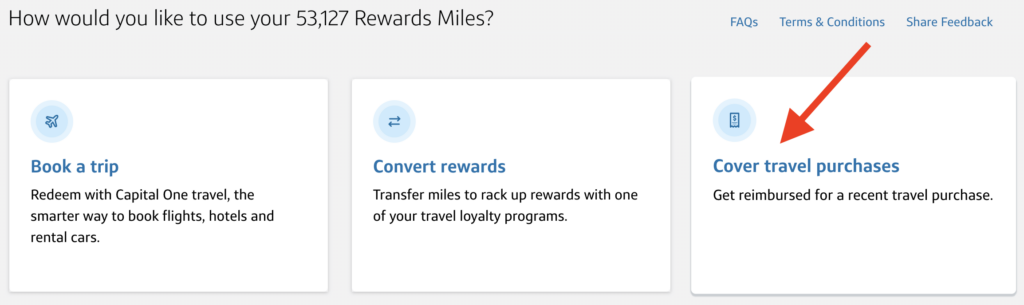

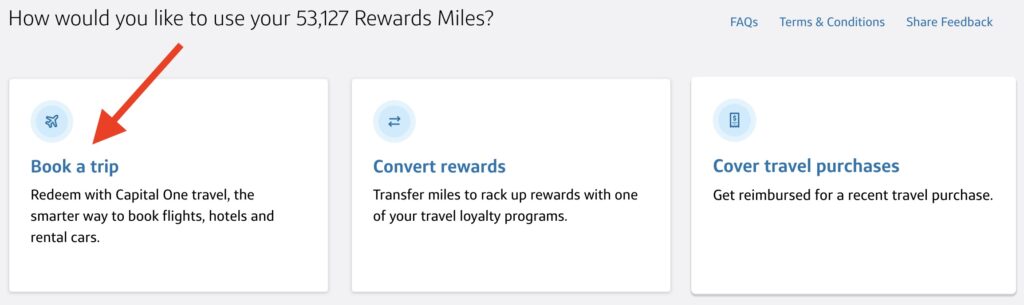

The miles you earn on this card can be used in three main ways: cashed out, in the travel portal, and transferred to travel partners. To do any of these things, log on to your Capital One account and click on your miles.

RELATED: All About Capital One Miles

Transferring to Partners

If you’re looking to get the most bang for your miles, transferring them to travel partners is the way to do that. You can transfer miles and redeem them for flights and hotels that are worth well over one cent per point, which is the value you will get by redeeming miles any other way.

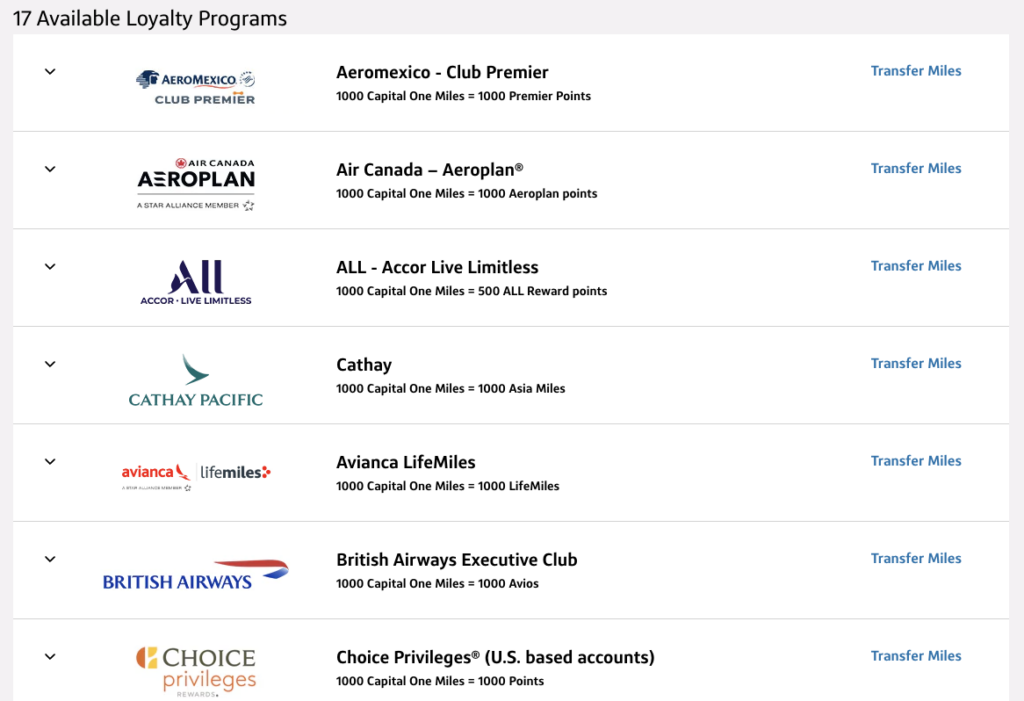

Capital One has more than 15 transfer partners:

- Aeromexico Club Premier

- Air Canada Aeroplan

- Cathay Pacific Asia Miles

- Avianca LifeMiles

- British Airways Executive Club

- Choice Privileges

- Emirates Skywards

- Etihad Guest

- Finnair Plus

- Flying Blue (Air France/KLM)

- I Prefer hotels – transfer ratio 1:2, so 1,000 Capital One Miles equals 2,000 I Prefer hotel points

- Japan Airlines (JAL) Mileage Bank – transfer ratio 1:.75, so 1,000 Capital One Miles equals 750 Mileage Bank miles

- JetBlue TrueBlue – transfer ratio 5:3, so 1,000 Capital One Miles equals 600 TrueBlue points

- Qantas Frequent Flyer

- Qatar Airways Privilege Club

- Singapore Airlines KrisFlyer

- TAP Miles&Go

- Turkish Airlines Miles&Smiles

- Virgin Red

- Wyndham Rewards

Here’s how to transfer your miles to partner airlines and hotels.

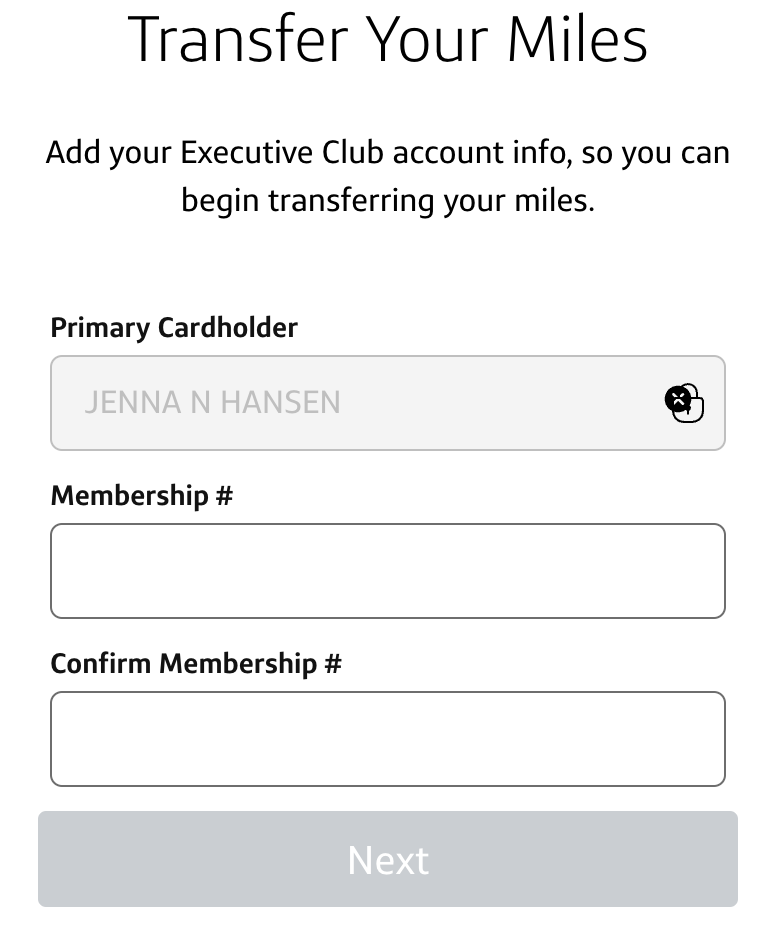

First, log in and click on your miles, then choose “convert rewards.” Select which program you’d like to transfer to.

A box will pop up and you can enter your information, then click next and choose how many miles you want to transfer. Finally, confirm the transaction. Most miles transfers are instant, but you may need to refresh your airline or hotel loyalty account.

Cashing Out Miles

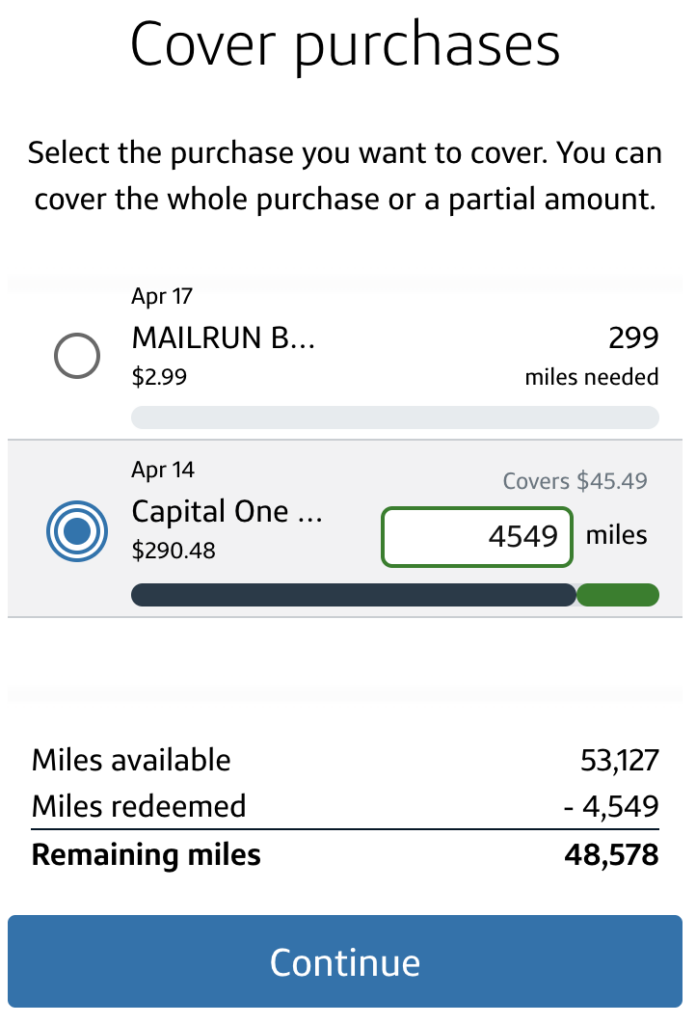

Any purchase made on your card that is considered travel can be credited back to your account with your miles. Basically, you’ll trade in the miles to get a statement credit that covers the cost of the travel after you’ve booked it.

A box will pop up with any purchases that are eligible to be covered with miles. Choose which travel purchase and how many miles you want to use. You can cover a portion of the purchase or all of it. Select continue, then confirm the transaction. It takes 1-3 days for the credit to post to your account.

The travel purchase must be made on your Venture to be eligible to be covered with miles. Miles are redeemed at a one-cent per point value, meaning every 10,000 miles is worth $100.

We like to use this option for things that are harder to cover with miles, like rental cars, cruises, and theme park tickets.

If you want to use them for theme park tickets, you’ll need to purchase through a third-party site like Undercover Tourist so that the purchase codes as travel on your credit card statement. We’ve done this multiple times for Disney tickets!

Related: Save money at Disney with DVC

Using Miles in the Travel Portal

You can use your miles to book rental cars, hotels, and flights in the Capital One travel portal. Like using them to cover travel purchases, they are worth one cent per point (so 10,000 miles = $100).

Honestly, you shouldn’t ever use them this way because you’re missing out on the miles you could be earning from spending on your card!

Here’s what to do instead:

- Use the travel portal to book your flight, hotel, and/or rental car, and use your Venture to pay.

- You’ll receive 5X miles for hotels and rental cars and 2X for flights.

- Then, once the miles have been posted, use them (plus any other miles earned) to cover the purchase!

That way, you are still using miles to cover the cost, but you’re earning extra miles first by putting that spending on your card.

Wrapping Up

The Venture card is an excellent option for anyone looking to earn flexible miles that can be used in a variety of ways, all for a low annual fee. It has a good group of benefits and the miles earned can easily be combined with any other miles-earning cards. Plus, you get 2X for all your purchases, so you know you’re always getting a good return for your spending. It’s a great go-to card to keep in your wallet long-term.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Thank you for using our card links when applying for new cards. It helps us run our small business at no extra cost to you. We appreciate your support!

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.